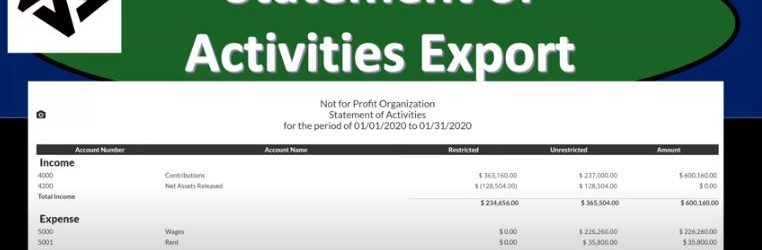

This presentation we will generate, analyze, print and export to Excel a statement of activities or income statement report, get ready, because here we go with aplos. Here we are in our not for profit organization dashboard, we’re going to be heading on over to the reports on the right hand side. So let’s be opening up the reports. And we’re looking at the statement of activities. So you’ll recall the statement of activities is, in essence, an income statement. We’ve been working with the income statement by fund, but then we created our custom reports down below. So we took this report, that’s going to be a general report, we’re going to scroll down to like custom reports down below, which is then the saved reports.

Posts in the Accounting Instruction category:

Statement of Activities Formatting 185

https://youtu.be/S3lCOA6esqY?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

In this presentation, we’re going to take a look at the formatting of a statement of activities or income statement, we’ll take a look at customizing the statement of activities and customizing it for internal use, as well as external use and then saving those customized income statements so that when we go into them into the future, it will be as easy as possible, get ready, because here we go with aplos. Here we are on our not for profit organization dashboard, we’re going to be opening up our reports, let’s go to the reports on the right hand side to do so we’re then going to go into the income statement by fund. So let’s take a look at the income statement five fund which is going to be our statement of activities report.

Closing Entries 175

https://youtu.be/OdjLcvkWPfY?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

This presentation, we’re going to discuss the closing process for our accounting system. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard, let’s head on over to our Excel file to see what our objective will be, you’ll recall, we’re going to be in tab 10. By the way, we’re over here in tab 10. You’ll recall that we’ve been looking at each transaction with the accounts that will be affected, posting those over to our Excel worksheet to see the effect on the trial balance on the accounts. Now, we did this in terms of posting to our first trial balance up top and so row one. And then we said, okay, what if we break this information out, and I want to break this information out by not just the expenses by their nature, but by their function. Now, in aplos, we have a nice system to do that we’re going to use the phones and the classes, or the funds and the tax to do that here.

Net Assets Released From Restriction 172

This presentation we will record a transaction related to net assets being released from restrictions. In other words, we have net assets that had some restrictions put on them, we’re going to be spending money in such a way that it will be releasing the net assets from restriction will record the journal entry to move those net assets from a restricted area to unrestricted so that they can be used and reflected on our statement of activities and statement of net position. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard. Let’s head on over to our Excel worksheet to see what our objective will be. We’re over here in tab 10. So tab number 10. On the Excel worksheet, you’ll recall in previous presentations, what we have done thus far is we’ve been thinking about recording transactions in terms of journal entries, the accounts that are affected, and then putting them into our trial balance.

Allocate Expenses to Categories Part 2 171

https://youtu.be/H1D3e6dKlTI?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

This presentation, we’re going to continue on allocating our expenses by category by function, including by program, admin, and fundraising with the use of our tax feature within our accounting software, get ready to go with aplos. Here we are in our not for profit organization dashboard, we’re going to go on over to our Excel file to see what our objective will be. We’re continuing on with the allocation of our expenses, you’ll recall the objective being that normally we have our expenses broken out in the statement of activities here. And we need to break them out both by function and what they’re used for by nature and by function.

Allocate Expenses to Categories Par 1 170

https://youtu.be/F4FtVtXckPo?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

This presentation and we’re going to start breaking out our expenses by nature. In other words of what the expenses are used for with the use of the tags, the categories being the education, the community service, the administrative and the fundraising for that 4020 2020. Being the allocation percentages, we will be using, get ready, because here we go with abalos. Here we are in our not for profit organization dashboard, we’re going to be heading on over to Excel to see what our objective will be.

Month End Expenses Part 2 162

This presentation we’re going to continue on with part two of recording our typical kind of month end type expenses like a telephone and utility type expenses Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard, we’re going to be heading on over to Excel to see what our objective will be. So we’re going to be on over in Excel, we’re in the eighth tab. Last time, we made these first two ones green, because we did those ones. And now we’re going to continue to make the next one green, because that’s the next one we’re going to do, we’re going to be recording our expenses, this is going to be the utilities expense, I’m going to right click on that one, make it green.

