Topics, 100 Accounting Resources, 100 Reading List

We will now go through common financial transactions, transactions needed by most any business, and analyze them using the accounting equation and our set of rules and thought process.

We will start off looking at transactions involving cash, cash being the most common account affected. Understanding how cash is affected will act like a add, or crutch, when considering the other account or accounts effected in the transaction.

First, imagine a situation where the cash goes up because the company received cash, and consider possibilities for the other account affected.

We know that at least one other account will be effect and that the accounting equation must remain in balance. If there is only one other account effected we are left with just three possibilities to keep the accounting equation in balance. Either the liabilities went up, equity went up, or another asset account also went down. Below are examples of each.

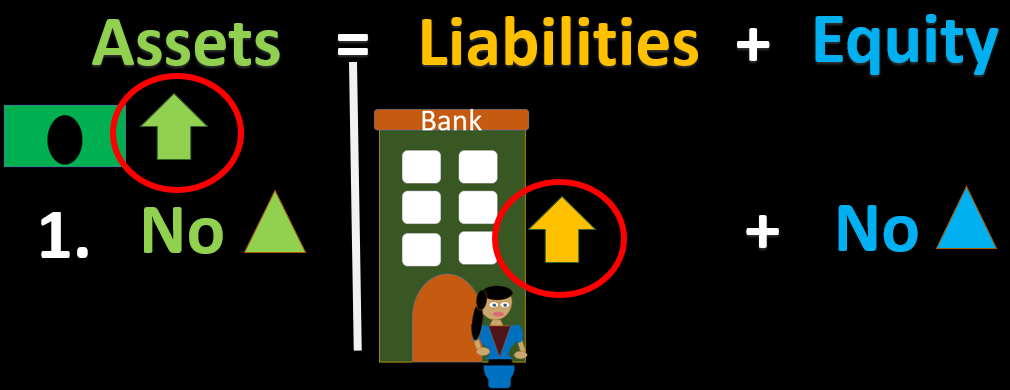

If cash went up because of a business receiving a bank loan, then liabilities would also go up, keeping the accounting equation in balance.

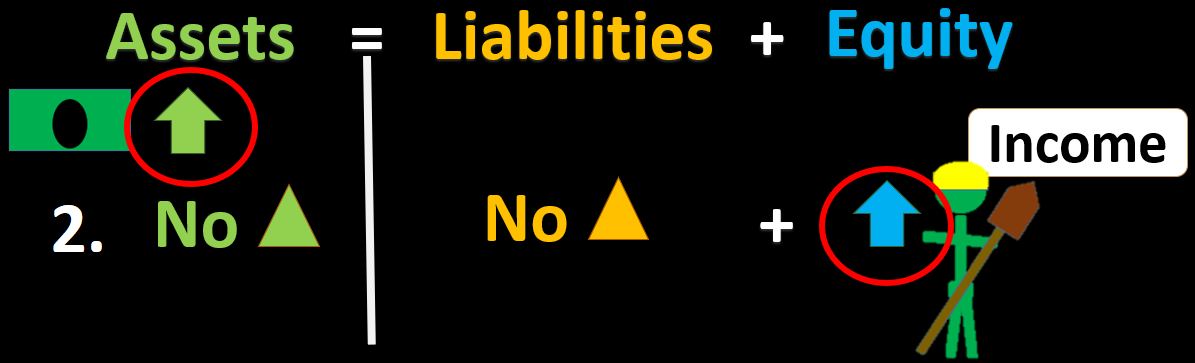

If cash went goes up do to collecting cash for work the company did then revenue or income would also go up, revenue being part of equity.

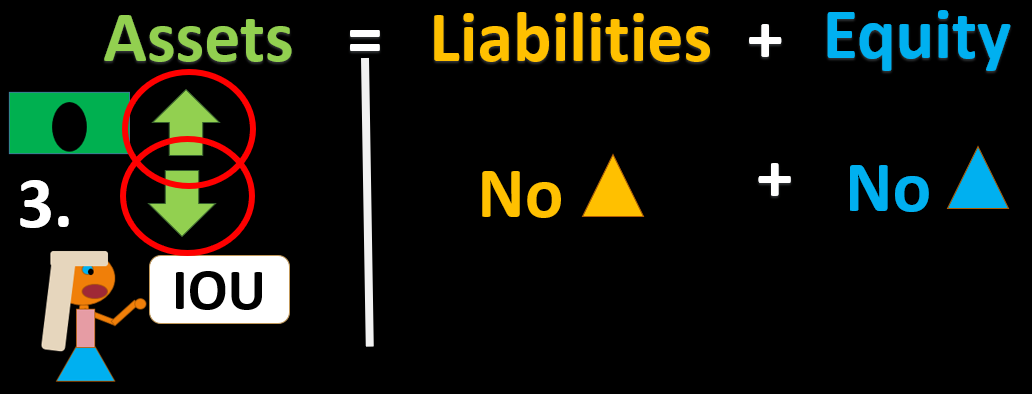

If cash went up because we are receiving money for work done in the past we would also reduce the accounts receivable account, an asset account representing money owed to the company for past work completed.

It is possible to use an expanded accounting equation, listing all accounts under each account type, forming a kind of trial balance which can be used to create the financial statements. We will not be using this format here because it is not an efficient way to generate financial statements and gives the impression that debits and credits are not needed, which is not a good impression to give.

To understand double entry accounting and how financial statements are created, the accounting equation is not sufficient, and debits and credit will be needed. We will introduce how debits and credits work later, but the concepts will build on the concepts we learn here working with the accounting equation.

Below are more common transaction and the effect on the accounting equation:

Owner invests cash into the business:

The asset account of cash goes up as well as equity, the amount owed to the owner. Equity goes up because the business basically owes the cash back to the owner. When investing cash into a business, an owner is hoping to receive a return on investment and be able to withdraw cash from the business in the future, to be used for personal use.