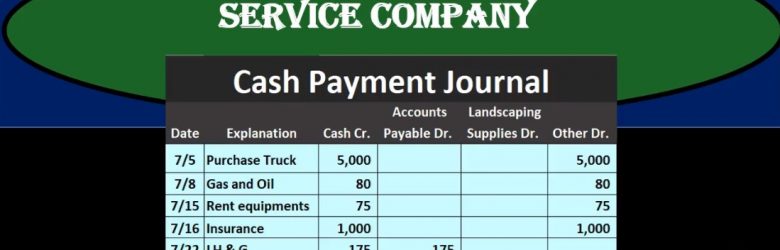

In this presentation, we will take a look at a cash payments journal for a service company, the cash payment journal we’ll be dealing with transactions where we have cash payments, that’s going to be the factor that will be the same for all transactions with cash payments meaning this column here cash payments will always be affected wish they kept cash payments journal cash payments journal will be used when using more of a manual system rather than an automated system. However, it’s good to know what the cash payments journal is, even if using an automated system because it’s possible that we or it’s very likely that we would need to run reports that will be similar in format to a cash payments journal. And it’s useful to see this format or how different types of accounting structures can be built.

Posts with the equipment rental tag

Rental Income New Service Item New Income Account 8.90

This presentation and we’re going to record rental income. In other words, we’re going to create a sales receipt within that sales recruiting receipt, we’re going to create a new service item that for rental income, we’re also going to be creating a new income statement account a new revenue account for the rental income. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re not going to create a sales receipt for a sale, the sale for rental income. So we’re imagining then that we’re renting out our equipment and we’re receiving revenue for the rental of the equipment.