In this presentation, we delve into the concept of responsibility accounting systems. When implementing a responsibility accounting system, the goal is to decentralize our organization, assigning distinct managers to oversee different segments. This decentralization empowers managers with increased responsibilities over specific areas, holding them accountable for controllable items within their purview.

A crucial distinction within responsibility accounting lies in categorizing costs as controllable or uncontrollable. Controllable costs are those that managers can influence or determine, directly impacting their department’s performance. If a cost cannot be controlled by a department manager, it should not be used to evaluate their performance within the responsibility accounting framework.

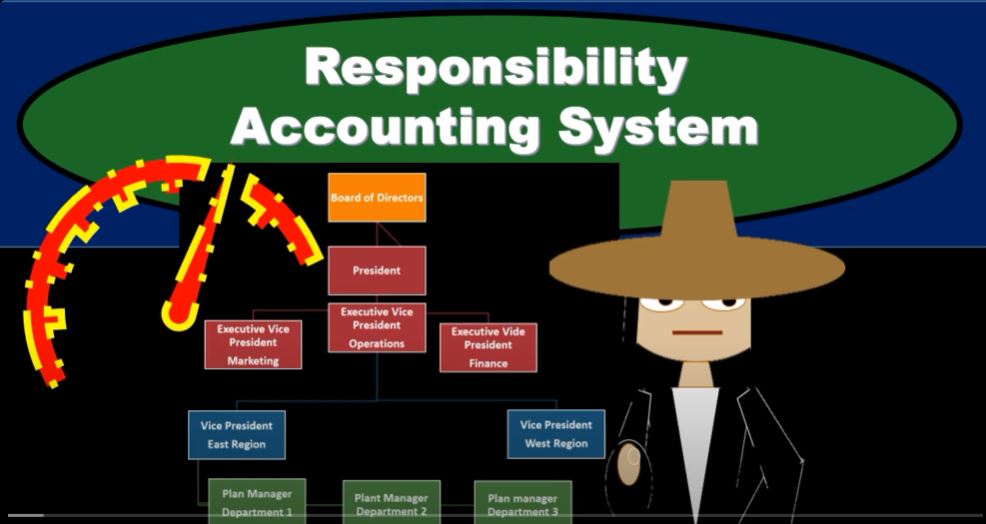

To effectively implement responsibility accounting, an organizational chart becomes indispensable. This chart delineates clear roles and responsibilities across various organizational units, ensuring each manager knows precisely what they are accountable for. This clarity prevents crucial responsibilities from being overlooked or left unassigned.

When it comes to reporting within responsibility accounting, lower-level managers deal with more detailed reports of their controllable costs. For instance, plant managers have intricate insights into departmental expenditures, which are crucial for making informed decisions at the operational level. As these costs aggregate upwards through the hierarchy, the level of detail decreases, but the scope of controllable costs broadens.

For example, a store manager might provide a detailed breakdown of their controllable costs, while a regional vice president receives a summarized version since they oversee multiple stores. This pattern continues up the hierarchy, with each level aggregating and summarizing the controllable costs of the units it supervises.

At the executive level, such as the Executive Vice President of Operations, the focus shifts to overseeing broader controllable costs that encompass multiple regions or divisions. Here, costs like VP salaries, quality control expenditures, and office expenses become part of the executive’s oversight, summarized from detailed reports provided by regional VPs.

To illustrate, consider the East region VP responsible for departmental salaries, depreciation, and insurance within their jurisdiction. Their detailed reports aggregate upwards to the Executive Vice President of Operations, where these figures contribute to a comprehensive overview of organizational performance and financial health.

In essence, responsibility accounting ensures that managerial performance is evaluated based on controllable costs they influence directly. This structured approach not only enhances accountability but also facilitates strategic decision-making at all levels of the organization, from department managers to executive leadership.