In this presentation, we will take a look at a comparison between the allowance method and the direct write off method. When considering both the allowance method and the direct write off method, we are considering the accounts receivable account. Remember that the accounts receivable account represents some money that is owed to the company, typically from sales made in the past, on account haven’t yet received the funds for sales made in the past and therefore, the company is owed money. We see this amount on the trial balance in this case 1,000,001 91. We then want to know information about that, including who owes us that money. We can’t find that typically in the GL as we have a GL for every account the GL only giving us the information by date. Typically, we want to see that information also broken out in the subsidiary ledger saying who owes us this money.

Posts in the QuickBooks category:

Allowance Method Accounts Receivable-financial accounting

Hello in this presentation we’re going to take a look at the allowance method which is of course related to the accounts receivable account, we will be able to define the allowance method record transactions related to recording bad debt recording the receivable account that has been determined to be uncollectible recording every single account that has been collected after being determined that it was uncollectible. So we’re going to take a look at some different transactions, the most common transactions when dealing with the allowance method and see what those look like and why we use the allowance method. We’re going to work through a problem. So what we’re going to have here is we’ve got our accounting equation, of course we have our trial balance, I do suggest working problems to take a look at a trial balance because it can give you the context in which to work problems. So here’s what we have. We’ve got the assets in green, the liabilities are going to be orange, the light blue is the capital account and the equity section.

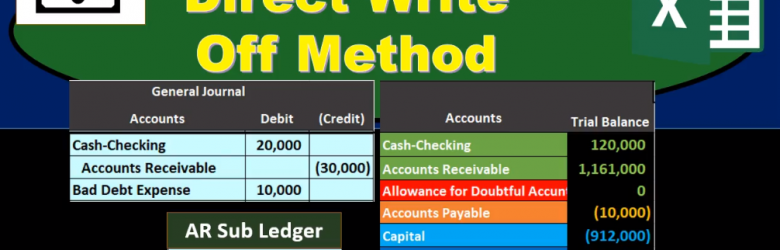

Direct Write Off Method

This presentation we will be discussing the direct write off method. The direct write off method as it relates to accounts receivable, quick summary of accounts receivable accounts receivable is a current asset, it’s an asset with a debit balance, we are going to be writing off certain amounts for accounts receivable that will become not due or not collectible at some point in the future. There are two ways to do this one is called the allowance method. The other is the direct write off method, we will be using the direct write off method here the non generally accepted accounting principles method being this direct write off method. However, a method that is typically much easier to use. Therefore, when considering whether or not to use an allowance method or direct write off method, we want to consider one do we have to use an allowance method due to the fact that we need to make our financial statements in accordance with generally accepted Accounting Principles, or are we able to choose between having an allowance method or direct write off method? If we choose to have a direct write off method, it’s probably because we’re thinking that the receivables that will be written off are not significant.

Accounts Receivable AR Subsidiary Ledger Explained

Hello, in this lecture we’re going to talk about the accounts receivable subsidiary ledger, the subsidiary ledger being the ledger that will be backing up the account of accounts receivable showing on the trial balance with 27,000. In it, in this case, accounts receivable being that accounts that represents what is owed to us. If we were the owner of the company, we might ask our accounting department, how much money do people owe us? In this case, it would be 27,000 would be the reply. Next follow up question would most likely be who owes us that money? And have we called them when are we going to get paid that money? In order to answer that question, we cannot look at the normal backup balance for all accounts that being the general ledger accounts. If we look at the GL we do get some detail in terms of the activity that has happened. However, that activity is not going to be in terms of who owes us the money. It’s in terms of date.

Accounts Receivable Journal Entries

Hello in this presentation we will be recording that journal entries for business transactions related to accounts receivable otherwise known as the revenue cycle. We will be recording these using debits and credits. At the end of this we will be able to list transactions involving accounts receivable record transactions involving accounts receivable using debits and credits and explain the effect of transactions on assets liabilities, equity, revenue, expenses and net income. We’re going to be recording these transactions up here on the left hand side constructing those journal entries in accordance with our thought process our list of questions to most efficiently construct the journal entries. We will then be posting them not to the general ledger but to this worksheet here so that we can see the quick calculation of the beginning balance and what is happening to the individual accounts as well. account types, in that we have the accounts categorized, as is the case for all trial balances. accounts have been in order that order been assets in this case in green, the liabilities in orange of the equity, light blue and the income statement accounts of Revenue and Expense Type accounts. first transaction perform work on account for $10,000.

