This presentation and we’re going to continue on with part two of entering the payroll information into our system within QuickBooks Online. Here we are in our get great guitar system. Last time we entered our information, we’re imagining we have payroll or paychecks, basically giving us this register information. And that register information we’re going to enter into the system.

00:22

So we’re going to imagine that we have a third party that’s helping us to process the payroll, they process the payroll, we’re going to say basically came out of our account our checking account. And now we have to mirror that we cannot process this information into our system, we can imagine then seeing the checks that are coming out of our bank account on our online bank system, or in our bank statement. And now we got to enter that information into QuickBooks.

00:46

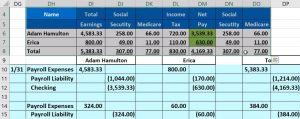

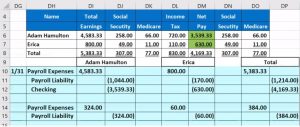

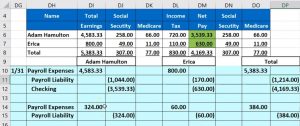

Now, it’s a little bit more complicated Of course to do so because of the payroll liability information we have to do. We’re going to be taking the register in essence will take this register information entered into the system. We thought about it in terms of journal entries, and Typically, if we’re trying to tie out to each specific check, we would have to enter the journal entry basically by employee. So we’re going to take our two employees, Adam and Erica, we break it down to basically this journal entry, which will result in this net check for Adam, this net check for Erica.

01:16

And we’ll enter that information into our system as basically an expense. So let’s go then into our QuickBooks. So we’re going to go back into QuickBooks Online, and we’re going to be taking a look at a expense. So I’m going to use the expense form, I’m going to select the drop down, we’re going to be going down to add expense. So it’s going to be like a check form, but an expense as if we’re imagining here, this came directly out of our checking account.

01:45

So then we have the business operations other or inventory. Note we have to we can’t use the first one here because it won’t let us hit any balance sheet accounts. So we’ve got we’re going to meet need to use then the other reasons so I’m going to go to the other reasons down below. And then we’re going to be picking up the person we are paying.

02:03

That’s going to be Adam Hamilton. So it’s copy Adam Hamilton, go back to the QuickBooks Online, and that’s going to be our employee. And tab. Now note, I’m setting up Adam Hamilton as a vendor. So I set up Adam Hamilton as a vendor, even though they’re an employee, I would do that for a couple different reasons unless you’re processing payroll within QuickBooks because I don’t really want to set up Adam as an employee in QuickBooks if I’m not using the QuickBooks system, because I don’t want it to mess up anything if I later decide to use QuickBooks, the QuickBooks system for payroll.

02:38

So I don’t want to have any preset employees that are kind of partially in the system. And to I don’t want to show you how to set up an employee in the system. If I can’t set up the most important part, which is going to be the information related to the payroll taxes and whatnot, everything else is going to be very similar to what it would be for a customer or a vendor.

02:57

Basically the information contact information That kind of stuff. The payroll tax information, of course, is the thing that would differ. If you were to be processing payroll, we’ll do that in a separate section below the main course project, we’re going to save the date, then it’s going to be a 131. to zero the end of the month, it’s going to be coming out of our checking account.

03:17

Note that you may want to take it out of in practice another payroll account, you might set up a payroll account, simply to put money into it for payroll and then to take it out. Why? Because if you have a lot of paychecks into that payroll account, it’ll be easier to track those specific payroll paychecks if you have like 20 people, then you may want another account just to say, hey, that’s my payroll account. Everything in here is payroll. If you have a question about it, I don’t need to mix it up with anything else. It’s all in payroll.

03:45

We’re just going to be using the checking account here we have our two employees. So we should be okay. We’re going to go down and add our our expenses. Now I’m going to add an expense or I’m going to choose a payroll expense, payroll, payroll expense. Now I’ve already set it up as an expense type of account. So you may need to set it up in your system, if you do, simply just type in payroll expense, hit tab. And then you want to set it up as the account type the account type of an expense.

