This presentation and we will take a look at the employee section of the homepage, which will include the pay employees and pay payroll, we will do this within QuickBooks Pro 2020, QuickBooks desktop 2020. Here we are in our get great guitars file which we set up in a prior presentation. If you don’t have the get great guitars file that is ok, you can follow along with your own company data.

0:25

We currently have the open windows open in the left side, you can open the open windows by selecting the view drop down up top and the open windows lyst. We also have the homepage open typically it is open when we open QuickBooks but if not, company file up top and the homepage. The homepage is a great tool for viewing activities by cycle and prior presentations, we took a look at the vendor cycle and the customer cycle. Now we’re going to be looking at the employee cycle.

0:55

Now note we’re going to be bouncing around a little bit from this current file that we have set up to a new because we’re not requiring that you set up paid payroll in order to go through this practice problem. To set up paid payroll you would go to this item over here to turn on payroll, it will typically be an add on feature, there is also going to be a manual payroll or is typically a manual payroll within QuickBooks. However, the setup process is having problems at this point.

1:23

Therefore, we won’t be setting up the manual payroll, but we will demonstrate payroll in a future problem as we will display the paid payroll in that future problem. Therefore, down here, when you look at the employees in our current file, we don’t have the full type of items that you would see. Therefore, I’m going to go to another file now. So this is not going to be like the file that you have currently, it’ll be a different type of file, which will then be including this icon. So I’m going to go to the second file. Here it is the employees down below.

1:55

If we were to pair purchase payroll or set up the manual payroll, then you’d see this a flowchart that we’re used to seeing in the vendor and customer section. So in this flowchart you have the entire time, we’re not going to spend a lot of time, going through the entire time section, the entire time section will help us to track time by employee is not really the part of the payroll process, it’s part of the tracking of payroll that the tracking of the time for it that we can then use to help us out to generate the payroll. And it can also be used to build things on the invoices as well to clients.

2:31

So we’re not going to enter the actual times, typically we’re going to go straight to the item of pay employees. And the pay employees in this section then, of course, would be the tool that we would use to process payroll. So let’s take a look at that now to go into the paid employees. Again, this isn’t a separate file, not the current file that you’re taking a look at, because the current file, or the problem we are looking at now will not have paid payroll and currently doesn’t have the manual payroll. So if go into this item, then we’ve got the pay employees screen.

3:04

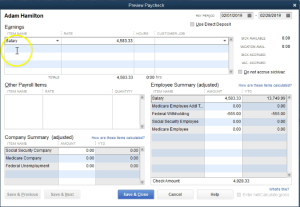

And what we’re going to have up top is the pay period ends, that’s when the period ends, for the payroll which could be bi weekly, semi monthly, monthly, or weekly or so on, then the check date, which is not always the same date notice, of course to the end of the pay period might end at some point and we might pay the check then at some future period, where they’re going to be writing a check. And we’ve got our two employees that we’re going to be writing the check for. If we were to select one of those employees, then we’re going to get the detail of the check, I’m going to check it off and then select an employee. And you’ll note then we have the detail for it. So this is Adam is going to be a salaried employee, the rate is this amount, which is a salary amount.

3:50

And then we have the salary that it’s going to be paid and the amount that’s going to be withheld from the check, including federal withholding Social Security and Medicare, which would have to manually input considering this was the manual input system, that would then give us the net check. Then we have the employee or portion including Social Security, Medicare and federal income taxes. Now, we’re not going to get into a whole lot of details, recording payroll, we got a whole nother course on recording payroll, we’ll spend a little bit of time after this problem focusing specifically on payroll. So if you want to get a lot of detail, you want to take a you know, payroll course on it.

4:26

And then if you want to get a little bit more update on the payroll will spend more time after this practice problem in specifically payroll. So we’re going to close this back out the other employee he is Erica, we have the same kind of process, hourly pay this time. And then you would basically have the same kind of detailed down here. If I close this back out, then we would process the payroll in this section, it would then

4:51

generate the payroll checks. So as with other types of items, we want to see, you know, what would the payroll do it’s similar to a forum type of thing happening payroll is, of course, generating checks, but they are specific checks, they’re going to be payroll checks, what will those payroll checks be affecting as we generate those payroll checks, it’ll affect much more than just two accounts oftentimes.

5:14

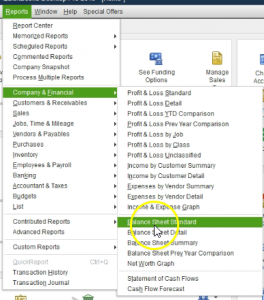

So what’s going to happen when we enter payroll, if I if I close this back out, this process will enter checks. When we enter checks into the system, let’s consider what will happen in terms of the financial statements. I’m going to go back up top over here, I’m going to go to the View drop down, I’m going to go to the open windows, I’m going to look at the financial statements are going to go to the reports and again, your financial statements will not reflect payroll, this is a practice file, we’re going to go to the reports up top, we’re going to go to the company and financial, we’re going to go to the balance sheet standard. Within the balance sheet, I’m going to change the dates up top to the customized report, change the date range.

