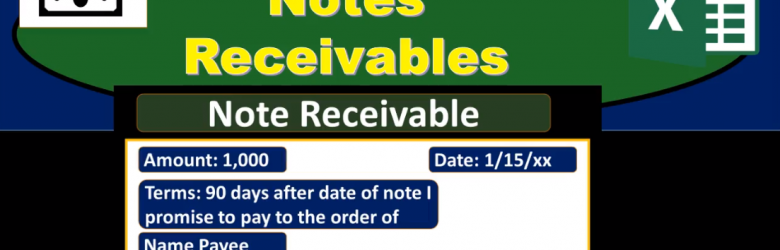

In this presentation, we will take a look at notes receivable. We’re first going to consider the components of the notes receivable. And then we’ll take a look at the calculation of maturity and some interest calculations. When we look at the notes receivable, it’s important to remember that there are two components two people, two parties, at least to the note, that seems obvious. And in practice, it’s pretty clear who the two people are and what the note is and what the two people involved in the note our doing. However, when we’re writing the notes, or just looking at the notes as a third party that’s considering the note that has been documented. Or if we’re taking a look at a book problem, it’s a little bit more confusing to know which of the two parties are we talking about who’s making the note who is going to be paid at the end of the note time period? We’re considering a note receivable here, meaning we’re considering ourselves to be the business who is going to be receiving money. into the time period, meaning the customer is making a promise, the customer is in essence, we’re thinking of making a note in order to generate that promise, that will then be a promise to pay us in the future.