In this presentation, we will set up a new company file from QuickBooks desktop, QuickBooks Pro 2020. These are going to be the icons we will be using in order to open the program, you’ll recall that we’re going to be using QuickBooks 2020. We no longer need this set up process, I’m going to remove that or QuickBooks Pro 2019. The process would be much similar for prior versions of QuickBooks as well.

0:24

Note that this is the program this is actually the program file. As we open up the desktop version, we will be creating company files in a similar fashion as you would think with Microsoft Word, or excel in that we have the program. Then we have the word documents, Excel worksheets, and we could then open up those Word documents and excel worksheets from the actual docs document or worksheet, or we can find them by first opening the program. QuickBooks is a little bit different because most people with QuickBooks will open up the program instead of going and searching out the file size.

1:00

And one reason for that is because most people only have one file unless you’re a bookkeeper do public accounting, you typically work with only one file. Therefore, if you open up QuickBooks, you expect it to go through the one QuickBooks file that you are using. However, you want to know where that file is located in case there’s a problem. And if you are a bookkeeper, you want to be very organized with where you put the QuickBooks company files because it can get confusing just like any kind of file system.

1:26

Therefore, the first thing we’re going to do is set up a file that we’re going to be putting the folder into. So we’re going to create a new company file that company will be called get great guitars. So we’re going to create a new file, and then put get great guitars here once it is created. So I’m going to make a new folders, put it right on the desktop, we’re going to call it I’m going to call it get great guitars. And that’s where we’re going to end up as having our company file once we set it up within QuickBooks, so we’re going to start the new company from scratch, we’re going to open up QuickBooks by simply double clicking the icon.

2:00

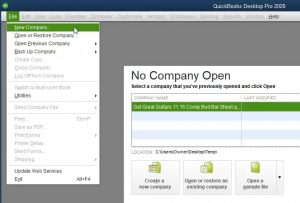

When we open up QuickBooks, it’ll typically open up to this screen, older versions will typically often go right into the company file that you had previously opened. If that is the case, you can go to the File tab and you can close this the company file that you are in, or we can actually just go to new company file without even closing the company file we’re in. Recall that this file here is only showing the recent items that we have been in. So once again, if we only work with one company file, it’ll typically be listed here.

2:29

And we can use this quick search field to go into it very quickly. However, if we have multiple company files, then this field may not show all of them because we haven’t been in there recently. So you want to know exactly where they are. Even if you only use the one file, you really want to know where it is located on your desktop on your computer. Because if there’s a problem with the system, and then you don’t know what, then you have to go and actually search for the file, I could actually be a little bit confusing.

2:56

So you want to know where the QuickBooks file is. And this field doesn’t really show you exactly where it is. And so you don’t really want to depend on that. So just be aware of it. This is not the file that we will be using, we’re going to create a new company file from scratch. Now if you look at the screen down below, you could use this icon which says Create new company file. The other icon open or restore. If you had to wanted to restore a company file or open an existing file, or open a sample file which are useful to us within QuickBooks as well, we do have the feature now find a company file, which makes it a little bit easier now to find those company files within the system.

3:36

You know, QuickBooks default settings to save the company files were a little bit strange before it would kind of put an under the C drive and under like five folders down under an Intuit type folder. So it’s nice to have this icon here, which will help you to locate QuickBooks files as well, we may review that icon later. Now I like to instead of using the Create a new company file here, go up to the File tab up top, which has the same option.

4:04

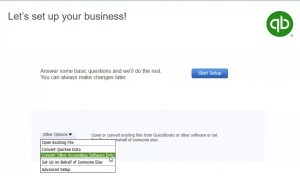

The reason I like it better is because if I have some other window open, and I don’t see this window, then I could still open it, you can open it from any window, I can go to the File tab, and we can go to new company. So that’s what we’ll do here file new company. Then QuickBooks says let’s set up your business. So we have the answer some basic questions, and we’ll do the rest. So you can always make changes later.

4:27

So we’re going to start here note, you have some other options. And if there these are some other options that are applying typically, if you already have some accounting in another system, there may be some options to import some of that data from a prior system. So open or convert existing files from QuickBooks or other software or set this file up on behalf of someone else. If that’s the case, then you can go into some of these open existing file.

4:54

Obviously, if we opened it and existing file, we would have done that from a previous setup just to open an existing quick QuickBooks file convert Quicken. So Quicken is another Intuit product very similar to QuickBooks designed more for individual and investment tracking. So you may be able to then convert the quick in data to QuickBooks data, and then be able to save some data input in that case, converged other accounting software.