Receivables Introduction

In this presentation we will take a look at receivables. The major two types of receivables and the ones we will be concentrating on here are accounts receivable and notes receivable. There are other types of receivables we may see on the financial statements or trial balance or Chart of Accounts, including receivables, such as rent receivable, and interest receivable. Anything that has a receivable, it basically means that someone owes us something in the future. We’re going to start off talking about accounts receivable that’s going to be the most common most familiar most used type of receivable and that means something someone, some person some company, some customer typically owes us money for a transaction happening in the past, typically some type of sales transaction. So if we record the sales transaction, that would typically be the way accounts receivable would start within the financial statements, meaning If we made a sale, we would credit the revenue account, we’ll call it sales. If we sell inventory, it would be called sales. If we sold something else, it might be called fees earned, or just revenue or just income, increasing income with a credit, and then the debit not going to cash. But going to accounts receivable.

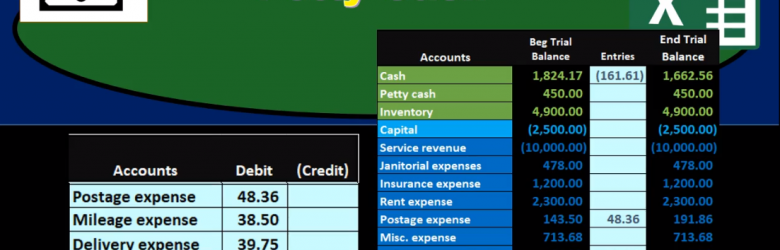

Petty Cash

In this presentation we will talk about how to set up and record a petty cash fund. Setting up a petty cash fund seems like an easy thing to do to have a minimal amount of cash that we can have expenditures for small purchases for however, it can be a little bit tricky to set up the petty cash fund and there is kind of a shortcut to recording transactions for the petty cash fund. So we’ll go over the process of setting up the petty cash fund recording the initial investment in the petty cash fund and then recording the activity from the petty cash fund. Now the objective of course in this will be to have not just the checking account where we need authorization in order to take money out of the checking account, we would typically want anything going out of the checking account to be by electronic fund transfer or by cheque so that we have a clear paper trail of what is going on the petty cash However, if we just have some small items that we need to take care of with cash and as to convenient to have small items with cash to be paid.

Bank Reconciliation-Accounting%2C Financial

Hello, in this lecture, we’ll discuss a bank reconciliation. At the end of this, we will be able to describe what a bank reconciliation is perform a bank reconciliation, make a needed adjustments to our books in the reconciliation process, as well as record those adjustments. So this is going to start off the bank reconciliation process. We’ll start off with, of course, the bank statement. So the bank statement is going to come from the bank, generally, it happens at the end of the month, although we could get it electronically at any timeframe. But typically, it’s still good to get it as of the end of the month so that we can have a set timeframe as to when we’re going to reconcile our account and deal with the timing differences at that time. So this bank statement coming from the bank is going to be as of the end of February in this case, and we’ll have a typical information on a bank statement, which will be that we will have the beginning balance, and then we’re going to have the additions to it generally our deposits and then we’re going to have the corrections to it.

Cash Disbursements Internal Controls

In this presentation, we’re going to talk about Cash Disbursements, internal controls. Now we’re going to talk about a voucher system for the payment process. But before we get too into the voucher system, note that the systems will change depending on the type of organization and what industry we’re in and how large the organization is. So if we just have a small organization, then we probably just want to have some internal controls for the owner of the company, the owner, being a key component of the internal control system and having a lot more oversight over many of the things that happened. For example, for the payments that happen, we may have someone that requests something on an employee that wants to request a payment may even you know, enter the payment into this system. However, we want to make sure that the owner still has some control over such as the cheque signing.

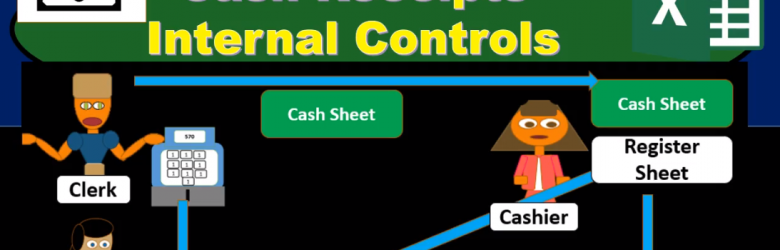

Cash Receipts Internal Controls

In this presentation, we will talk about cash receipts, internal controls. Now we’re going to talk about a voucher system for the payment process. But before we get too into the voucher system, note that the systems will change depending on the type of organization and what industry we’re in and how large the organization is. So if we just have a small organization, then we probably just want to have some internal controls for the owner of the company, the owner, being a key component of the internal control system and having a lot more oversight over many of the things that happen. For example, for the payments that happen, we may have someone that requests something on an employee that wants to request the payment may even you know, enter the payment into the system.