This presentation and we’re going to record rental income. In other words, we’re going to create a sales receipt within that sales recruiting receipt, we’re going to create a new service item that for rental income, we’re also going to be creating a new income statement account a new revenue account for the rental income. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re not going to create a sales receipt for a sale, the sale for rental income. So we’re imagining then that we’re renting out our equipment and we’re receiving revenue for the rental of the equipment.

00:37

So there’s going to be a new kind of income that we have. For us. We’ve had the guitar service income of the guitar lessons, service income, other types of service incomes and the selling of the guitars. Now we’re going to have the rental equipment. So therefore we’re going to go up top to the New button. We’re going to go into the money and we’re going to be creating a make a sale. So make a sale. This will be pulling up the sales receipt we’re going to be putting this to a current customers, my current customers renting some of our equipment, we’re going to call that music store stuff is going to be renting some of our music equipment or music stuff store, it’s going to be renting some we’re going to say the date is the at the to 29. And then I’m going to scroll down to the payment method, I’m just going to say check on the payment method reference number for the check.

01:31

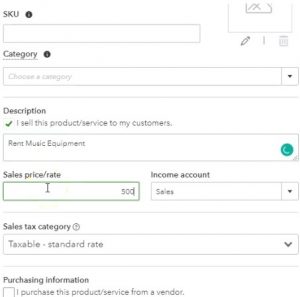

Then we’re going to go down to the product and service we’re going to add a new product and service which I’m going to call rent, music. He quit meant he quit meant ever go, thanks something like that. Then we’re going to say tab and we’re going to be setting up this item. Now it’s gonna we’re going to call it a service item. We’re not selling the inventory. So we’re going to call it a service item here. This is a rental process. So I’m going to keep it at the rent. Music equipment, I’m going to copy that no SKU, no category description is going to be the same. And then the price, I’m going to say is 500.

02:12

Now note when you think about the rental of music equipment, again, you kind of want to break it down, you probably bought one to break it down into what music equipment if you’re talking about renting the the amps amps or something like that, then you can have a fixed rate for a particular piece of equipment. So in this case, you might imagine an invoice that has multiple pieces of equipment that has fixed rates on it, and then hourly rates for those pieces of equipment. Or you might have some kind of package deal where you can say hey, this is the amount of rental equipment for this one price. And you get these package things in them.

02:48

You want to think about those types of things when you thinking about how you’re going to create the sales receipts and the invoices because that makes it a lot easier to basically market those types of things as well as making it easier to just say Bill for them. In terms of the sales receipt and the invoice, we’re just going to say 500 and be very general here with the music equipment. Now, we’re also going to be sitting it to another account over here, the sit the income account. We have two accounts right now one for our products that we sell and the other for the services.

03:21

Now, you want to be careful on too many kind of different categorizations of income accounts. But if you have a major difference in terms of the type of income you have, then you want to have those then you might want to have another different account on the income statement. Remember that there are various other reports however, that can help you break down your sales by service item or by item, for example. And so you can use those other reports too, so don’t get carried away. In other words, with putting too many income accounts like for example, you wouldn’t want a different income account for every guitar lesson instructor that you had possibly you break out Guitar Lessons income, maybe that would be another account you want here, but you probably wouldn’t want every, every instructor broken out as a separate line item here, you’d go into more detailed reports for that.

04:10

Okay, so I’m going to go down here, I’m going to say sales. And we can keep it at sale. After some deliberation there, I came up with equipment rental income, so that’s the line item, and then I hit tab. So equipment rental income is what we’ve decided on here. And then I’m going to create a new income account. So it’s going to be a new income account. And then the sub category, I’m going to create the service or fee income, and then the name is going to be the equipment rental income, and no sub account. And we’re going to say Save and Close. So there we have it, is it taxable? No, because it’s going to be service income. So I’m going to say non taxable, no vendor.

04:46

So I’m going to say that looks good. Let’s save it save and close here. So there it is in the description and the product, then we’re going to say the quantity that we have will be I’m going to put it at nine so nine times the rate of 500 4500 what’s this going to do when we record it, it’s going to be increasing because it’s a sales receipt, it’s going to be increasing some type of cash account, in our case that undeposited cash account, then the other side is going to be going to sales or some type of revenue account, it’s going to be going to a particular revenue account, which we set up along with this item, which is going to be that rental income revenue account.

05:23

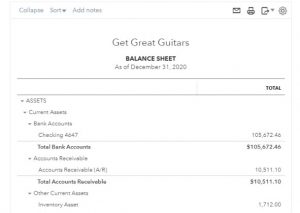

Let’s save and close and check it out. So we’re going to say Save and Close. Then I’m going to open up our report. So we’re going to go to our reports down below. On the left hand side. Let’s open up the three reports since we’re going to have a new account here. So we’ll open up the balance sheet Report. I’m going to change the dates up top so we’ll scroll back up top change the dates from 10120 to 1230 120. We’ll run that report. And then I’m going to duplicate the tab right clicking on the tab up top and duplicating it. Then I’m going to go to the tab to the left. Then I’m going to go down to the reports again on the left.

05:59

We’re going to be Then opening up the PnL profit and loss or income statement, there it is, we’re going to do the same process with this one, we’re going to be adjusting the date. So the dates, we’re going to go to the dates, and change that from Oh 1120 to 1230 120. Run that report. Then I’m going to right click on the tab up top and duplicate the tab. do this one more time with the trusty TB trial balance. So we’re going to go back in here like to search for that one. So we’re going to search for the trial balance, not my favorites yet, you would think it’d be in my favorites by this point. I feel like it’s a favorite report at this time, trial balance, and we’re going to open that one up. And we’ll change the dates up top there too from a 10120 to 1230 120. We’ll run that report.

06:49

All right, let’s first take a look at the balance sheet balance sheet closing the hamburger holding down control scrolling up a bit to get to 125. Then we have the undeposited funds which Increasing, there’s the undeposited funds with the 4500. Within its scrolling down, we then see the music store stuff with the sales receipt that we have just entered for that 4500. Scrolling back up to the top, we’re then going to go to the other side, which is going to be on the income statement or profit and loss. Let’s jump on over to it. What closing the hamburger. Then up top, notice we have the new income account.

07:29

So the new income account at that 4005. That’s the difference that we want to see here. Now note again, you don’t want to get carried away with a new income account for every kind of new type of income that you have. And especially don’t get carried away by breaking it out by by customer or something like that, because you want to look at the other reports to do that. So these breaking out, for example, we have sales, which is the service service stuff. We may want to break it out for the major services like we could have another account here that was for the instructor sales or music Construction or something like that income, but we wouldn’t want to put the a particular instructors and for this one for example, we may want to break it out as it might be appropriate here to break out the rental income as opposed to the other kind of incomes.

08:12

However, we wouldn’t want to be breaking out like the types of rental things that we rented like an AMP and a guitar and you know, another kind of things like that. So, so just be you know, be aware of that be, you know, don’t get carried away with the too many rental or the too many income items. Then of course, if we went to the P and L or I mean the trial balance, we could see this on one tab or one page, we can see the undeposited funds here and one tab, one tab and one page, and we can see on the bottom with the sales information where we have the equipment rental income there.