5:20

So if you have some other type of accounting software that you want to import, instead of starting from scratch in QuickBooks, you probably want to consult with a CPA or a bookkeeper to think about whether or not you want to convert that or just start from where you are at at this point in time, set up on behalf of someone else and advanced setups. And so we’re going to go through here and start this simple setup, the basic setup the advised set up and then we’ll go back into the file. And we’ll make some more adjustments in terms of the chart of accounts, adding new accounts in adjusting the preferences.

5:56

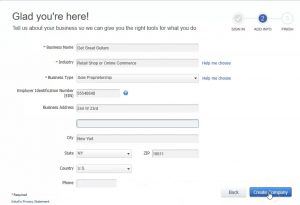

QuickBooks, then once I sign in, you’ll enter your email address will use this email address to see if you have an into an account. But it’s kind of their checking feature. Next, we’re going to enter the company data. So the company data, everything that has the Asterix here, the red mark, those are things that are going to be a required field.

6:16

Now note that not all the fields are required, if you’re going to be using this bookkeeping system, and you’re going to be using it in order to give invoices to customers and whatnot, then you’re going to be wanting to include things of course, like the business field and the EIN number and all of that kind of data.

6:32

If you’re just simply using it for bookkeeping system to track your bookkeeping and you’re not providing that type of information to third parties. And or and or if you just want to test the system and work through the system, then of course, all you need is really the name, the industry and the business type, you need the name because that’s going to help QuickBooks to say what company file it is, it’s going to save the company file under the name, it wants the industry because that in the business type, because these things are going to help QuickBooks to customize the set up for you, it’ll try to customize the chart of accounts for you so that you can set them up.

7:09

So these three are the ones that you’re going to have to have in order for QuickBooks to do anything to set up a company file. In other words, if you don’t have an EIN number, or you don’t want to put an EIN number for whatever reason in the system, you could still set up the file, but you would want the EIN number, if you were to issue something like 1099, same with the address, and so on and so forth. So let’s go ahead and put put in this information, our business name is going to be get great guitars there Here is the get great guitars, then we’re going to go to the industry, we could use the help me choose item for the industry.

7:45

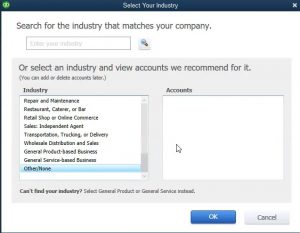

Now note that these items are the things that are going to help QuickBooks to set up things like the chart of accounts that I’ll give you kind of a default chart of accounts to work with, which for most people is useful. However, for some people, you might want to customize your own Chart of Accounts. So therefore just keep that in mind. So if I go into the Help me choose, we have the industry selections we can have these are going to be the basic type of industries.

8:07

Again, if you don’t want any Chart of Accounts over here, at like, you’ll notice that if you select any industry, it gives you basically the accounts it says, hey, these are the chart of accounts that’s kind of common to this industry. These are the chart of accounts that we’re going to set up for you, they will automatically be there from QuickBooks by setting it up, if you say hey, I don’t want a chart of accounts, I want to do my own accounts, I want to set up my own stuff to customize it for myself, then you can go down to the other tab down here, no Chart of Accounts. And you could just basically started from scratch, it’ll just give you a couple basic accounts that are pretty much mandatory for any kind of industry.

8:42

Most people will want to basically choose an industry here and most of these industries will be something that fit most people, you want to have that chart of accounts that’s going to be set up for you. Because then if you’re not really familiar with accounting, you can kind

8:58

of use the chart of accounts as a deep in other words, you can think about when we record transactions, is it on the chart of accounts, is there something on the chart of accounts, if it is basically use that as the default, because QuickBooks is saying, hey, that’s the industry standard. And if it’s not on the chart of accounts, then you can basically add new accounts as you go. So you can always add new accounts.

9:20

But if you have some concern about what’s industry standard, what’s the norm, then then, of course, you want to choose the chart of accounts here. And that’ll really help to guide most people, we are going to be choosing a retail shop or online commerce. And as we do this, then it’ll see the chart of accounts on the side over here and we can kind of review through them. The main thing we want is, is that if we’re a service company, we’re not going to have things related to basically the cost of goods sold basically inventory type of items.

9:48

If we have inventory items, which we want to look at with our example problem, because they can make things a bit more complex. And then we are going to need things like cost of goods sold and the tracking of the inventory. So we want to pick something that will have that we’re going to have the retail shop and the online commerce, we will be considering items of inventory as well as service transactions when creating our bookkeeping system.

