Presentation and we’re going to enter payroll into our practice problem. Note that we’re not going to be processing payroll through the quickbooks online system, because that’s going to be an add on feature. We will talk more about payroll after the the practice problem has ended and its own section so you can get some more information there.

00:17

We also have a course specifically on payroll if you want to go specifically into payroll, it’s pretty much a specialty field that you could spend a lot of time on in and of itself. Here, we’re going to assume that we had payroll process by a third parties such as a paychecks or an ADP. We want to take that information, put it into our QuickBooks system, so that we have it reflected on the financial statements. So let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Let’s first take a look at the flowchart in the desktop version, just so we get an idea of the flowchart.

00:53

If we go back to the desktop version, we would see the payroll items down below. Now there’s three items in the payroll section. We can A track that time the main section would be, however, to pay the employees we be paying the employees. But this feature that will result in payroll liabilities as well that we will have to withhold from the employees as well as our own payroll liabilities that we would also then need to pay with this feature.

01:17

The main process within payroll is, of course, the pain of the employees, and then we’ve got to pay the payroll to the Fed and the state. In our practice problem, we’re going to say that we have the third party vendor that’s going to be processing the payroll, we’re going to take their report entered into the system. Now you would think that would be fairly straightforward. However, it’s still pretty complex because you get a payroll report from a third party vendor like ADP or paychecks and you try to think about well, what numbers go into the system and how am I going to do that? That’s still somewhat confusing. So let’s just get an idea of that.

01:48

Note that payroll in general if it wasn’t for the all the laws and the withholdings would be very easy. It would be just like any other expense, you would just credit cash and you debit payroll expense and you’re done. However, because of the With regard to withholding for federal and state taxes, as well as human resources, laws and whatnot, and overtime and all this kind of stuff, it gets much more confusing to process the payroll.

02:09

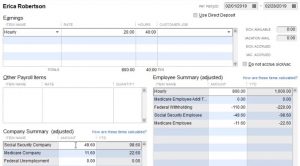

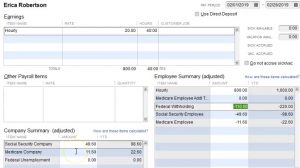

So if you were to process the payroll in QuickBooks, this is QuickBooks desktop just to get an idea of the calculation, it will then help you of course to process and calculate those payroll taxes. So for example, you put in the rate and the hours, it’ll calculate the amount of pay which is going to be the 800 here, and then it’ll calculate for you. Depending on the on the level of payroll service that you you purchase from QuickBooks, if you were to do it within QuickBooks, it’ll calculate for you the federal income tax, the Federal withholdings, which would be dependent on the W for information that the employee would fill out when they first start, and this is going to be the most complex tax because it has many factors.

02:50

Then we have the social security that would have to be taken out a federal tax, the Medicare that would have to be taken out, and then any state taxes and benefits that would have to be taken out as well. Well, so then we would get to the net check. So obviously, that gets a little bit more complicated, especially if you have multiple employees that have their own kind of preferences or their own different taxes that would need to be withheld. These two are fairly standardized, the federal income tax is not from employee to employee.

03:17

So that was more complex, that would give us the net check down below, then we’d have the Social Security and Medicare and other taxes, those would be the main two that we would have to pay on the employer side. So note, QuickBooks would kind of help you out with that as you as you process the payroll information by helping you to calculate some of these taxes as long as you put the data input properly for things such as the federal income tax. So what we’re going to imagine is that we’re going to get a report something like this from ADP, and we’re going to take that information, say, Well, I need to get that information into our QuickBooks system so that our financial statements reflect the payroll.

03:55

Then if you want more detail on the payroll, you can go to the payroll reports. From the third party, ADP or paychecks, or whoever your payroll provider is. So that means that we would need to take in this system, we would need to say, hey, you’re going to be handling our payroll, helping us out with our payroll, I’m going to take your reports, and then enter those reports into our our system in some way. Now, this might be done electronically, you might have something that they can integrate with QuickBooks Online and whatnot.

