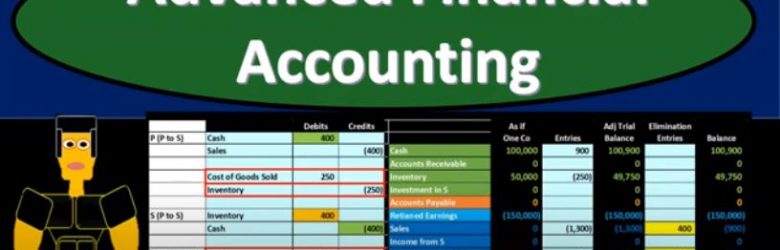

Advanced financial accounting. In this presentation we’re going to discuss an intercompany transaction where a parent makes a sale to a subsidiary and then the subsidiary resells it. In other words, we have this intercompany transaction, we want to think about how that is constructed. And then how we can do the reversing entry for it or a consolidation entry in the case of a consolidation of a parent and subsidiary in a consolidated financial statements, get ready to account with advanced financial accounting. So within a situation where we have a sale from P to s, and then S sells it to an outsider remember that as it goes to the outsider, that’s going to be the legitimate type of so that’s the arm’s length transaction, the sale from PETA is not so and therefore we kind of have to eliminate that. Now if it’s been sold to an outsider, then we have a situation where the inventory is still gone. There has been a sale being taken place. And so we so that’s good, but we still have to do the reversal of part of that intercompany transfer and it’s gonna boil down At the end of the day, basically debiting, the revenue account reversing revenue, and reversing the cost of goods sold. So this is the boiled down version. Now if you think about it, you might say what happy because if p sales to s, then you’re going to like debit cash credit, you know, you’re going to credit the sales, and then you debit cost of goods sold, and credit inventory and then asked is going to be recorded cash, and then they’re gonna be recording, then the other side go into inventory, and then right, there’s more, and then they made the sale to the outsider. So how do we boil this down? How does the intercompany boil down to just this right? We kind of kind of have an idea of that in our mind.