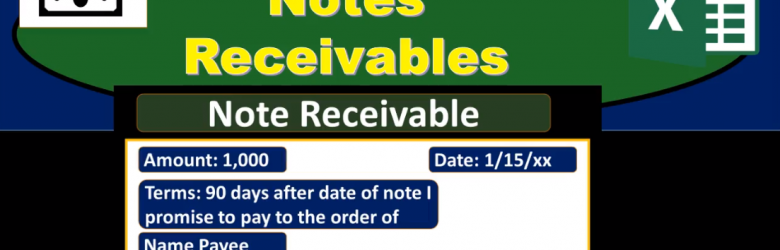

In this presentation, we will take a look at notes receivable. We’re first going to consider the components of the notes receivable. And then we’ll take a look at the calculation of maturity and some interest calculations. When we look at the notes receivable, it’s important to remember that there are two components two people, two parties, at least to the note, that seems obvious. And in practice, it’s pretty clear who the two people are and what the note is and what the two people involved in the note our doing. However, when we’re writing the notes, or just looking at the notes as a third party that’s considering the note that has been documented. Or if we’re taking a look at a book problem, it’s a little bit more confusing to know which of the two parties are we talking about who’s making the note who is going to be paid at the end of the note time period? We’re considering a note receivable here, meaning we’re considering ourselves to be the business who is going to be receiving money. into the time period, meaning the customer is making a promise, the customer is in essence, we’re thinking of making a note in order to generate that promise, that will then be a promise to pay us in the future.

Posts with the earned tag

Receivables Introduction

In this presentation we will take a look at receivables. The major two types of receivables and the ones we will be concentrating on here are accounts receivable and notes receivable. There are other types of receivables we may see on the financial statements or trial balance or Chart of Accounts, including receivables, such as rent receivable, and interest receivable. Anything that has a receivable, it basically means that someone owes us something in the future. We’re going to start off talking about accounts receivable that’s going to be the most common most familiar most used type of receivable and that means something someone, some person some company, some customer typically owes us money for a transaction happening in the past, typically some type of sales transaction. So if we record the sales transaction, that would typically be the way accounts receivable would start within the financial statements, meaning If we made a sale, we would credit the revenue account, we’ll call it sales. If we sell inventory, it would be called sales. If we sold something else, it might be called fees earned, or just revenue or just income, increasing income with a credit, and then the debit not going to cash. But going to accounts receivable.

Adjusting Entry Wages Payable 7

Hello, in this lecture, we’re going to record the adjusting entry related to payroll, we’re going to record the journal entry up here on the left hand side and post that post that to the trial balance over on the right hand side trial balance in terms of assets and liabilities, then equity and the income statement, including revenue and expenses, all blue accounts, including the income statement being part of equity, we’re first going to go through and see if we can find the accounts that will be related to a payroll adjusting entry. And then we’ll go explain why we are going through this process. So just if we have the trial balance, and we know it’s an adjusting entry related to payroll, we know that there’s going to be at least two accounts affected. And we know that because it’s an adjusting entry, it will be as of the end of the time period. In this case, let’s say it’s the end of the year 1231.