This presentation and we’re going to take a look at the month in financial statements. And this time since we have two months to compare, we’re going to be creating comparative financial statements comparing the two months that we have a comparative balance sheet, a comparative income statement, we’ll also take a look at the transactions by date, the great report for checking our numbers, reviewing numbers for an employee, and possibly even for billing purposes to see how many transactions has been made. So you can possibly bill by transaction.

00:28

Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re not going to be taking a look at the reports. So these are the types of reports we want to practice putting together and possibly give to someone whether that be a supervisor, or a cut or a client. And then we also want to basically check our work. So those are going to be kind of our two objectives. So we’ll pull the reports think about how we can check the work, both with regards to a practice problem and in practice, and then think about how we can put these reports together in order to provide them to somebody So we’re going to go down to the reports down below. Let’s start off with our balance sheet report.

01:05

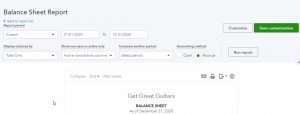

So I’m going to go down to the balance sheet or favorite type of report here. We’ll open that up. And I’m going to scroll up top, and we’re going to be changing the dates up top from one, let’s make it a 10120 to 1230 120, then run that report. Now, this would be the balance sheet that we might want to provide. And we probably would, at the end of each month, provide the balance sheet. And then on top of that of a new thing, and the thing will focus on here is we might want to provide the comparative numbers for the time period. So now we’ll make that comparative balance sheet that we saw in the beginning sections of our of our analysis. Here are reports as we were reviewing the information.

01:50

So I’m going to hold down Control, scroll up a bit. And there’s a couple ways we can do a comparative balance sheet, you’ll recall one, let’s change the end date to Oh to 29 to zero, because there’s 29 days in 2024. February, apparently. And so there we have that. And then we could change like the the total here from totals two months. And then it would give us the and then run that report. And then it would give us the month in numbers January and then February. Remember, the balance sheet is as of the end of the month. So this is as of the end of January as of the end of February, unlike the profit and loss report, which is beginning to end kind of performance report.

02:33

The other way we could do it is I’m going to change this back I’m going to go, that’s cool, but I don’t want to do it that way. And I’m going to change this one to the second month, which is going to be Oh 20120 and then run that report. So now we have just for February. And now I’d like to tell QuickBooks pick up the prior month from that. So to do that, I’m going to select this item I’m gonna say QuickBooks please take up the previous period and And then I’m going to run that report. And there did it.

03:04

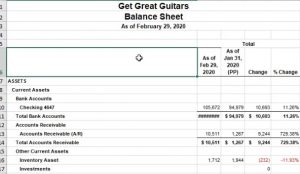

So now we have the two periods, the first period on the left now, and then the prior period on the right, we got this p p up top, I don’t know why they have to do that, I don’t really like that. But when we export it to excel, we can get rid of that, that kind of formatting, weirdness. And then we also can make a difference column you’ll recall by selecting this drop down and saying what if I want the change? And then we can take a look at the change and so we can see how how we did you know for our how not how it you know, kind of where we stand at the end of one period versus the other, we got that difference number and then we can then go to the change in percentages, run bat report. And that would be so now you gotta kind of pretty interesting report here.

03:49

You know, this looks pretty impressive. even give this to somebody. So you what you probably want to do when presenting and giving to somebody positively make the balance sheet the the summarization. Balance Sheet first, which doesn’t have all your subtotals, then the standard balance sheet. And then if they have more questions, so you want to get more detail or impress somebody, then you give something like this, which will have, you know, the more information on it. So that’s what I won’t do that. But that’s how you probably want to want to give the information. You don’t want to overwhelm people, but you do want to impress them with all the reports, possibly.