5:50

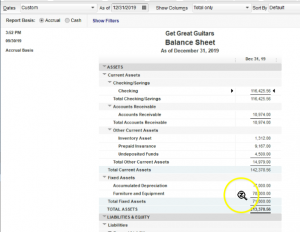

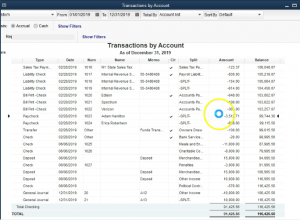

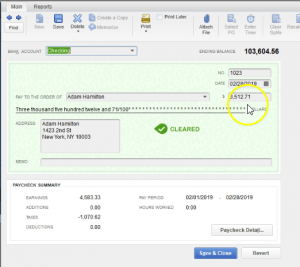

Now this is going to be in 2019 for this data file. So it’s going to be a 10119 to 1230 119. And then so January through December, I’m going to say okay, and this is going to be our balance sheet. Now within the balance sheet, we know that the checking account will be decreasing, because we’re going to be writing payroll checks. So I’m going to double click on the checking account. And let’s see if we can find some payroll checks. So if I scroll back down looking for the payroll checks, here they are here we have Adam, Hamilton and Erica, if I was to select one of these items, notice the check here is for Adam 3512, double clicking on it.

6:30

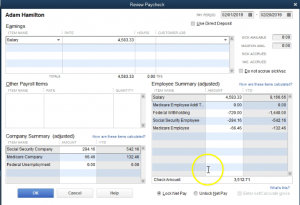

That amount, of course is not the gross check. But the net check. That’s the amount of the actual check, there were this amount of taxes that were taken. If I want to see the the detailed notice this is a check screen. But it’s a payroll check and therefore has a different kind of data input stream to it on the bottom here. If I go to the paycheck detail, then we see basically our input screen. Here’s the salary. Notice the actual check was written for 3512 71.

7:00

So we have the salary minus the federal withholding minus the Social Security minus the Medicare, these are the federal taxes that were calculated for this particular problem that will then give us to the payroll taxes. On top of that, then we also had the Social Security, Medicare and fed and federal unemployment are not here. But we could have that in terms of the employer taxes paid over and above what the employee amounts are.

7:27

So in other words, these taxes over here are theoretically taken out of the employee, check these taxes over here are paid over and above the 4005 at 333 in the employee check, closing this back out, closing this back out, then we can close this back out, then we’re going to go to the reports drop down up top, we’re going to go to company and financial. And now let’s take a look at the profit and loss of standard that’s going to be the income statement type report, changing the dates once again from Oh 1011, nine to 1230 119.

8:03

So January through December, scrolling back down through this, we’re looking at the other side being payroll expenses, within payroll expenses, I will double click on the payroll expense. And then we’re going to have these items for Adam and Erica, once again, if I was to select, for example, this paycheck for Adam, double clicking on that amount, and then I’m going to go to the check detail, we have the full amount in the expense of the 4005 83. So notice on the expense side, we’re recording the entire expense, not the net check, because that’s what was actually earned.

8:40

So we’re increasing the expense for the entire amount, the amount that’s going into the that or decreasing the checking account is the net check not the entire amount, but amount minus the taxes, closing this back out to closing this back out. We also have the 258, the 66 here, double clicking on that, where does that come from double clicking on the check item, that’s going to be the employer taxes. So that’s actually payroll taxes that are paid over and above the check, then the net check or the payroll check, closing this back out closing this back out. Now those liabilities, then that, that we didn’t pay the employee, but which they earned and the employee or liabilities or something we owe to the government,

9:30

and therefore they’re going to be on the balance sheet, and a liability account. So if I scroll back down to the payroll liability, the payroll liability will be increasing double clicking the payroll liability, we will once again see some examples of these paychecks for Adam and Erica, if I double click that 750, for example, and the check detail, there we have the the detail of it, it’s going to be these items that will be increasing the liability as well as these items on the employee and employer side, closing this back out, closing this back out 720 it’s breaking those items out this is the social security and for the employees social security for the Medicare.

10:13

So this is federal income tax employee Social Security employees Social Security, Medicare, Social Security employee or Medicare employee, Medicare employer. All right. And that’s what we’re going to owe to the to the government, that’s going to be the typical payroll. So obviously, that’s a lot of information. You got to understand payroll, you gotta kind of see this a few times. And you got it why and get into more detailed sense of, you know, running the reports, the quarterly reports, the yearly reports and all that kind of thing. And for that you really need a full practice problem on the payroll, I’m going to close this back out.

10:49

Going to go back to our homepage. The bottom line that we want to know here though, is of course, this item is similar to the forms that we have created up top, but a little bit different. Because this item is going to be something a tool that we will be used to in essence create checks, however, those checks are going to be specific checks that will have a lot involved in them, those checks being the payroll checks, then if we close this back out, the next item that we will have in our little function here will be to pay the employees and this will be a function that will help us to pay those payroll liabilities.

11:24

So you’ll recall that if we go back to the balance sheet then that we had payroll liabilities that we owe, that payroll liability field will in essence be a tool helping us to create paychecks or basically checks out paychecks checks, they will be decreasing the checking account for the proper amounts in order to process the payroll properly. So that’s going to be the the payroll items down here. Again, we’ll spend more time on payroll after this this presentation are this problem because we’re not going to be setting up the paid payroll within this problem.