And I’m going to say it’s going to be unrestricted. And then we don’t need anything here, the debit amount is going to be that 11 five, I believe is what we’re working with here. 11, five, yes, 11 500. We don’t need any any other categorization here. So we look good, the other side is going to be going out of that new account, we set up in the expenses, pp and e 8100. It’s also it’s going to be the fun should be unrestricted, I’m going to say unrestricted here, unrestricted. And then that’s going to be the credit of 11 500. Now, if you’re not good with with the debits and credits, obviously, if you went the wrong way, what would happen you’d see this account be doubled. And in that would be wrong way, right. And then you just switch the debits and credits, and you’d be back on so the total debits add up to the total credits, this is going to be our transaction.

Posts with the plant tag

Percent of Sales Method 425

Corporate Finance PowerPoint presentation. In this presentation we will discuss the percent of sales method, the percent of sales method been a tool that can help us with our projections out into the future help us to think about where we will stand, think about what our balance sheet accounts will be in the future. If we, if we estimate some type of growth into the future also help us to determine whether or not we may need additional funding to support our growth plans that we have set in place. Get ready, it’s time to take your chance with corporate finance percent of sales method. Now this method can be a little bit confusing when you first look at it in the calculation or formula for it can be a little bit intimidating as well, I highly recommend to get a better understanding of this formula and how to apply it to go through the practice problems, we will have practice problems related to this formula in terms of Excel problems, as well as working through the practice problems and presentations in one note.

Balance Sheet Property Plant %26 Equipment From Trial Balance 13

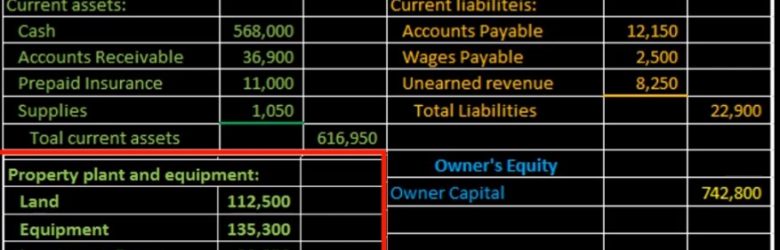

Hello in this lecture we’re going to put together the section of the balance sheet of property plant and equipment from the trial balance property, plant and equipment will be part of the assets can be the subcategory of assets, we talked last time about the creation of the current assets. And now we’ll be moving on to property, plant and equipment, which will then sum up everything for total assets. We will be picking these numbers up from a trial balance. And once we have completed all the financial statements, what we’re basically doing is taking a debit and credit format from the trial balance, converting it to a plus and minus format in terms of the financial statements, assets, equal liabilities plus owner’s equity so that people can read it even if they don’t understand debits and credits. In this lecture, we’re focusing in on this section here, which will be a land equipment and each cumulated depreciation.