04:21

So you probably want to start off or put the easy report the simple report, these condensed balance sheet up top than the standard balance sheet, then something like this, which will have the changes and whatnot. And that’s how you’d want to present the numbers to don’t just give them the full numbers, all numbers are make up, their eyes roll over and they won’t listen to a word you say. Alright, so in any case, let’s go ahead and do some more adjustments up top, some of our standard kind of adjustments will do the customization up top.And let’s go ahead and remove the brackets here, make those red, and then I’m going to scroll down to the footer and we’re going to be removing the date time. And a report basis will remove those items. And I’d like to get rid of a pennies as well let’s get rid of the pennies. Alright. So there we have, it looks pretty good.

05:11

Okay, so then what you want to do is review these numbers, check your numbers to obviously the the 2020 total column. And if those tiles great, if they do not tie out, then you can, that’s okay, you can drill down and anything that doesn’t and then we’ll go to the transaction Detail Report, which is really where you can kind of get a better analysis of that. Let’s go ahead and print this out. So I’m going to print it a couple different ways. we’re imagining we’re going to give this to somebody. So I’m going to print it as a PDF, and then we’ll do the Excel thing and put it all on one excel sheet as well. So I’m going to print it as a PDF. First I’m going to say print, and we’re going to use the cutepdf printers. I’m going to say print that one. It’s going to ask us where we want to put it at some point. That’s what I’m expecting to happen.

05:58

There it goes and Then I don’t want to put it right there, I want to put it like in the month eight. So I’m going to put it in month, eight, eight, month two. And I’m going to call this a comparative balance sheets, comparative balance sheet. There we go. gonna save that one, close it up. I’m also going to export it to excel by selecting the drop down here. As we’ve seen in the past, or the export, it’s going to be populating down here. So that’s what I want. I’m going to open that one up. And there it is, I’m not getting any weird Yo, I used to get these weird yellow things, saying there’s something wrong with my subscription for a while, but I think I fixed it now.

06:37

So those things aren’t happening here, which is nice. So in any case, we’re going to see if it’s on one or two pages, I’m going to go to the second page here. It’s on two pages. That’s not good. I’m going to go back to the first page. And I think I could just make this one a little bit smaller. Maybe that should take care of it. Maybe make these a bit larger so you can see the numbers that would be nice. Alright, that looks pretty good. I don’t know why this column so wide. Didn’t seem like it needs to So what any case, I’m going to save this now, so we’re going to save it. So I’m going to go to the File tab up top, we’re going to go save as browse, then it’s going to see where we want to put this thing. I’m going to put it into the course data here. And then I’m going to put it into eight months to eight months to that seems weird. And then I’m going to say just call it the financial statements.

07:22

I think I could just overwrite this whole thing because it has the type down here. So I’m just going to call it financial statements. All right, and then I’m going to save that. Then I’m just going to minimize this because I’m going to keep on putting the other reports onto it back to QuickBooks, I’m going to right click up top and duplicate this cell. Then I’m going to go back to the one to the left. And let’s do the same thing for the P and L. I’m going to open up that old hamburger and I’m going to scroll down to the reports on the left. We’re going to be opening up the P and L the profit and loss the income statement.

08:00

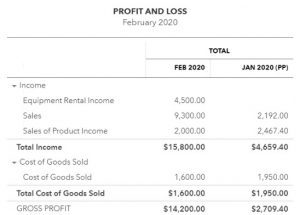

So there it is. We’ll change the dates up top once again. So you could, the dates we’ve been working with is Oh 10120 to 1230 120, we can go ahead and run that report. And you can kind of check your numbers to that report here. So you can say, all right, does that does that match out and if it doesn’t, then you can kind of zoom in on him and check that and then we can also take a look at the transaction detail, which we will do shortly. Now we can also run this just remember this one, you can you can run for the month of February too. So you so in this report, the profit loss, you might give them the full two month time period, you might say now here’s the month of February, which is oh to a 1202 out to 29 to zero, here’s the month of February so you can see the performance there. That’s the last month we were on.

08:53

So you can see how we did there much better. We have income. That’s good. And and so we could do that and we could do it coming Harrison. So let’s do the comparison report again, which we can do a couple different ways. First way, oh 1012020 229 220, the full period. Now note, if you do that here, you’re talking about two months worth of accumulation, as opposed to the balance sheet. If you were to do that you would only get what you know, it’d be the same numbers, because it’s only as of the end of the time period. So this one’s going to have double that. And then if I went up top, and I said, Well, now I’d like to say, from total two months here, and then run that report.