04:15

So it should be the an account type of an expense, and the name payroll expense. Now the big thing, the amount going into payroll will not be the amount of the net check, it’s going to be the amount of the gross pay, so we’re going to take the gross pay of the 458 333. So I’m going to put the gross pay of the four or 583 point three, three there. And then the next account that we’re going to have is going to be the payroll liability. That’s going to be what was taken out of the paycheck including Social Security, Medicare and income tax or federal income tax for the employee, not ours. And so we’re going to say this is going to be payroll, pay roll liability and tab, we’re going to set that one up, it’s going to be a liability account.

05:04

So if I choose here, it’s going to be accounts payable credit card, no other current liability. That’s the one. That’s the one. And let’s see if we have a payroll, we have payroll tax payable, that looks good. And then I’m going to call it payroll liability. That’s fine. Alright, that looks good. So then we’re going to say Save and Close. And there we have it.

05:27

Now the amount is going to be the combined amount of the three items, which is 1044. I’m going to put it in here as a negative 1044, which is kind of a confusing thing to enter this these items. And the difference between those two, the expense and the liability comes up with 353 933. Does that get to our net check? 353 9.33 Yes, that’s going to be the net check. So what’s going to be the effect of this Going to be decreasing the checking account for the net check or the net amount that came out of the checking account electronic transfer for 353 9.33.

06:08

It’s going to be increasing the expense account of the 458 3.33. gross pay, not the net pay the gross pay, and it’s going to be increasing a liability. It’s going to be increasing the liability. I know it has a negative here, it’s going to be increasing the liability with the 1044. And that’s the amount that we have to pay to the government in the future. All right, let’s do this again. Let’s do it again. We’re going to say it was that was good time.

06:34

So let’s say save a new and do it all over with the second employee where we where we will take Erica’s information and enter that into the system. So now we have Erica, for some reason we don’t have a last name for Erica. Erica has a last name I think but we’re gonna say Erica, like ever Smith. Smith. Alright. So it’s a good last name and then we’re going to set it up as a vendor now. And employee for the practice problem. And again, you may want to just simply do that in the system if you’re not running payroll within the QuickBooks system.

07:09

And then and you might, if you do do that in the notes down below or something like that, you might want to, you know, reference that this isn’t the employee that’s being processed through some other system, paychecks or EDP, it’s going to be coming out of the paycheck as with the last one, we’re going to be debiting payroll expense, so will debit the payroll expense, and that’s going to be for the amount of the gross pay, which is $800. So we’ll pick up the 800. And then we’ll have the payroll liability right underneath it. So I’m going to say pay, payroll liability car populates for us now, Isn’t that nice?

07:52

And that’s going to be for the sum of these amounts, or the 170. So I’m going to say that’s going to be Negative 170. All right, that leaves us with a gross check or a net check or net amount that comes out of your checking account electronic transfer of the six fifth of the 630. There’s the 630. So that looks correct. What’s this going to do? Increase the PayPal, it’s going to decrease the checking account by 630. Increase the payroll expense by the gross pay 800 increase the liability that we owe for payroll taxes of the 117.

08:27

Let’s go ahead and save and close this now. And then let’s see if we can run some reports. So we’re going to then go to our reports. And let’s open up our trust our three trusty reports here since this is a new thing will open up the balance sheet. We’re going to scroll back up top and change the dates up there from a one on one to zero to 1230 120. We’ll go ahead and run that report. Then we’ll duplicate the tab up top by right clicking on it and duplicating it. We’ll go back to the tab to the left, we’re going to do the same thing for the P and L, the profit and loss the income statement.

09:07

So there’s the p&l profit loss income statement, let’s change the dates up top to the same range. Once again, that being a one on one to zero to 1230 120. We’ll go ahead and run that report. Then I’m going to duplicate the tab up top right clicking on it and duplicating it. And then we’ll open up the trusty trial bounds just for because you know, it might be a good thing to have open to because we have multiple accounts affected here on both the balance sheet and the income statement. And that’s when the trial balance is trustee. So we’ll open up the trust trial balance and I’m going to change the dates up top there as well from a one on one to zero to 1230 120.