Month End Expenses Part 1 160

This presentation, we will record transactions related to month end expenses. In other words kind of general typical type of expenses, those being things like the utility bill and the phone bill, and so on and so forth. Note that as we enter these into place, we will be doing this in kind of a two step process, one entering the expenses. And then at a later point, we’ll take those expenses and apply them out to the unrestricted categorization. So we’ll explain this in a bit more detail as we go, get ready, because here we go with aplos. Here we are in our not for profit organization dashboard, we’re going to be going on over to Excel to see what our objective will be, we’re not going to be on tab eight, and we’re going to be recording our expenses.

00:45

Most of these journal entries will be pretty straightforward, in that we’re going to be decreasing the cash account and recording the expense on the other side of things. So we’ll be entering these into our system. And as we do so, typically, an expense will be going down and the other side will be going to cash that’s going to be our typical type of transaction as we enter these, however, also note that when we when we go over to our our financial statements, our income statement or statement of activities, we’re going to want to be breaking these out into restricted and unrestricted, we’re going to record these as unrestricted as we record them.

01:22

However, we also want to see those expenses that are going to be broken out by in this case, you can see there by usage or what they’re used for, which is the the programs, the health service and the community service, the education and community service and the admin and fundraising, we also want to see them by nature. In other words, we want another report that we could see that’s going to be broken out in this format, we’re going to specialize our duties, so that we can enter them kind of normally how you would normally enter them, which is basically by their normal kind of expense accounts and then our allocate to unrestricted category, and then we’ll go in and reallocate with the use of these percentages at a future point in time.

02:04

And that’s going to be the method that we will be taking a look at for that objective. So let’s go up top, I’m going to make these green as we go. So I’m going to right click on this, make it green. So we’re going to be working on the green one. So then we’re going to go back on over this is going to be the telephone expense, going to go to the accounting tab, we’re going to then select the old the transaction dropped down. And I think the easiest way to do this is to go directly into the register. So the register is probably the easiest thing to do, we’re in the checking account register, we’re going to be decreasing it now I’m going to do this with as of the end of the month. So January, I’ll be around the analysts say the 30th.

02:45

And then I’m going to assume these are electronic transfers. If they were not, we would have the check number over there. The first check we’re going to say is going to go to Verizon Verizon. Now we’re setting up the vendors basically, as we go here, we probably don’t need a lot more detail on the vendors, if you’re just paying like Verizon either, as opposed to if it was a customer that we would want probably a lot more contact information on so it might be really easy and to just enter the the vendor as we go here. And then we’re going to say 6200 is the amount for the payment. Now I’m not going to put a check number because we’re going to say it’s kind of like an electronic transfer. And then we might need to be adding new accounts.

03:24

As we go on the expenses down here, you’ll see we don’t have a telephone expense yet. So what I’m going to do is open up another tab, which is going to have our chart of accounts. And for the first month, we’ll just be adding accounts as we go. Now the second month of operations, it’ll be a lot easier because all the accounts will be set up and we can just simply be consistent from month to month. But our first month, we want to set up these these new accounts as we go. So let’s go up top, I’m going to right click on the tab up top, we’re going to duplicate that tab, then we’re going to go into the accounting. So we’re in the fund accounting, we want to go to the accounts we want to go to the account lists. So fund accounting accounts account list is basically our chart of accounts here, we want to be in the expense section.

04:11

And then we’re simply going to be adding the expenses as we go. Now when you add expenses, just remember that you might have some more sub categorizations that you want to add here. That’s fine, you might want let you might not need these sub categorizations you might want them just basically in expenses here. I’m just going to add them down here continuing add them down to other end and like I say I may not have the same kind of breakout between the admin expenses in the in the other that sub categorization is up to you completely customizable. I’m just gonna keep on adding them to this to this section where we stopped off last time at 5300. Also, just note that you want to make sure that your numbering is somewhere within the convention here. You can adjust.