04:23

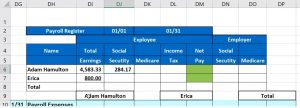

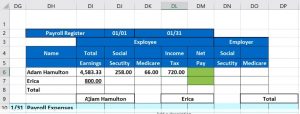

Or they might just simply give you the reports and you can somehow put that into your, your system. That’s what we’ll do here. So just to get an idea for the feel of this, too, we’ll do a little bit of a register so you can get an idea for it and how kind of long these registers can get once you add more information and how you could take that register and then put it into the QuickBooks system. So we’re going to imagine we have our two employees. We just got the two employees, Adam and Erica and their earnings, we’re going to say are the 4005 83 and the 800. That’s going to be their total earnings as their growth paid.

04:58

And then No, you got to take out social media. Medicare, these are the employee portions of the payroll tax. And typically they’re these are easier to calculate because they’re going to be more straightforward. And again, we’ll have more information on this payroll information, if you want in another course or will at will also add some more in its own section. But just in general, as we enter this into the systems, you know how to enter it in the Social Security is going to be usually the gross pay times point O six, two. So it would be equal to this times point O six to 6.2% or two at 417.

05:38

Now for some reason, and our practice problem, we have it with holding to 58. And I want to keep that because I wanted to match up with our bank reconciliation. So we’re going to we’re going to keep that number just just realize that’s basically how it would calculate the Medicare would typically be the gross earnings times point 145. Currently point oh 145 1.45% that 66.46 for our practice problem, we’re going to keep it at just 66. Because that’s what we want it to be.

06:07

Alright, then we have the income tax, the federal income tax. This is an our federal income tax in a company side, it’s the federal income tax, it’s being taken out of the employee wages, that will then be shown on their w two, and then they’ll have to it’s the it’s their federal income tax. This is the most complicated one, because it’s dependent on what they do on their w four form, you know, how many, how many exemptions did they have? What did they tell us basically to withhold and we have to look at tables and there’s a progressive tax system.

06:35

These two are fairly straightforward because they’re basically flat taxes, whatever the gross pay is, we apply a flat tax up flat rate. There are exceptions to that it’s not that simple, but for general purposes, it’s way more simple than the federal income tax calculation. So I’m going to say that we looked at the table we did the W four and you know, we got 720.

06:55

This one, by the way, is the one that you really, really need help with and someone You don’t, you don’t really want to be looking at the tables in the IRS website and trying to figure out how many withholdings, and that withholding stuff that you want a computer system to kind of, to look up that table and do that for you. And that would give us the net pay. So then we’d say, okay, the net pay is going to be the gross pay minus these three items.

07:18

So it’s going to be equal to the gross pay minus the Social Security minus the Medicare minus the income tax. So know that this is still fairly simple, because you could have other things like benefits of 401k plan, and you could have state taxes as well depending on the state that you are in. So then we’re going to go with Erica same kind of thing. The Social Security would be equal to the 800 times point oh, six two, typically, that’s currently what it is. We’re going to put it just at the 49 for our practice problem. The Medicare would be the 800 times point oh 145.

07:56

And we’re just going to put it at 11 for our practice problems and the federal income tax for the employee federal income tax would be based on all that info marital status and how many exemptions they have. And what they told us to put in there. And w four, we’re going to say here that it’s going to be 110. That means that the net check then would be equal to the 800. So we’re going to say it’s going to be the 800 minus two Social Security minus the Medicare minus the income tax. So the check they’re actually going to get is the 630. So this is the net check that we give them.

08:31

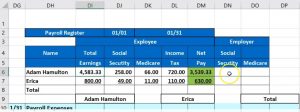

This is the amount that we take out of that net check. And their growth earnings then is this. Now we also have to match on the employer side, the social security medicare for the employer payroll taxes. So we’re going to match we’re going to give another to 68 and Medicare of 66. And then we’re going to be giving the 49 and the 11. We have to match that. So then you can see that if I sum these up Then you can think about payroll then in a couple different ways on this report, you can think about it individually, one by one, which we need to do, because we need to tell them individually what they have.

