In this presentation, we’ll explore the balanced scorecard approach to performance measurement. The balanced scorecard is a strategic management tool that provides a comprehensive framework to evaluate the performance of different divisions within an organization.

Why a Balanced Scorecard?

Traditional performance measurement often focuses heavily on financial metrics, such as financial reports and responsibility accounting reports, to assess the performance of each division. While these financial perspectives are crucial, they don’t capture the full picture of a department’s performance. Financial metrics alone may overlook essential factors that contribute to the long-term success and sustainability of the organization.

Beyond Financial Perspectives

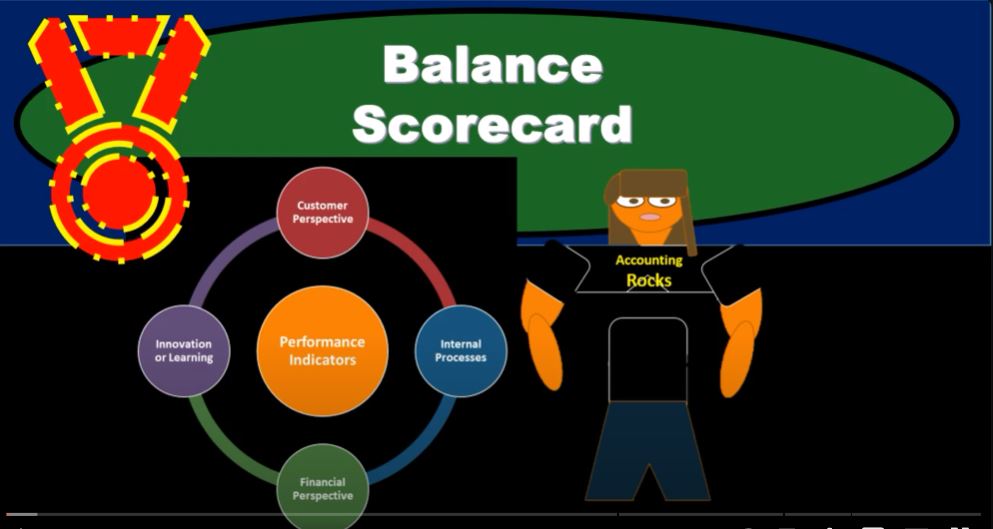

To effectively measure a department’s performance, we need a more holistic approach. The balanced scorecard allows us to incorporate various key performance indicators (KPIs) beyond just financial metrics. This involves creating a balanced set of metrics that reflect different aspects of a department’s performance. The aim is to provide a transparent and fair evaluation, ensuring that every department manager understands what they will be measured on.

Financial Perspective

Revenue generation is a fundamental goal for any company. Financial indicators such as net income, ROI, sales growth, cash flows, residual income, and stock prices are vital because they provide a clear, numeric indication of the company’s health and efficiency. These indicators are not only goals but also reflect the organization’s overall performance and operational efficiency.

Challenges with Non-Financial Metrics

Non-financial metrics, such as customer satisfaction or employee turnover, can be more challenging to quantify. Unlike financial data, which is inherently numeric, these metrics can be subjective and harder to measure consistently. However, whenever possible, it’s beneficial to translate these metrics into numeric values to facilitate comparison and analysis.

Long-term Vision vs. Short-term Goals

A key aspect of the balanced scorecard is aligning short-term goals with the organization’s long-term vision. Focusing solely on short-term financial gains can lead to decisions that harm the company’s long-term prospects, such as damaging the brand or reducing goodwill. The balanced scorecard helps ensure that departments are evaluated on criteria that support the long-term sustainability of the organization.

Components of a Balanced Scorecard

A balanced scorecard typically includes the following perspectives:

- Customer Perspective:

- Customer Satisfaction Ratings: Quantified through surveys and ratings.

- Number of New Customers Acquired: A measure of growth and market penetration.

- Percent of On-Time Deliveries: Indicates efficiency and reliability.

- Time to Fill Orders: Measures operational efficiency.

- Percent of Sales from New Products: Shows innovation and product development success.

- Sales Returns: Reflects customer satisfaction and product quality.

- Internal Processes:

- Defect Rates: Measures quality control.

- Cycle Time: Time taken to complete a process.

- Product Costs: Includes materials, labor, and overhead.

- Labor Hours per Order: Efficiency of the workforce.

- Production Days Without an Accident: Safety and operational risk management.

- Financial Perspective:

- Net Income: Overall profitability.

- ROI (Return on Investment): Efficiency in using capital.

- Sales Growth: Indicator of market success.

- Cash Flows: Liquidity and financial health.

- Residual Income: Profit after deducting the cost of capital.

- Stock Price: Market valuation.

- Innovation and Learning:

- Employee Satisfaction: Measured through surveys.

- Employee Turnover: Rate at which employees leave the organization.

- Dollars Spent on Training: Investment in employee development.

- Number of New Products: Indicator of innovation.

- Number of Patents: Reflects R&D success.

- Dollars Spent on Research: Investment in innovation.

Conclusion

The balanced scorecard approach provides a more comprehensive evaluation framework by incorporating financial and non-financial metrics. It ensures that all aspects of a department’s performance are considered, fostering a balanced and sustainable growth strategy. By aligning short-term actions with long-term goals, organizations can ensure they are moving towards their ultimate vision while maintaining operational efficiency and market competitiveness.