04:53

You know the order of the accounts basically with the account numbering but make sure that you have enough space within The account numbers so that if you wanted to add account an account between them, you can do so. So just be aware of, you know, the account number sequences that are generally being used here. So I’m going to say, you know, 53100, let’s say, and so let’s say five through one, zero. And I’m going to bring them all to the unrestricted. So all the expenses, I’m going to record to the unrestricted area. And then when we do the transfer, we’ll see how that happens at a later point, this is going to be the telephone, this is case telephone. Now, you might say telephone expense, you can put that there, but it’s a little bit repetitive, because it’s already in the expense category. But if sometimes, you know, telephone expenses, just what we automatically say sometimes. So then I’m just gonna say save. And there we have it, actually added one, one too many zeros, I should say, 5310.

05:56

Let’s make that. Let’s make fab 5320. So we’ll leave a good amount of room. All right, so I’m gonna get a little picky now. So then we’ll save that. And then let’s go back over here. And we’ll add the account, which is 53205320, it’s going to be in the unrestricted, that looks good. Now, on the added tags, I’m not going to add any more tags, right now we’re going to go back in and add more tags at a future at a future point. Okay, so let’s record this going to be increasing the telephone expense and decreasing cash. So I’m going to go ahead and submit that will record it, we should see it then populate down below. So here it is down below. Let’s check out our reports now. So I’m going to go to the second tab, and then I’m going to right click and duplicate that tab, I’m going to be on the second tab, right click, duplicate that tab, then we’re going to go to our reports within the reports, we’re going to go on down to the balance sheet. So we’ll open up the old balance sheet. So there we have it, then go back to the prior tab.

07:02

And then I’m going to right click on that tab, duplicate that tab, and then we’ll go back to the reports on the right hand side. And then we’re going to go to the income statement. So then we’re going to go to the income statement. These are by fund reports. Then I’m going to go back to the balance sheet, we’re going to adjust the date because I just want to see January’s I’m going to bring this on back to January the 31st. So January 31. And then we could see in the checking account, if we were to go into the checking account here, we should see the decrease for the telephone at the 6200 right here. Now I’m going to go back, we could drill down on that and see the see the more detail of it. But let’s go to the other side. Let’s go back to the income statement now. And then we’re going to adjust the date.

07:51

So we’ll see the date this year, this year to date, we’ll say yes, year to date. And then down below, once again, we’ll see the expenses. It’s in the other here, telephone, the telephone expense, and it’s an unrestricted. Now, like I say we could adjust kind of like the categorizations, I’m not spending a lot of time between admin and other that’s that’s, you know, custom towards the organization. So in any case, also note that it’s an unrestricted here, we will be breaking that out to the unrestricted categories. And we’re going to use tags to do that. But like I say, we’ll do that at a later time and kind of a specialized way. So we could do the input, the data input will be easy if I don’t have to deal with that percentage breakout. And then we can go back in there and deal with that percentage breakout all at one time, hopefully saving time by specializing. Alright, let’s go back to the first tab then.

08:44

And we’re going to continue on with this. So we’re going to make another one. So let’s then go down to our information. And I’m going to be working on the second one now. So let’s go to the printing and postage, I’m going to right click on that one and make it green. It lets me right click, it’s not letting me right click, there it goes, we’ll make it green. And then I’m going to same kind of transaction, we’re going to write a check cash goes down, other side’s going to go to printing and postage, which we’re going to have to make that account, I’m going to say the date is going to be the 31st of January, so January 31. And then we have that and then the payee we’re going to say will be so then I’m going to say the payee, let’s just make a new one, I’m going to say the post office. So let’s say post office, make a new one.

09:33

So we’re adding the vendor as we go. And then I’m not gonna have a comment here, we’re gonna save the amount we’ll just simply pick up the amount of 12,901 to 900, tab, tab, new check number because we’re gonna say it’s electronic. Now we don’t have an account most likely, so we’re going to have to set up the account. So I’ve got this tab right side by side over here, say Alright, this is the first month of operations I’m just going to build my expense accounts as we go. Remember that if there expense accounts you can be not too difficult to build. If you’re dealing with other accounts that you have a loan or something like that. That’s when you might want to go and get further advice from you know, your accountant or something your CPA or something like that. If you’re building the first month of operations, and you have the expense accounts, when you apply them out by category, then you get there fairly straight, you probably have, you probably have a fairly, you know, standard idea of the expenses, just remember that you want to keep them.