09:48

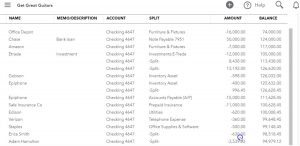

We’ll go ahead and run that report. duplicated go into the tab up top right clicking on it and duplicating it. Now let’s take a look at what we got. If we go to the balance sheet first I’m going to go to the balance sheet. I’m going to close the hand burger in the balance sheet, there’s, there we go. And then we’re going to, I’m going to hold down Control and go up a little bit. So we’re at the 125. So I’m currently at the 125. Now, obviously, the chicken account should be going down by those two amounts.

10:13

So I’m going to go into the checking account. We’re going to open that up, scroll back down. There they are, there’s Erica. And there is Adam. And it’s a split between the two other accounts because there’s more than one account that is going to be affected. And we’ve got these two, two amounts in there.

10:30

They’re not checks, but they’re two, we’re going to call them electronic transfers that came out of our checking account, that then should tie out to the actual amounts that came out on the bank statement so that we can then do our bank reconciliation, that’s why it’s better or it might be better you have to think about whether you want to enter them one at a time, or you can enter them as a total which would be easier to do make your financial statements correct, but might be a little bit more difficult to reconcile on the bank statement to the yearbooks if we open any of those are one of Those let’s open one of those, then we’re going to get to our form the expense form.

11:05

So there is our expense form and there is our calculation, there’s the 613. So let’s close this back out. Now the end, let’s go back up, let’s go back to our balance sheet. Then the other side, you would typically think would be on the profit and loss. So then if we go to the profit loss, close the old hamburger, scroll on down, we see that we have the payroll expense at the 538 333. That should tie out to our total here right total expense for gross pay 538-333-5383 30. In the in the total on journal entry format, I twisted my tongue there, sorry.

11:43

So then we’re going to be down here in the payroll expense. And same thing if we opened up one of those, obviously, we would go back to our expense report, closing that back out, and scrolling back up top if we go back to our profit and loss The other side of it, of course, is the liability side, back to the balance sheet for the liability side, that’s going to be in the current liabilities, we have this item. That’s what we owe to the government. That’s what we took from the employees.

12:13

And that’s what we have to pay on our own for payroll taxes that we need to pay to the Fed for Social Security, Medicare, and the federal income tax. Once again, we see the three amounts there, they add up to the 1000 to 14 total, which if we looked at our trial balance in total, that would be these three, right, that would be the 1000 to 14, which would be the 1000 to 14 here.

12:39

So there we have that what we don’t have yet is the employee or side of things now. So now we’re going to enter the employer side of things. And there’s no check that’s going on here. Therefore, we might just want to enter this as one journal entry, basically one transaction instead of having two separate transactions. Now note here we don’t have cash affected, so not going to go into it and expense account. Typically, you would be using some type of journal entry here when there’s no when there’s no checking account affected, but we could use the registers. And that’s what we’ll practice doing. So this second register down below is a liability register. That’s the one we’re going to have to use. So now I’m going to go back to our QuickBooks on the online QuickBooks, not the desktop. Let’s go back to the first tab, and I’m going to scroll back down to get back down to 100.

13:29

So QuickBooks doesn’t do anything funny to the forms doesn’t squinch them up or anything. So then I’m going to go down to the accounting down below, we’re in our chart of accounts. And you’ll see we have a register, you’ll recall for all of the balance sheet accounts, for the most part, not for the income statement accounts. Therefore, I can’t go into the expense account but can go into hopefully, this liability account for the payroll liability.

13:53

Let’s use that register to see if we can enter our transaction into it. If I see the drop down Remember all the options we had for the checking account register, here, we only have two, we’ve got a transfer or journal entry. So it’s actually a journal entry. That’s what QuickBooks thinks of it. That’s the form that’s going to be there, there is no form, therefore, you have to use a journal entry. Even though we’re going to enter this into the register, okay, I’m going to enter this in as of a 101.

