QuickBooks Online 2021. net sales by customer or income by customer reports. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching within your favorite browser for QuickBooks Online test drive, we’re in Craig’s design and landscaping services. Going down to the reports on the left hand side, we’re going to be opening up reports for sales by customer, this is going to be supporting a line item on the income statement. So let’s scroll on down. We’re looking for this sales type of reports.

Posts with the assign tag

Check & Expense Forms 1.28

QuickBooks Online 2021. Check and expense forms. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re going to be searching for QuickBooks Online test drive, then we’re going to be selecting and QuickBooks Online test drive. And then QuickBooks is going to try to call us a robot. Again, we’re gonna say we’re not a robot, you’re the robot, you’re you’re the robot, QuickBooks. And then we’re gonna log in there, we’re still looking at our vendor section. So if we hit the drop down over here, we’ve got the new drop down, we’re in the vendor section, we talked about, basically the accrual process, which is the entering of the bill and then the pain of the bill.

Bank Feeds .25

QuickBooks Online 2021 Bank feeds. Let’s get into it with Intuit QuickBooks Online 2021. Here we are online in our Google search engine. We’re typing in the QuickBooks Online test drive to get to our QuickBooks Online at Test Drive File, we’re going to be clicking on QuickBooks Online at test tribe, verifying that we are not a computer here, and then continue. Here we are in the Craig’s design and landscaping services practice file, we’re going to be touching in on the bank feeds. And the first thing we want to note is that we will be going into bank feeds in more detail, but it will be after the primary practice problem where we will focus specifically on bank feeds.

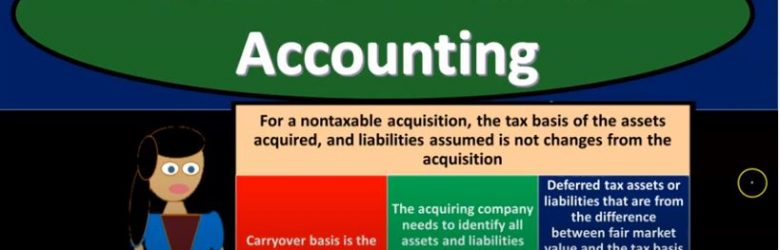

Consolidation & Income Taxes

Advanced financial accounting PowerPoint presentation. In this presentation we’ll talk about consolidation and income taxes get ready to account with advanced financial accounting. For a non taxable acquisition, the tax basis of assets acquired and liabilities assumed is not changed from the acquisition. In this case, then the carrying basis is the acquire ease basis, the acquiring company needs to identify all assets and liabilities acquired and their fair market value when the acquisition takes place, and then the deferred tax assets or liabilities that are from the difference between the fair market value and the tax basis when allocating the purchase price must be recorded by the acquiring company. So we have the tax expense allocation. When consolidated return is filed. What are we going to do with this tax expense allocation, the parent company and subsidiaries can file a consolidated income tax return or they can choose to file separate returns. So this is one of the things that we kind of have to consider here we’ve got a controlling interest that’s going to be involved. So we have two entities, one has a controlling interest and the other obviously parents subsidiary type of relationship question, then should we report just one tax return? Or should we have two tax returns, this is going to be a decision that needs to be made. But if we file one tax return, then at least 80% of its stock must be held by the parent company or another company included in the consolidation return for a subsidiary to be eligible to be included in a consolidated tax return.