10:27

The idea on the expenses is you don’t want the expense categories to be so broad, that, that you don’t have enough subcategories to make decisions on. And you also don’t want them to be so specific, that you have a huge list of expense categories. So you want to keep kind of the standard categorizations in place. Also, just note when you have income and expense type of categories, if you have an urge to put in in an expense category that is by vendor, like to say something like a Home Depot as the expense category name or something like that, then don’t do that. Because you can generally run other reports to break out the information by vendor. Same with the customers, if you have an urge to say, Hey, this is going to be you know, from this particular donor, and you write the the revenue to a particular donor or particular even if it’s a if it’s a government donor, you might want an account up here that says state donations grants or from government grants for state grants, that might be good.

11:25

But if you list different states and cities and whatnot, better giving the grant, then again, that’s probably too detailed of information, because you can run other reports to do that. But on the expense side, like I said, you probably have a fairly good idea of, you know, just the general expense category. So here, of course, we’re going to be dealing with the post office. And so we could put that into into basically simply office supplies which which they have already given out in our our question here as well. Is it is it distinct enough from other office supplies for postage or delivery, or something like that, that I would like another expense account, if you believe it’s worth the time to break that out, then you’re going to say that, then you want to, you know, make another account, if you think it’s, you might as well just group it all into the post to the office expense, that’s fine.

12:12

And also just remember that office expense and office supplies just as general expense categories often are are categories that will be overused and become more like a miscellaneous expense category where people just dump everything. And so you want to you know, there’s some some type of middle ground between between the two extremes, not too many accounts, but not an excessive amount accounts. Okay, so I’ve kind of ranted on that. So anyways, we’re gonna say it in the account number is going to be 5340. And we’re going to say then, that this is going to be unrestricted, all unrestricted. And we’re going to say the name, printing, postage expense, like I said, you could put expense because it feels natural. And notice even they put expense here, like when they said building expense and whatnot, it feels natural to put expense after some names.

13:03

But it’s also kind of repetitive because it’s already in the expense category. When you see these in a drop down, however, it might be useful to see the expense after it as well. So just whatever your convention is, you might want to you know, you could put an expense by by everything. But like I say, some accounts, it feels natural to have an expense, some accounts you don’t, you don’t technically need an expense, given the fact they’re in the expense category. All right, we’ll say Save, and then that’s going to be the 5340. So let’s go back over to the first tab. And we’re going to say this is going to be 53405340. That’s the one we want. unrestricted, no tax yet, we’ll be back for tax Later, we’ll see you later tags.

13:45

And so that’s going to be it, that’s going to be decreasing the cash, the other side is going to go to the expense, the 5340. So we’re going to say Submit. And there we have it. So that should that should be recording, it’s up top in this ledger. If we then go back on over to our reports, let’s go into our balance sheet. Let’s refresh the old balance sheet over here. And then that should be in our cash. So cash should be affected. Now if I go into the cache for the unrestricted, we now see that we have the post office in there, as would be expected, then we’re going to go back and check out the income statement. What happens to the is it on the income statement? Well, let’s refresh it. Because we have to be working with fresh reports.

14:28

Otherwise, it’s just not even worth looking at them. They’re not fresh. I only work with fresh stuff, printing and postage. There it is. And it’s in the unrestricted category. Again, we haven’t broken it out the tags. We will do so later. Once we do so we’ll we’ll run another report breaking these out by tag which will in essence, break these out to the four categories are two programs, the admin fundraising. Okay, so look, that’s gonna be it for now. And then we’ll continue on with this next time just adding more expenses in a similar category and a little bit faster fashion. That’s it for now. Let’s get out of here.

Donation & Purchase of Furniture 155

And I’m going to say it’s going to be unrestricted. And then we don’t need anything here, the debit amount is going to be that 11 five, I believe is what we’re working with here. 11, five, yes, 11 500. We don’t need any any other categorization here. So we look good, the other side is going to be going out of that new account, we set up in the expenses, pp and e 8100. It’s also it’s going to be the fun should be unrestricted, I’m going to say unrestricted here, unrestricted. And then that’s going to be the credit of 11 500. Now, if you’re not good with with the debits and credits, obviously, if you went the wrong way, what would happen you’d see this account be doubled. And in that would be wrong way, right. And then you just switch the debits and credits, and you’d be back on so the total debits add up to the total credits, this is going to be our transaction.

Salaries Expense 145

In this presentation, we will record a transaction related to salaries expense into our accounting system. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard, we’re going to jump on over to our Excel file to see what our objective will be here, we’re going to be in tab number six, tab number six, where we have our transaction. Here we are in our not for profit organization dashboard, we’re going to be jumping on over to Excel to see what our objective will be, we’re going to be in tab number six. So we’re in tab number six, we’re going to be recording the salaries expense.