14:23

I’m sorry, not a 101 30 120, the end of the month, and it’s going to give us a reference number, that’s fine. I’m not going to put a P, because I’m going to put both employees in there in the memo, I’m going to say payroll tax, federal tax, let’s keep it at that. And then we’re in the liability, the liability is going to increase so the liability is going to increase we’re not in the checking account register, we’re in the payroll liability register, it’s going to be increasing by the total of these two, which is going to be the three eight for So it’s going to increase by 384. Let’s do that it’s going to increase by Am I an increase? Yeah, 384. And then we’re going to say the other side of it then is going to be going to this is to the payroll expense.

15:19

Now note, this is when you might want to break out payroll expense, which is the gross pay of the employees and payroll taxes. In other words, you could make this account a new account called payroll taxes, and let’s actually do that that’ll sometimes QuickBooks combines these. But, you know, it’s, it’s useful actually to break these two out, and most people don’t understand why they’re broken out. So let’s go ahead and break them out.

15:42

And we’ll say tab. I’m going to say that this is going to be an expense type of accounts. I’m going to say this is going to be an expense. And I’m just going to call it a payroll type of expense, and we’re going to put it into payroll taxes. So then I’m going to say save clothes, and then we’ll go ahead and save that and see what that does. So then we’re going to go back to our reports, let’s go to the balance sheet report, and scroll back up top. Going to go back.

16:12

Now within the payroll liabilities, if I open up the payroll liabilities now, I’m going to have a couple sets of transactions, I got the two expense forms for the two for the two employees, this is what was taken out of their paychecks. And then I have the journal entry. The journal entry form is what we had to put in and pay over and above. If I go into the journal entry form. Now, you’ll recall we put this into the register, but QuickBooks will see it as a journal entry doesn’t go to any form. In other words, QuickBooks said I don’t know where to put this, I don’t have any form. To put this on.

16:43

Therefore, I’m going to a journal entry for going to the debits and credits themselves rather than the data input form. closing this back out and scrolling back up and go into the profit and loss report. We can see here that now we have the let’s go ahead refresh this, I’m not sure it’s refreshed and then I’ll close the hamburger, I’m going to make it a little bit larger 125.

17:07

Okay, so now we have the payroll expense, that’s where the gross pay went that we saw last time. And then the payroll liability remember the payroll liability, I mean, the payroll taxes. Remember that the payroll taxes is going to be if they’re broken out, and oftentimes they are only going to include the employee or payroll taxes doesn’t include the employee payroll taxes. And if you go into that item, then of course, we have our journal entry there, which has the form of a journal entry because there was no other form, therefore, it’s going to default to the journal entry.

17:36

Let’s go back to the profit and loss. let’s just review it one more time on the trial balance. This is where you can see everything at one spot and given there’s multiple accounts affected. It’s nice to see the trial balance. So what happens if you just if you just look at the trial balance, the checking account checking account is going to go down the checking account went down by the check to Erica and the check to Adam So the two checks are there, it’s going down by the net pay, not the gross pay. Going back to the report, the other side of that you would typically think of its payroll expenses, which you see down here in the income statement section of the trial balance.

18:13

Going into the payroll expenses section, you see, the gross pay into payroll expenses for our two employees. Going back up top back to our report, the difference between the gross and net would be in the payroll liabilities. So in the payroll liability section, the liability section, you see payroll liabilities, then we go into that item, we see those two expense forms for the payroll liability, but also that journal entry. And there they are, that’s how much was taken out. That’s the difference between the gross and net pay back to our forms.

18:46

We also have the payroll taxes for the employee or portion down here, we put it into its own expense account. There it is. So this is what we had to pay over and above with like a separate transaction, another journal entry Other than that, checks we paid to the employees or the amounts we paid to them the the electronic transfer. And then the other side of that is also in the payroll liability account up top. So if we go into the payroll liability account again, once again we’ll see that journal entry for the employee or portion. So I’ll scroll back up top. This is what we have right now in the trial balance will try to break these out and give you a copy of the trial balance so you can kind of compare them after each section.