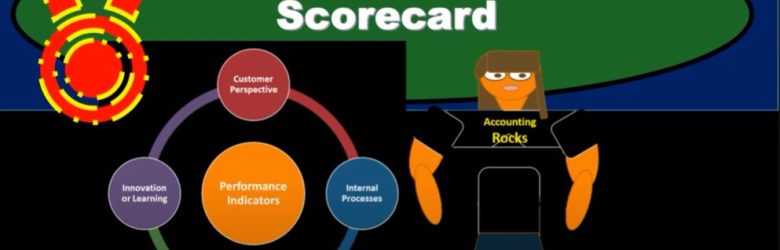

In this presentation, we’ll explore the balanced scorecard approach to performance measurement. The balanced scorecard is a strategic management tool that provides a comprehensive framework to evaluate the performance of different divisions within an organization.

Posts in the Financial Accounting category:

Save Customization or Memorize Profit & Loss Reports 3080 QuickBooks Online 2024

In QuickBooks Online 2024, mastering the art of presenting customized and memorized Profit and Loss reports is essential for effective communication with clients. Let’s dive into the streamlined process:

Navigate to QuickBooks Online:

Open your browser and search for the QuickBooks Online test drive. Ensure the URL is from intuit.com, select the United States version, and verify your humanity.

Access Financial Statements:

Open major financial statement reports by right-clicking on the balance sheet and profit and loss in the favorites, selecting “Open Link in New Tab.”

Set Date Range:

Change the date range by going back to 2020, for example, from 3010123 to 12301230. Run to refresh the reports.

Customize Profit and Loss Reports:

Consider your audience—likely non-accountants—and make the reports visually appealing. Customize fields, collapse columns for a summary, and even create vertical and horizontal analysis reports.

Save Customization:

Save customized reports for easy access. Organize them into groups like “Month-end Reports” for quick retrieval.

Delivery Options:

Determine the best way to deliver reports. Options include emailing secure attachments, printing and mailing, or using electronic transfers.

Export to Excel:

While exporting to Excel is an option, consider using Excel for formatting purposes rather than delivering raw data. It allows further customization.

Use a PDF Printer:

Create a polished PDF file by using a PDF printer. Combine multiple reports into a single PDF for ease of access.

Utilize Cloud Drives:

Share reports through cloud drives like OneDrive, Dropbox, or Amazon. Ensure accessibility and security.

Management Reports:

Leverage management reports to consolidate and present a comprehensive financial overview, including both balance sheet and income statement details.

Presentation Matters:

Remember that the presentation of reports is crucial. Attention to detail, neatness, and a professional look boost client confidence, especially when dealing with non-accountants.

Continuous Improvement:

Regularly update and refine your report delivery methods based on client needs and feedback. Strive for continuous improvement in both content and presentation.

By following these steps, you not only customize and memorize Profit and Loss reports efficiently but also present them in a way that instills confidence in your clients. In the world of QuickBooks Online 2024, the key is not just data accuracy but effective communication and presentation.

Bank Feeds & Your Accounting System 1017 QuickBooks Online 2024

Welcome to the world of QuickBooks Online 2024, where we’ll explore the intricacies of bank feeds and seamlessly integrate them into your accounting system. Join us on this journey to Cloud Nine as we delve into the QuickBooks Online test drive, the primary tool for the first part of our course.

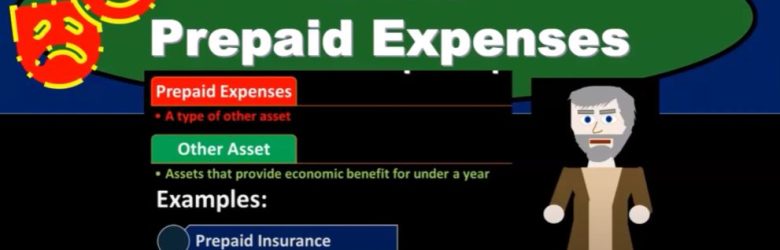

Audit Prepaid Expenses 14110

In this comprehensive presentation, we will delve into the intricacies of auditing prepaid expenses, with a primary focus on the audit process related to prepaid insurance. Prepaid expenses, categorized under other assets, pose unique challenges in the audit process due to the nature of payment preceding the receipt of benefits.

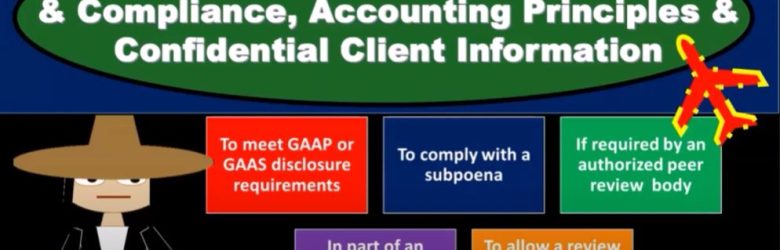

General Standards & Compliance, Accounting Principles & Confidential Client Information 9150

In the dynamic world of accounting, professionals are tasked with the critical responsibility of ensuring financial transparency, adhering to established standards, and safeguarding confidential client information. This presentation dives into the intricate web of general standards, compliance accounting principles, and the delicate handling of confidential client data.

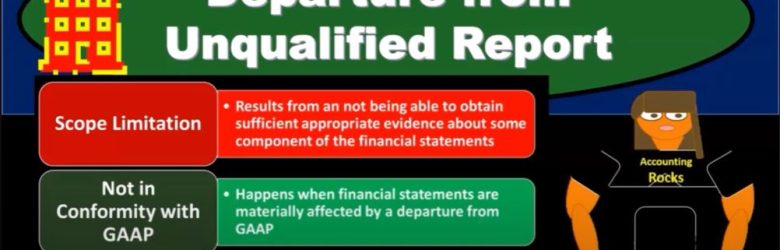

Departure from Unqualified Report 18120 Auditing

In the complex world of financial auditing, the standard unqualified report stands as the pinnacle of assurance, affirming that the financial statements are in conformity with generally accepted accounting principles (GAAP). However, auditors often encounter situations that lead to departures from this standard, raising flags and demanding a closer examination. In this presentation, we delve into the scenarios where deviations occur, the types of reports they may trigger, and the implications for both auditors and the entities being audited.

Effect of Information Technology on Internal Controls 6020 Auditing

In today’s presentation, we delve into the intricate realm of how information technology (IT) shapes and influences internal controls within the business landscape. The fusion of businesses, internal controls, and auditing with advancing technology presents auditors with both opportunities and challenges. It necessitates collaboration with IT specialists to ensure the effective implementation of internal controls. This presentation explores the nuanced landscape, weighing the benefits and potential pitfalls of IT in internal controls.

Mean and Outliers 1417 Statistics & Excel

In the world of data analysis, understanding statistics is paramount. Excel, a powerful tool for data manipulation, plays a crucial role in unraveling the intricacies of datasets. In this blog, we delve into the world of statistics and Excel, focusing on mean and outliers. For those using OneNote, we’ve included a reference to the corresponding tab and presentations.