10:13

So we’re going to say, Okay, next we have the business type, what’s the business type that we have set up once again, we have the drop down, or we could go to the help me choose center, if we go to the help me choose, we have the business setups. Now these are basically the business type entities that we have.

10:30

Most people when they set up a very small business, they’re going to be a sole proprietor. In other words you haven’t Incorporated, you haven’t set up anything that makes the entity basically a separate entity from yourself or a pass through type of entity. That’s what we’re going to choose here.

10:44

Now you could be a partnership or LLC. So that would basically a partnership would mean that you have two people that would be involved as the owners, an LLC is a kind of limited liability type of partnership. If you have questions on which of these to set up as an terms of your legal entity, you want to consult an accountant or a lawyer on that. And then we have the LLC could be a single member or multiple, we have the corporation. Most small to mid sized companies are not c corporations, they may be typically S corporations more likely a pass through type of entity, not for profit organization or other.

11:22

Once again, we’re going to choose the sole proprietorship here, most of the accounting kind of basics and fundamentals within QuickBooks will be much the same with these different types of entities. The major difference being with the equity section, you know, when we have the partnership, we have to think about two partners and breaking out the equity. So we’ll discuss that a bit as we go.

11:42

So we’re going to say okay, and then we are going to put an EIN number and address because we do want to look at the documentation for recording transactions that we would give to somebody else such as invoices and other types of transactions. The EIN number is an employer identification number, this is a number from the IRS. Now you would think you would only need it if you had employees. But that’s not necessarily the case.

12:08

Because anytime you have a business transaction where somebody wants to identify you with something other than just the business name, they typically need a number, obviously, the IRS thinks of you as a number, but other people think of you as a number two when they have to deal with the IRS. So if you had to give a 1099 or something like that, or someone needed to give you a 1099, then you have to give them some type of number, if you don’t have an EIN number, you got to give them your social security number, which you know, that’s not the best thing to be given out most of time, right?

12:36

So you want it so an EIN number might be something that would be useful for pretty much any any business, you can go to the irs.com, website irs.gov, IRS not not IRS. com, irs. gov. GOV and look at the process for the EIN number. And then we have the business address, this is the address I’m just going to use for the example problem.

12:58

So here’s the address that we’re going to use zip code. And the country this kind of stuff, of course, will be showing up on things like invoices that we will be sending out to the clients to the customers. So then we’re going to create the company file, we could actually select the blue item creating the company file now. And my my EIN number is not formatted correctly. So let’s I think I’m missing an eight, I’m missing a digit, which for me, I’m going to add an eight. So I’m going to say all right, there’s the added eight. And then I’m going to say create.

13:29

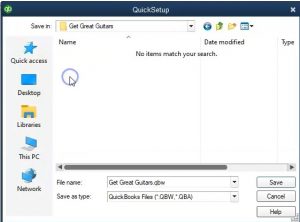

Now QuickBooks is going to say Where do you want to put it. So we have to create the company file. So this is where we’re telling QuickBooks Hey, this is where we want to create the new company file. So whenever we go into it, we’re actually opening up a company file here. So we want to go to the folder that we just set up, which is going to be the get great guitars. And that’ll be here. So get great guitars, hearts a little bit messy on the desktop here. And then I’m just gonna keep notice that name, get great guitars, you’ll notice it’s a QBW file

13:56

as a quote, as opposed to a QBB type five, which will be about backup type file. And so here’s the QuickBooks file, type the QBW. So I’m going to go ahead and say save, it may take a little bit of time to set up the company file. So be patient be calm, it’s setting up the company file that’s been updated. Now we get this little pop up screen, which says QuickBooks desktop usage and analytics studied into it, we work continuously to improve our software and provide you with the best possible product service and experience.

14:28

One way we do this is by tracking QuickBooks desktop usage, QuickBooks is a web enabled product. When you’re connected to the internet from within QuickBooks, in addition to delivering product updates, messages, service information, and help content, we also collect data about you and your use of our software. This helps us see where our software is effective. And what Intuit services help you manage your business most effectively learn more about the data we collect.

15:01

So they’re basically saying, Hey, we’re tracking the usage of QuickBooks to some degree, it should just be for business, you know, analytics use, hopefully to help the software to improve. So I’m going to say all right, continue. That before we get into the software, QuickBooks, once again gives us another kind of upsell in type screens and other types of things we may want to purchase related to QuickBooks again.

15:22

So keep everything in one place with QuickBooks desktop. So you got to get paid faster type of center for for a payment setup, we have once again the payroll that they’re saying, hey, do you want payroll information, once again, that would be an added cost to learn more about that. And then we have the checks and supplies Do you want to have checks and supplies that would be pre printed that typically types of things that would go along with the QuickBooks systems such as checks that which you can print out through QuickBooks, we’re going to say no here, and I’m just going to close it up here.

