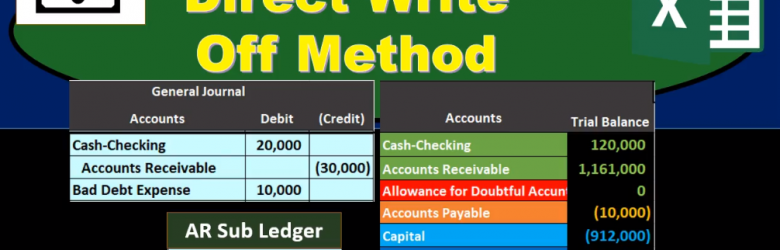

This presentation we will be discussing the direct write off method. The direct write off method as it relates to accounts receivable, quick summary of accounts receivable accounts receivable is a current asset, it’s an asset with a debit balance, we are going to be writing off certain amounts for accounts receivable that will become not due or not collectible at some point in the future. There are two ways to do this one is called the allowance method. The other is the direct write off method, we will be using the direct write off method here the non generally accepted accounting principles method being this direct write off method. However, a method that is typically much easier to use. Therefore, when considering whether or not to use an allowance method or direct write off method, we want to consider one do we have to use an allowance method due to the fact that we need to make our financial statements in accordance with generally accepted Accounting Principles, or are we able to choose between having an allowance method or direct write off method? If we choose to have a direct write off method, it’s probably because we’re thinking that the receivables that will be written off are not significant.