In this presentation, we’re going to talk about Cash Disbursements, internal controls. Now we’re going to talk about a voucher system for the payment process. But before we get too into the voucher system, note that the systems will change depending on the type of organization and what industry we’re in and how large the organization is. So if we just have a small organization, then we probably just want to have some internal controls for the owner of the company, the owner, being a key component of the internal control system and having a lot more oversight over many of the things that happened. For example, for the payments that happen, we may have someone that requests something on an employee that wants to request a payment may even you know, enter the payment into this system. However, we want to make sure that the owner still has some control over such as the cheque signing.

00:46

So remember that we would typically want to pay things by cheque so that we have that audit trail and we would want the owner to sign the checks. So that if we had a clerk or bookkeeper that was entering the information, they couldn’t make, you know, basically purchase Just as for themselves that may look like business purchases or something like that, that’s going to be a very typical type of fraud. So for a small company, we want to make make payments by cheque make sure that the owner has the access to the purchasing information of, of the company, and the owner is able then to sign the checks, and that’ll be a good control. Now, the owner also may want to do the bank reconciliations, they may not be entering everything into his system. But if they do the bank reconciliation at the end of the month, they have a lot more. That’s another control that can be done even by small companies.

01:36

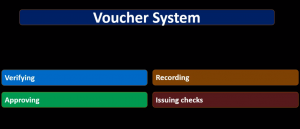

And reconciling the books itself records on the bank account is often a very good control over cash in and of itself. Now when we talk about a large organization, then we’re going to have more components of purchasing system. And we’re going to have to set up a system of controls limiting different type of activities that can be involved within the purchasing process. Note that the purchase process is a huge area where fraud can take place. And it’s going to be an area where fraud can happen, where where purchases happen, that are not approved or that are going for personal use rather than business use. So broadly speaking, the components of the system will to be to verify what will be purchased, we want to verify the activity, we want to make sure that there’s an approving process. So if there’s one person that’s asking or one department asking for purchases, we want to make sure that we have an approval process in place for the purchases, we want to make sure that the recording takes place.

02:34

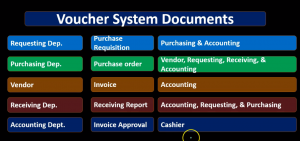

And then we want to have the issuing of the checks Finally, within these components will typically have some separation of duties within those components in order to safeguard our assets and not have purchases that will be applied for for example, personal use or non needed information or components for the system. So a voucher system example may look something like this. For example, we might have some department we requesting for a purchase something needs to be purchased a department is making a request for a purchase, we then we’re going to have the form of a purchase request. So we’ll have the purchase request, it’s going to go to the purchasing department and the accounting department. So the so we’re going to have that purchase the purchase request, go into the Department of purchasing, purchasing and the purchasing typically will be its own department, the only one authorized really to, you know, prove the purchasing process. And then the accounting department who will ultimately record the information into the system.

03:34

And then the purchasing department will then create the purchase order. And the purchase order will then be going to the vendor, as well as our requesting department to show that that they have sent it out to the vendor receiving and accounting. So the purchase order is going to go now remember that the purchase order is just going to be a request from the vendor to to Send it over payment has not yet been made, there’s actually no transaction happening here. We’re going to send the purchase order to the vendor Of course to in order to give us the the item that we’re requesting. We got the requesting department being the purchasing being the requesting department up here that the department that requested whatever item we are purchasing, and we’ve got receiving, which could be somebody like if it was being shipped to us and we have a separate department to receive it. Then we’re going to give a copy there so that they can see the the information or the item coming in. And then we have the accounting department which will finally be recording this information.

04:40

Then we’re going to have the vendor have the invoice so the vendor is going to provide the invoice to us. Notice it’s a little bit backwards and you might think of something like buying from Amazon where we would make the payment by credit card possibly before we got the goods here. We’re going to send the purchase order of the request and then get the vendor getting the invoice possibly at the same point in time that we receive the goods that we requested and the invoice is going to go to the accounting. So accounting now has the purchase request the purchase order and the invoice and then the receiving department is going to have the receiving report and that means that they got the actual whatever item was there you can imagine the receiving department is you know, the truck came in we got whatever it is that we ordered, and that’s going to the receiving report is going to go to and note that the receiving report now can count the information or the goods that has been received and they’re going to give their receiving report to the accounting department, the requesting department the original requester and purchasing the purchasing department.

05:52

So note the accounting department now has the Purchase Requisition the purchase order the invoice, the receiving report, and then the accounting depart is going to invoice, the invoice approval. And finally, the cashier will get that and we can record that information in to the system and make the payment the cashier then writing the check to the vendor. So this is going to be a process you can see that it’s going to be involves a lot of people within the purchasing department that allows us to make the separation of date of duties. It allows us to have the verification and process and allows us to record things in a different location than the original request is happening. So also However, you can see that it has a lot of, of added steps then a system where if you were a small company, which is a requesting department to check, that would be a lot faster. And note that if these kind of processes aren’t being followed, it’s very likely that people will start to tend towards that Because that being the quickest point between the two activities that we want to do, but if we do that we’re missing the recording, we’re missing to have everything recorded the way we want, we’re missing that separation of duty duties, and that will increase the likelihood of fraud.

07:15

So we need to review this process and make sure that we’re going through this process. Because although it takes more time, and it’s not as efficient as just writing a check, it does provide those other goods which we are balancing out. That being the safeguarding and all that other stuff, in comparison to a quick process. And as we grow, our goal, then we’ll be going we’ll be will be that we need to figure out what the best system of internal controls will be, is a small system of internal controls going to work and we can we just have a approval process by management or by the owner, or is it we have to have a larger system and as we implement that larger system, how many separate separations and approval processes do we need? In order to have an efficient system and also have one that safeguards as against potential problems such as fraud