09:34

It’s going to give us the month now this is this is nice, because it gives you January, February, and then the total of the two months, which is nice, because then you can give them this report and say, Hey, this is how we did in January. That’s how we did in February. Here’s the total of how we did overall so far at this point in time, and January, a bit of a last February, picked it up and then and now we’re at 7000 77 total. So that’s a nice report, we also might want the difference, you know, what’s the change from one to the other, and that’s the one we’re going to generate here.

10:08

So to do that up top, and remember, in the balance sheet, you don’t have this total column, because it would have been, it doesn’t make any sense on the balance sheet because it would be as of the end of January in the end of February, you know, add them up. But here, it makes sense, because it’s a performance report over time. All right. Now let’s see it the other way, we’re going to go back up top and say, let’s just look at February again. Oh 20120. And then we’ll run that report. And I’m going to get rid of the months here, go back to the totals. Run it again. Now we just had the February numbers. Now I’m going to pick up the prior period.

10:45

So I’m going to select the previous period, please run that report, if you would. Doesn’t want to do it, it would not. And then now we have the two months now February, the first the latest month first and then I’m going to See, well, what if we want the difference, the change will pick up the change the difference, run that report. So there we have that now we have the difference like how we did in one month versus the second month. And then again, we can go back up and get the percentage change. And pick up pick up those numbers. So again, what you can you can imagine now you can give a lot of month end reports, you probably want to give the profit loss report for the month, probably, possibly for the month to date.

11:29

So for February, the month to date for February, you can have a report that would have broken out by months and combine them together as we saw, and then a report like this, which would probably be your last report the most detailed one, which would have the two month time period and in the change between them, as well as the percentage changes. And again, if you were to present these, you want to level up in terms of you know, how much detail how much confusion you get in them. Whether you do that, whether you’re presenting them or or or in person, or giving them to somebody.

12:03

Okay, let’s format these are standard format, and we’re going to go to the customized up top, we’re going to be removing the pennies, we’re going to be making the negative numbers bracketed, I’m going to make them read as well going to go down to the header and footer now and I’m going to remove the date prepared time prepared report basis, then I think that’s it, we could change the name as well to to an income statement if you so choose, you know, that might be a way to customize it. We’ve done that in the past, I won’t do it here.

12:33

I’m going to say and and we should be changing I should also change the name here should be a profit, it should be a comparative profit and loss. comparative and I should have done that for the balance sheet as well. And also note that we just have February here, so we should basically change that as well. I’d like to put the date so we could do that when we export it to excel. Put the proper date, you know a two month time period down here, just simply remove it from this report. But that’s all I’ll do for now since I want to get to the transaction Detail Report. So let’s go ahead and print these out in a couple different ways.

13:10

One with the printer, we’re going to say print, we’re then going to go to the printer up top that looks good going to the cute PDF printer, it’s going to ask us where do we want to put it at some point, there it goes. And then I’m just going to call this a comparative income statement statement. There, then we’ll export it to excel. So I’m going to close this back out. Let’s export it to excel now. So there we do that opens up down below. So I’m going to open that one up. There it is, and if I look at it, let’s see if it fits on a page by going to a second page. It’s does. Now I’m not gonna do any format in here because I’m going to copy it over to there are other worksheets.

13:58

I’m going to select the whole worksheet. By selecting the triangle, then I’m going to right click on it and copy it. And then I’m going to minimize this and I’m going to go to our other Report, I’m going to hit the plus button down below that and then I’m going to double click on the name and call this a P and L. Let’s just call it that, that I’m going to be in a one and I’m just going to paste this here right click and paste it the first one the first not 123 not the values only. There it is.