15:51

Or you could say start working down below, I just kind of x these things out, typically, as long as they get out there. Now again, before we’re actually in the software system, QuickBooks has a other basically pop up that it’s happening before we’re in the system. And this includes things like the new feature tour will discuss a bit about the new features, you know, this is going to be the new features since basically last year that we had, and we’ve got the invoicing, we’ve got the reports, we’ve got the help support and file management, we’re not going to go through all these. Now just note that you could take a look at those if you don’t want to and you want to get straight into the work, then once again, you’re going to close this screen out.

16:29

And then QuickBooks desktop will typically default to our good old home screen here on the left, you see the home screen on the left. Now typically, I like to see on the left the open windows. So what I do whenever I start a new company file, or whenever I open it, I then go to the View tab up top, and I go to the open windows list. So then I could see the open windows, which in this case is just the Home tab.

16:52

So of course the Home tab is going to give you that flowchart, you’ve got the vendors, you’ve got the customers, you’ve got the employees, that’s basically our default kind of setup, this will help us to basically enter data fairly easily. The other thing we want to take a look at that we selected as we set up the file is going to be the chart of accounts. So to get to the chart of accounts, I typically you could go to the chart of accounts here and the company data, I usually use the drop downs to get to the chart on account. It’s a format of lyst.

17:21

So I’m going to go to the lists up top and go to the chart of accounts, what are the accounts that we will be using, whenever we do some new thing that will be set up, we’re gonna have to let name and account in some way, typically, and these are going to be the chart of accounts that we will be using. So notice QuickBooks set these up for us, we didn’t have to do anything, they set up the chart of accounts how based on the industry that we put in. So based on the industry saying that we’re going to be basically selling kind of inventory, we have the chart of accounts. So we have and notice the order of the chart of accounts, it’s going to be in order by in essence type. So the type is going to basically be the accounting equation, right assets, liabilities, equity, and then broken out into more detail, the assets would be current assets, which we don’t have any yet, we’re gonna have to add some.

18:06

And then we have the property plants and equipment or fixed assets, then we have the other assets. And then we have liabilities, which is going to be the current liabilities, and then the equity section. So assets liabilities, equity, then income type accounts, revenue type of accounts, and then Expense Type of accounts that it’s going to be the order that the accounts will be set up in our default then will be typically, when we add new items, when we start to enter things into the system,

18:36

we’re going to say, Hey, is there an account already set up that would line up to the new thing that we are putting into the system, the new bill, the new check the new payment, if there is we’ll just simply use that account, because that’s typically going to be the default account for the industry that we are in.

18:52

If there is not, then we’ll consider adding a new account. So you want to be careful adding new accounts because they can get kind of long and messy. So you’re going to you what you want to basically that’s the system that I would basically put in your mind is it you know, put a new thing in there is there an account already selected that would go along with this one, if there is great if it seems like there’s you’d like a new account to track this out separately, then make a new account, just don’t do it, you know, be don’t do it every time make a new account for every transaction.

19:21

You’ll note, of course that we have the merchandise sales, because we said we’re going to be selling the inventory. So that’s going to be one of our key accounts, we’ve got the cost of goods sold, we’re selling inventory. If we did not sell inventory, if we said we were a service company, then we probably wouldn’t have those items. Down here in the income type section, it might name then the revenue or income type of accounts some other name. If we would like to change the name of these accounts, of course we can, we can call it revenue, we can call it some other sales item. If we if we choose to.

19:54

We’ll go through some of those options as we move forward and future presentations. Also note that if you click QuickBooks and you open it back up, it will typically require you to have a password. So if you want to put the password in proactively will do that. Now note that it will typically require you to have when you want to make sure that you know where the password is, it’s not as easy to recover the password here as it is with other types of things. So don’t just put in a password and say well, that’s okay, I could recover it later.

20:22

If I forget about it or something like that just to push forward, make sure you write it down it’s not as easy to recover the password. So the where you go for the passwords as you go up to the company drop down up top, you’re going to set up user preferences and passwords and you want to change your password because I’ve already set one up so it says change the password. And this would be the screen where you would enter the password. The recommendations that I believe these are the minimum requirements actually are to have seven characters including one number and one uppercase letter.

20:53

So make sure to put that in there our password for all the files that we will be working with in this practice problem will be GGG 1234 get great guitars GGG 1234 any file you open up here will typically need that password if you use one of the backup files related to this problem.