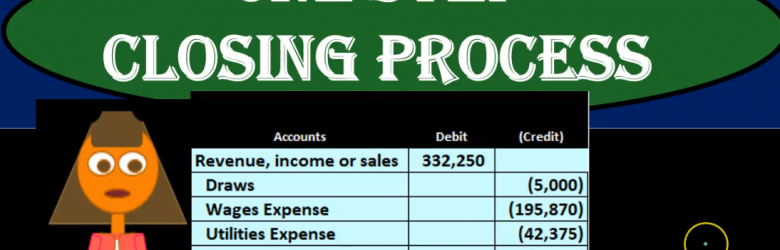

Hello in this presentation, we will be looking at a one step closing process. In other words, we will be closing out temporary accounts using one journal entry. There’s a few different ways that we can perform the closing process. And there’s benefits and cons to each way of doing it. The one step closing process is the simplest way to do it. And it’s also a way that we can imagine what is happening within the closing process as easily as possible a skill useful when considering what’s happening from time period to time period, and how the financial statements are working. So here we’re going to look at a one step closing process. Remember what the closing process is, it’s going to be a process at the end of the time period that we will be performing.

Posts with the capital tag

Closing Process Explained

Hello in this lecture we’re going to talk about the objectives of the closing process the closing process will happen after the financial statements have been created. So we will have done the journal entries where we will have compiled those journal entries into a trial balance, and then we will have made the financial statements. And then as of the end of the period in this case, we’re going to say as of December, when we move into the next time period, January, what we need to do is close out some of the temporary accounts those accounts including the income statement and the draws account so that we can start the new period from start in a similar way as if we were trying to see how many miles we could drive say in a month. If we wanted to Vince in December, and then see how many miles we’re going to drive in January of next year.

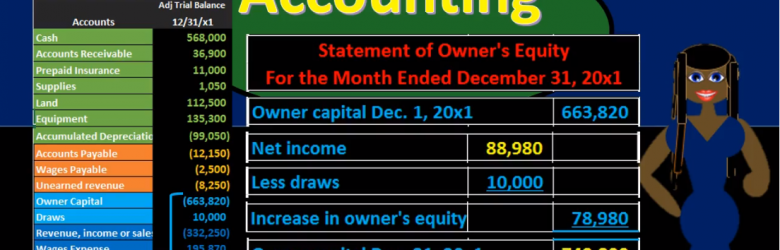

Statement of Equity From Trial Balance 17

More in this presentation we will take a look at the statement of owner’s equity and see how to construct the statement of owner’s equity from the trial balance. When looking at the trial balance, we can see the accounts will be in order with the assets and then the liabilities, then the equity and then the revenue and expenses. The equity accounts being broken out here of owner capital and draws. But it’s a little deceiving to break out this equity section. Because the trial balance really is showing both a point in time the balance sheet account permanent accounts up top and timing accounts which are going to be the revenue accounts down below. When we think about the point in time for total equity as a whole. We’re really considering the entire blue area here. This is one of the most confusing concepts to really know when you’re looking at these financial statements.

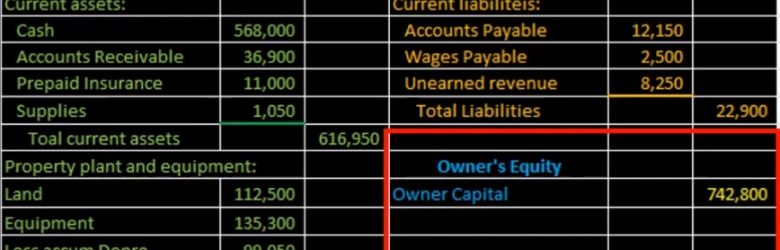

Balance Sheet Equity Section Creation from Trial Balance 15

Hello in this lecture we’re going to be creating the equity section of the balance sheet. In prior lectures, we have taken a look at the current assets section, the property plant and equipment section and then the liability section. This will be rounding out the balance sheet where we will finally get to total assets being equal to total liabilities and equity represent in the double entry accounting system. In terms of the balance sheet in terms of the accounting equation, we of course, are pulling these numbers from the adjusted trial balance. the adjusted trial balance also represents the double entry accounting system. However, it represents that double entry accounting system in the format of the building blocks of debits and credits. All we’re doing is taking those building blocks in terms of debits and credits, rearranging them to the accounting equation, so that readers who don’t understand debits and credits can then read them. Now when we look at the equity section, this is a bit confusing when we convert from the trial balance to the equity section.