Topics, 100 Accounting Resources, 100 Reading List

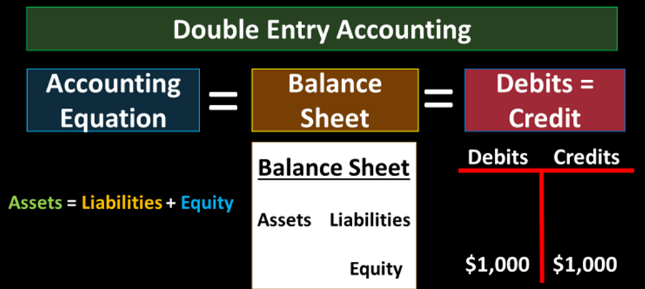

As mentioned earlier there are many ways the double entry accounting system can be expressed including the use of an accounting equation, debits and credits, and a balance sheet. We will focus on the accounting equations in this section. The benefits of an accounting equation include the use of a simple formula, simple math that can be explained and understood. Transactions will be described using the symmetry of the accounting equation. The problem with using the accounting equation to record transactions and build the financial statements is that it is not as efficient as the use of debits and credits. We will learn the balancing concept using the accounting equation, but as we do, keep in mind that the accounting equation is not the whole story, that we will need to understand new concepts, the concepts of debits and credits, to record data with which to generate financial statements well.

The accounting equation is:

Asset = Liabilities + Equity

The format above is the most common form of the accounting equation for financial accounting because the left side of the equation shows what the business owns and the right side shows who it is owed to, either a third-party liability or the owner. Recall our separate business entity assumption while considering the accounting equation. Thinking of the business as a separate entity helps to understand the accounting equation, the left side of the equal sign showing what the separate entity owns, the right showing who has claim to what the separate entity owns.

Because the accounting equation is a formula it can be expressed at least two other ways. A second way to write the equation is:

Assets – Liabilities = Equity

The format of the accounting equation above is useful because it emphasizes that equity is the book value of the company, the amount left over after subtracting liabilities from assets, an amount which can also be called net assets. To understand the meaning of equity we can consider the liquidation of a company, the selling of assets for cash, the payment of liabilities owed, and the leftover cash which would then be available to the owner, this amount being equal to equity if assets were sold at book value. Note that all assets will not be sold for the exact amount reported when a business is sold. For example, an asset of equipment valued at $50,000 may not be sold for $50,000 in a free market, possibly being sold for something less like $40,000 or something more like $60,000. We will discuss this more at a later time. For now, remember that equity represents net assets on a book value basis, assets minus liabilities.

A third way to write the accounting equation is:

Assets – Equity = Liabilities

This format of the accounting equation is not as useful but is another way the accounting equation can be expressed algebraically.

Account types include assets, liabilities, equity, revenue, and expenses. Recognize that account types are not the same thing as actual accounts, each account type having multiple accounts falling into the category. Understanding account types and the accounts that fall into each account type category is essential to the accounting process.

Account types include. . .

For more reading consider the e-book below

Previous Next