09:09

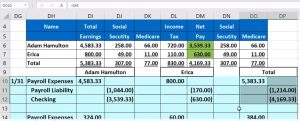

And we need to give it to them in some ways, such as a pay stub or some type of electronic format. But we can also think about it in total, in terms of putting it into our system. So if we put it into our system, we might think, Hey, why don’t I try to group it, however, makes most sense to put it into my system to calculate it. And then if they need more detail, you can go to the third party, the third party individual to get the more of the details on the breakdown of employee by employee, so you could think of it as some in payroll. So total gross pay for all employees is 5003 8333.

09:43

And the social security for all employees is the 307 and the Medicare for all employees. I’m summing these up obviously is the 77. And the federal income tax, not ours but the employee federal income tax is the 830 that we took from that And then you could sum these up this way, which would be 416 933. Or you could do the same calculation here, you can say, all right, this is going to be equal to the gross pay minus the total Social Security minus the total Medicare minus the total in federal income tax.

10:18

And then we would have that which should be the same as if we sum these up. And then we have the amount we have to pay in total for Social Security and Medicare, not for our Social Security and Medicare, but for the employees is those items. So that’s how we can we can think about this in terms of check by cheque or the total item.

10:39

Then when we enter this into the system, we pretty much kind of have to think of it in terms of a journal entry. If you’re going to enter this basically into into the payroll Now we could use registers and we may do that we might use the register to try to enter it But typically, you kind of have to pick up a journal entry. It’s useful even if you don’t want to think about journal entries too much that to look at the payroll journal entry because Again, you know, this, this is just a simplified table, this can be a lot longer if you have, depending on the state you’re in and the benefits you provide and whatnot.

11:10

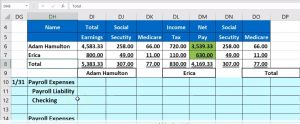

And so it’s, it’s useful to be able to think about that table and say, Okay, how is that going to be input into our financial statement. So let’s think of the accounts that would be affected. Now I’m going to think about it employee by employee and then the total. So the journal entry will be employee by employee and then the total, we have the payroll expense, the payroll expense for the first employee, Adam Hamilton would go up by the gross pay, so the expense goes up by the gross pay, even though we’re going to pay them the net check.

11:39

Then the liabilities would go up, you could break them out individually Social Security payable to Medicare payable federal income tax payable, or you can group them together as we will do here. That’s going to be the sum of these items, right? That’s what’s going to be taken out. Now, you could think about it this way, what’s going to be the the checking account or what’s going to reduce the cash That’s going to be the net check. Right? That’s this. And then the difference between those two is going to be these three items what we took from them, not because we get to keep it but but because we have to pay it on their behalf to the government. So I’m going to do that here. I’m going to do that with a negative sum of these three.

12:20

And there’s our journal entry. So the so these are credits for 583 33 meaning the liabilities going to go up in the credit direction cash is going to go down in the credit direction I know you know, and then the payroll and then the expense is going to go up which brings net income down. Now what let’s do that for Erica as well. I’m just gonna keep the same. So here’s the accounts affected and here’s Erica’s journal entry we’re going to pay Erica? Well Erica earned 800 but we’re only going to pay Erica the 680. That’s what’s going to come out of our checking account.

12:53

The difference is what we took for America we took out of her pay before she even got it. The not because we get to keep it But because the government made us do it, because we have to pay them to 4911 and 110 to the government, and that’s going to be the 800. Okay, and then we can think about this and in total, so if I went to the total, we can say, I can think about it in terms of the total gross pay is here, we’re going to pay total out of the bank account, the total net pay, and the difference is the total that we took from our employees for payroll taxes.