14:24

Now you can do the formatting things if you want to. So like I don’t need this total column here, and I don’t need this, this PP there like that. And then the change that looks good, that’s February date isn’t exactly right. Because it should be you know, January, January and February. comparative we should do that on the balance sheet too. We can do that. This is as of this is this is February, and our January and February. How to spell February. I like that word. Let’s check it out on the spellcheck here. All right, I did it right away. So then I’m going to go back to the p&l. And so that looks pretty good. So I’m going to save this. And now let’s go back to our, our QuickBooks. So let’s duplicate this tab, I’m going to go up top and right click and duplicate that tab. And then let’s go into our transaction detail reports.

15:33

I’m going to go back I’m going to go open up the hamburger going to scroll down a little bit back to 100. We’re going to go down to what our reports down below. So let’s go to our reports down below. And then I’m going to go all the way down to the accounting reports. They put those at the bottom. It’s like the accounting reports aren’t important. Over just for the accountant, apparently, so they think of it. So in any case for my accountant We have the transaction detail by date, we want the transaction detail by date. Going to open that one up. And then we’re going to close the hamburger again, I’m going to hold down Control and scroll up a bit back to the 125. Scrolling back up top and changing the dates, I’m going to make it from Oh 20210 201-202-0229 to zero.

16:28

All right, and then we’re going to run that report. So this is our detailed report. Now, if your balance sheet or income statement didn’t tie out, then this is the report that you want to check it to also give you the trial balance just in the practice folder. So you can check those numbers in terms of just the trial balance, easiest report to kind of look through. So remember, this one’s got the date. It’s got the transaction types, like the journal entry, the deposits and so on and so forth. Got the number of the posting, the name, vendor, customer, employee other memos. If we put some in Notice I didn’t put money in, that’s bad, you should have memos probably. But, you know, it’s kind of I didn’t put them in there.

17:05

So anyways, we got the account and then the split account the two accounts that are going to be affected. If there’s more than two, then you’ll typically see the split here, very nice report to be able to, to, you know, kind of see the financial transaction, the debits and credits of two accounts that are going to be affected. As you learn this information, if you’re if you’re picking it up, also a very good report just to see the transactions that have happened, you might want to bill by transaction, say, Hey, this is how much I bill for this range of transactions or something like that you fall into this range of transactions.

17:36

Therefore, this is how much I bill for for that. So then you’re going to want to check over here, check your numbers to the right and compare those out. So I’ll scroll down here a little bit more slowly. Now, if anything is on this report, if anything’s on your report and isn’t on this report, then you may have a duplicate a number you want to check pad out. If anything’s on this report, it’s not on your report, it’s possibly a date problem, maybe you entered something in the wrong date.

18:07

So it’s a little bit more difficult, then if that’s the case, what you want to do is change the date, it’s a little bit more difficult to go back in time, because we have data for last for the prior periods. But if the date problem was something in the future, like, let’s say I just make this 2021 and run the report. Let’s make it Well, there’s no 29 1230 120, let’s say, and then run the report, then you can then you can scroll back down because there’s no 29 days. And anyway, if I scroll back down, then then you can see anything down here that’s going to be past that date period, and it’s a date problem, then you can go in there if that’s the problem, and fix the date.

18:48

Okay, so now I’m going to go back up top, change the date back, because I don’t really need to, but I’ll change it back into Oh to 29 to zero, then we can run this report, we might want to custom Eyes it a bit so I’ll do the customization. I didn’t do it last month but I’ll do it this month will customize it will remove the pennies will make the negative numbers bracketed and red and header and footer column. I’ll remove the date and time prepared and run it. All right. Now let’s let’s print this thing. I’m going to go back up top, then we’re going to go to the printer. Going to print this to the cute PDF printer, I’m going to go ahead and say print. It’s gonna it’s gonna ask the cute PDF printer, that’s where I wanted to go.

19:32

Let’s go ahead and print that thing. It’s going to ask us where we want it to put in. And so I’m going to say I want to put it in the here transaction Detail Report and save that. close this up. Let’s export it to excel. Now I’m going to select the drop down and export it to excel which had open up down below. Let’s open that up. So there it is. I’m going to have to do some formatting here. But I’m not going to do it here, I’m going to copy it over first. So I’m going to select the whole report, triangle control, see copying the whole thing, minimizing that go into our other report where we had the balance sheet and P and L, making a new tab, the little plus button on the bottom, double clicking on the tab down there. And this is going to be the transact shown detail. And then I’m going to go up top into a one and paste it Control V. And there we have it.

