QuickBooks Online 2021 Profit and Loss P and L income statement overview. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive practice file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in Craig’s design and landscaping services practice file, we’re going to go into the profit and loss or income statement by going to the reports down below, we’re going to be opening up the standard profit and loss which should be in your favorites because it is a favorite report, profit and loss report, otherwise known as an income statement, sometimes called or referred to, in short as the P and L,

Posts with the sub category tag

Income Statement Overview 220

Hello in this presentation we will discuss the income statement objectives. At the end of this presentation, we will be able to describe what an income statement is list the parts of the income statement and explain the reasons for an income statement. First, we’ll start off with a question we’ll which will explain the timing of the income statement or introduce us to an explanation of the timing of the income statement? And that is the question of asking somebody, how much do you make when we work through if we were to ask somebody how much they make? They would mentally make some type of assumption in order to answer that question, or they would ask you the question if they chose to answer at all. The question, What do you mean? Do you mean per month? Do you mean per year? Do you mean per week? And this is going to be something that needs to be answered in order to answer the question.

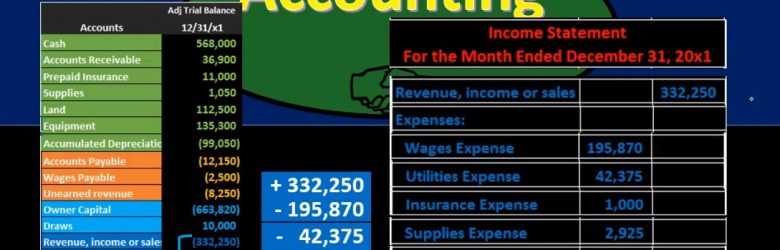

Income Statement from Trial Balance 16

Hello in this presentation we’re going to take a look at the creation of the income statement from the trial balance. First, we want to take a look at the trial balance and consider where the income statement accounts will be. When looking at the trial balance, it will be in order we have the assets in green, the liabilities in orange, the equity in light blue, and then the income statement accounts including revenue and expenses. That’s what we are concentrating here we’re looking at those income statement accounts. And that is what will be used in order to create the financial statements to create the income statement. Note that all the blue accounts represents the equity section. So the income statement really is going to be part of total equity. If we consider that on the balance sheet, then we’re really looking at a component of this capital account.

Short Term Loan Adjusting Entry 10.10

This presentation we will look into recording and adjusting entry related to a short term loan. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Let’s first take a look at our reports our balance sheet report for this transaction that we’re going to be recording or this adjusting entry, we’re going to be opening up our favorite report that being the balance sheet report, we’re going to change the dates up top the dates from let’s make it a 1012020 229 to zero. Now, when we think about the adjusting entries, we’re always going to be thinking of them as kind of like the cutoff dates, we’re trying to make things correct as of the cutoff date, which in this case, it’s going to be the end of the second month.