13:33

And so there we have that, that should also add up this way. So there’s the 553. And here’s the, here’s the 1214. And then here’s the 4169. Then we also have and I would think about this as a separate journal entry, our payroll taxes. Notice that these are payroll taxes, but they’re not really the company payroll taxes, because theoretically They’re coming out of the employee wages, right? They’re not they do affect how high the employee. That’s why I say theoretically because that how high you how much you pay someone kind of varies depending on how many payroll taxes are kind of stuffed into the, you know, the gross pay and whatnot.

14:15

But, but these come out of the employee pay, this is what we have to pay outside of the employee pay. That’s why this is really the payroll taxes for the employer. And so if I go here, and I say, all right, the payroll taxes that we have to pay then are going to be the payroll expense, payroll expense, and we could call it payroll tax expense. But oftentimes, QuickBooks will just group payroll expense between both the expense of the wages and the taxes.

14:41

If this was payroll tax expense, note that it’s only going to be the employer portion, because the employee payroll taxes is included in their earnings on the expense side on the income statement. And that’s can be really confusing for a while. And then we’re going to say that no credit is going to be valuable. I could do the same for that I pick up the red numbers here. Yeah, then I’m going to do the same for Erica, we have to pay for Erica payroll taxes to the government on top of the wages of the 60 and the 60. And then the total, we have to pay for payroll taxes is going to be the 307 and the 77.

15:23

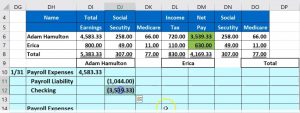

I don’t know why I made that negative. And then that should tie out this way as well. If I was to add these up, that’s the 384. That’s going to be the 384. Now you don’t have to do this little worksheet if you don’t want to do it onderon. You could use this just to implement the information into QuickBooks as we’ll do next time.

15:44

But I just want to give you an idea of how this is going to be formatted. So that when we enter it into into QuickBooks, we have an idea of these two kind of journal entries, whatever kind of register you get a report you get from a payroll company. It should have some kind of breakout like this sometimes Kind of register, that you can basically break this down by a check by check basis, get, you know, get the gross wages and kind of like you would see on a, there’s two parts to it, something that you would kind of see on your paycheck stub or expect to see on your paycheck stub gross pay minus what they took out of it, and then the neck net pay.

16:19

But that’s not all of it, because you also need to have the employee or payroll taxes somewhere. And sometimes that’s more difficult to find on the payroll tax reports, you know, because they these are going to be very transparent. Typically, they’ll put it in multiple different formats, because that’s what you got to give to the employees in some way that’s going to be the detail needed. And then we but we also need, of course, the employer portion that we need to enter in the system.

16:44

When we enter it in the system, then I would think about it as soon as two separate transactions that would usually be put into the system as a journal entry, but you can’t put it into two separate transactions per you know, employee so for example, I could enter the totals We’re into the system. But it would still be to two separate journal entries for the total that the payroll journal entry in in the payroll tax during lottery. Now, if you do the totals here, if you think about this, you guys, well, I could do this and I can just put it all in the system, then my financial statements will be correct, that’s true.

17:18

However, you’re in the checking account, you’re only going to have one amount in the checking account coming out of the checking account. And you really need. So when you do the bank reconciliation, you’re going to have multiple checks that came out of the checking account, and you’re gonna have to somehow tie them in. So as long as you match that out, like in the checking account, you’re going to see multiple checks coming out of a checking account.

17:39

If you if you’re a if you’re okay with that and you could tie that into one lump number, that’s fine. Or you might want to break it out into a transaction, one transaction for each employee that resulting in you know, a separate check for for each employee. So you have a separate check here that will tie out when you do the bank reconciliation. As we’ll see when we do the bank reconciliation for Adam, and then for Erica, and then there’s no check down here that’ll that’ll come out of the bank account later when we pay the payroll liability. So next time, we’re going to take this information that we have kind of like in our register type of format and now we thought about the journal entry will take that journal entry will enter that into QuickBooks Online.