Topics, 100 Accounting Resources, 100 Reading List

Financial statements are the end goal of financial accounting, the final product most useful to external users like investors, creditors, and customers. Financial statements include the balance sheet, the income statement, the statement of equity, and the statement of cash flows. We will concentrate on the first three statements here and move to the statement of cash flows later.

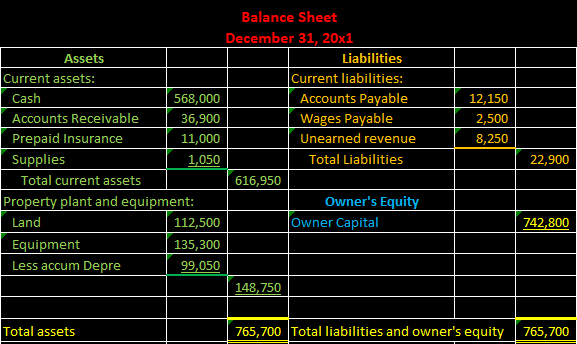

The balance sheet shows the business’s financial position as of a point in time and includes permanent accounts of assets, liabilities, and equity. The balance sheet only shows one date, typically the end of a month or year, because the balance sheet shows where the company stands financially as of that date, that point in time.

The sections of the balance sheet are equivalent to the accounting equation components including assets, liabilities, and equity. To say the balance sheet “is in balance” is like saying the accounting equation “is in balance”, both being ways to express that double entry accounting system is working.

Below is a simplified balance sheet.

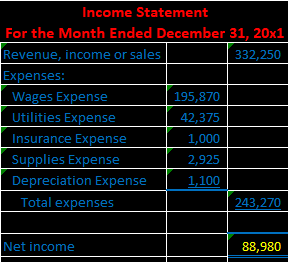

An income statement describes a company’s performance over time, how well the company has done at achieving the goal of revenue generation.

The income statement is a timing statement requiring a beginning date and an ending date to make sense, in a similar way as tracking miles driven over a time needs a beginning and ending time frame. If we want to know how many miles we can drive in an hour, we set the clock, set the odometer, and drive for a particular time. If we want to know how well a company is doing at generating revenue, we set the clock for a month or year, set the temporary accounts, including revenue and expense accounts, to start a zero and proceed to earn revenue and incur expenses over the established time frame.

Net income, the bottom line number of the income statement, is calculated as revenue minus expenses and represents the earnings of the company less expenses required to generate the revenue. Net income does not represent net cash flow, cash being a form of payment. Net income represents the net amount of earnings, earnings measured in dollars, but the time period in which revenue is earned does not necessarily equal the period in which payment is received.

For more reading consider the e-book below

Previous