In this presentation, we will take a look at a comparison between the allowance method and the direct write off method. When considering both the allowance method and the direct write off method, we are considering the accounts receivable account. Remember that the accounts receivable account represents some money that is owed to the company, typically from sales made in the past, on account haven’t yet received the funds for sales made in the past and therefore, the company is owed money. We see this amount on the trial balance in this case 1,000,001 91. We then want to know information about that, including who owes us that money. We can’t find that typically in the GL as we have a GL for every account the GL only giving us the information by date. Typically, we want to see that information also broken out in the subsidiary ledger saying who owes us this money.

Posts with the receivable account tag

Allowance Method Accounts Receivable-financial accounting

Hello in this presentation we’re going to take a look at the allowance method which is of course related to the accounts receivable account, we will be able to define the allowance method record transactions related to recording bad debt recording the receivable account that has been determined to be uncollectible recording every single account that has been collected after being determined that it was uncollectible. So we’re going to take a look at some different transactions, the most common transactions when dealing with the allowance method and see what those look like and why we use the allowance method. We’re going to work through a problem. So what we’re going to have here is we’ve got our accounting equation, of course we have our trial balance, I do suggest working problems to take a look at a trial balance because it can give you the context in which to work problems. So here’s what we have. We’ve got the assets in green, the liabilities are going to be orange, the light blue is the capital account and the equity section.

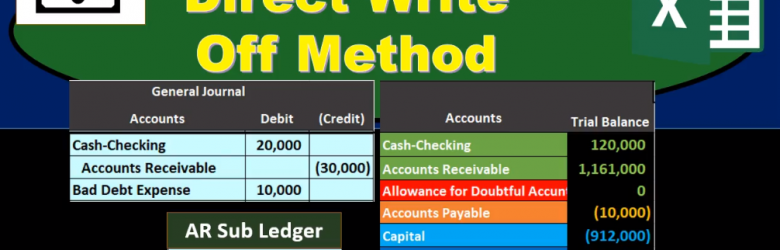

Direct Write Off Method

This presentation we will be discussing the direct write off method. The direct write off method as it relates to accounts receivable, quick summary of accounts receivable accounts receivable is a current asset, it’s an asset with a debit balance, we are going to be writing off certain amounts for accounts receivable that will become not due or not collectible at some point in the future. There are two ways to do this one is called the allowance method. The other is the direct write off method, we will be using the direct write off method here the non generally accepted accounting principles method being this direct write off method. However, a method that is typically much easier to use. Therefore, when considering whether or not to use an allowance method or direct write off method, we want to consider one do we have to use an allowance method due to the fact that we need to make our financial statements in accordance with generally accepted Accounting Principles, or are we able to choose between having an allowance method or direct write off method? If we choose to have a direct write off method, it’s probably because we’re thinking that the receivables that will be written off are not significant.