Advanced financial accounting a PowerPoint presentation. In this presentation, we will discuss forward exchange contracts get ready to account with advanced financial accounting, forward exchange contracts. Now we’re going to go over some of the components of the foreign exchange contracts here, we’ll go into them on a lot more detail as we work through practice problems related to the forward exchange contracts. But just to visualize the basic kind of layout of a foreign exchange contract as you think about these items, and there’ll be a lot more concrete once we look at practice problems, we’re basically have a setup where we’re going to be working with a bank or a dealer, typically a bank, and we’re going to be setting up a foreign exchange contract which is basically going to say, we have a receivable and payable on the books at this point in time and we’re either going to put the receivable or the payable that is going to be due to us or something that we will pay in foreign currency at the end of the time period. Whereas the other side the receivable or the payable, the other side that’s not in foreign currency will be in US dollars. In other words, we We will determine the amount that will that we’re talking about. And then we’ll use an exchange rate which we’ll talk a little bit more about the exchange rate that we will use to value it in today’s dollars will put either the receivable or the payable in US dollars and either the receivable or the payable and foreign dollars as of this point in time. And then as time changes, as the rate of the foreign currency changes, then that could result in the difference between, you know, what we thought the value would be, at the point in time we went into the forward contract between the US dollar and the foreign currency as that difference changes over time that could result in basically a gain or loss.

Posts with the hedge tag

Forward Exchange Financial Instruments

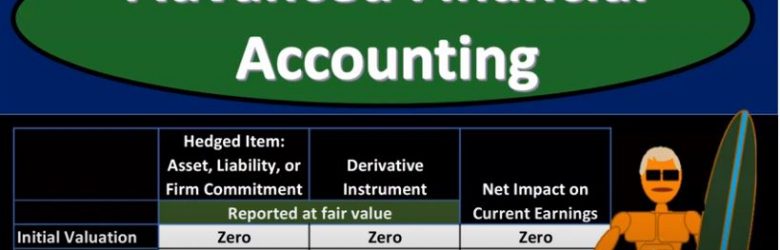

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss forward exchange of financial instruments get ready to account with advanced financial accounting, forward exchange financial instruments let’s start off with some definitions starting off with financial instrument itself will be either cash evidence of ownership or a contract that imposes on one entity on contractual obligation to deliver cash or another instrument and conveys to the second entity, the contractual right to receive cash or another financial instrument. That of course, being the most complex component here. So let’s read that one more time. The financial instrument a contract that imposes on one entity a contractual obligation to deliver either cash or another instrument and conveys to the second party the second party in this item, the second entity, the contractual right to of course, receive the cash or another financial instrument derivative. So a derivative, financial instrument or other contract whose value is derived from some other item that has a value that varies over time. So let’s think about that one more time again, derivative financial instruments or other contracts whose value is derived from, they’re going to get the value from some other item that has a value. That is that varies over time, meaning of course, that it will be changing over time. So let’s think about the derivative characteristics. And then we’ll apply these to the component of what we’re considering here. foreign currency and foreign currency transactions in terms of typically foreign currency type hedge transactions.