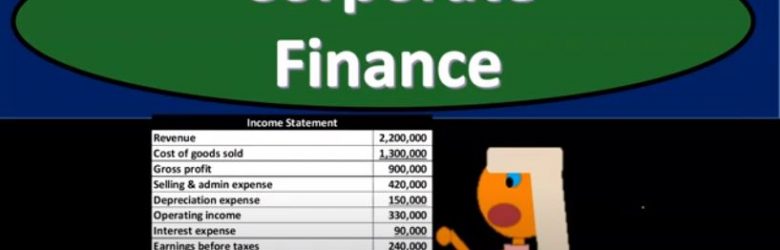

Corporate Finance PowerPoint presentation. In this presentation, we’re going to continue on discussing the income statement. Get ready, it’s time to take your chance with corporate finance income statement continued. Remember that as we think about the financial statements, we can break them out into basically two objectives that an investor might have the investor would want to know two general things one, where does the company stand at a point in time with their approximate value as of a point in time? And two? What is the likelihood of their performance in the future? What how well, will they do in the future? How can we predict how well they will do, we’re going to base it on past performance. So the point in time statement is going to be the balance sheet. So remember, if you’re looking at financial statements, for the year ended, say, December 31, the balance sheet will be as of a point in time and therefore as of December 31, it will not be a range. Whereas if you’re looking at a time frame, meaning the beginning to the end of the period, so if you’re looking for financial statements for the period ended, or the year ended, December 31, then the income statement, the primary timing statement, will be represented, it’ll say January through December or for the year ended December 31.