20:29

So there’s our report. Now, I’m going to go to the second tab page layout to see if it fits on a page and it totally doesn’t. So I’m going to go to the first page and say, all right, I gotta do something here. So I’m going to go up top and go to the page layout. And we’re going to go to the size and I’m going to go to the orientation and make it landscape that’s the first thing to do. Then I’m going to try to fix this titles and get rid of this column eight because I don’t need it.

20:56

Now you could just kind of minimize call me so it goes away, but I’m going to do this just because I think it’s worthwhile to work with these merged cells. So I’m going to go up top and I’m going to unmerge, the cell Home tab, alignment, merge, do it here, Home tab, alignment group merge, one more time, Home tab, alignment group merge. And then I’m going to highlight these three, I’m going to grab the cell by put my cursor on it and just move it over to column B. Then I’m going to select all of column A, and right click on that selected area, and delete that. Got rid of that. And then I don’t think I need to post in columns. I’m going to right click on that and delete it. And so that looks pretty good. So we’re getting close.

21:44

This one looks like it’s wider than I needed to be. Now the memo column column, I don’t have many maybe those memos are important though. So maybe I just hide this one, maybe I maybe I highlight it and then say I’m just gonna hide it and see if that does it. And so that pulls it over. Then I’m going to highlight these cells. And to try to center this again. But I’m not going to use the merge because I don’t like it.

22:06

I’m going to right click on it the other way and do it this way, because it’s way better. And then I’m going to go up top and say we’re going to go to the alignment, it’s going to be horizontal aligned, center across the selection. And then you don’t have to deal with it, the merge cells messing anything up, like they do merge sales, mess things up, I’m telling you, then we’re going to go to the format sales again, let’s do this again. So under the alignment, horizontal, we’re going to center across all right, now you might be able to just kind of format paint this, I’m going to try to format painted to this one, but then it changed and made it big. It wasn’t supposed to be that size of font, but that’s okay. So I’m going to save that. Then let’s go ahead and print this whole thing to a PDF file. So we’re going to go to the File tab, we’re going to go to the printer.

22:53

We’re going to be printing to the PDF file. I’m going to print the entire worksheet, not just the entire workbook, not just that worksheet, and now we have five pages balance sheet, profit law, you know, and this one looks like it’s all good. So I’m going to go ahead and print that. And then it’s going to ask us where we want to put it. And I’m just going to tell it where we want to put it, it’s good, it’s right where I want it to be, it’s asking me, that’s where we want it.

23:20

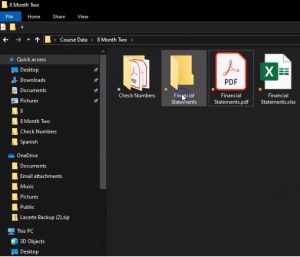

So I’m going to say save. So that looks good. And let’s check out what we have. So we put it into this folder. And this is what we have. Now I’m going to make these larger icon this time. So we could then give somebody the individual reports balance sheet, income state statement and the transaction detail with three attachments to an email, for example, or we can then make another folder let’s make another folder called finance. She’ll stay two men, and then we can put those three files in it. The transaction detail the comparative balance sheet and the income statement.

24:00

Put those in there. And then we can zip it right clicking it and compressing its and to the zip file. And that allows us to attach that zip file. Instead of instead of having the three attachments, then we can also open just this one attachment that has all of our reports in it, and that would look something like this. There’s the balance sheet, there is the profit and loss and there’s a transaction detail. Now remit. Now note by this point, you can add a whole lot of reports and just depends how much stuff you want to give per month. So we we’ve talked about multiple different formats of these balance sheets you can give. At this point in time, you can think about making graphs and that type of thing that you put in your reports as well at the month end or quarter end.