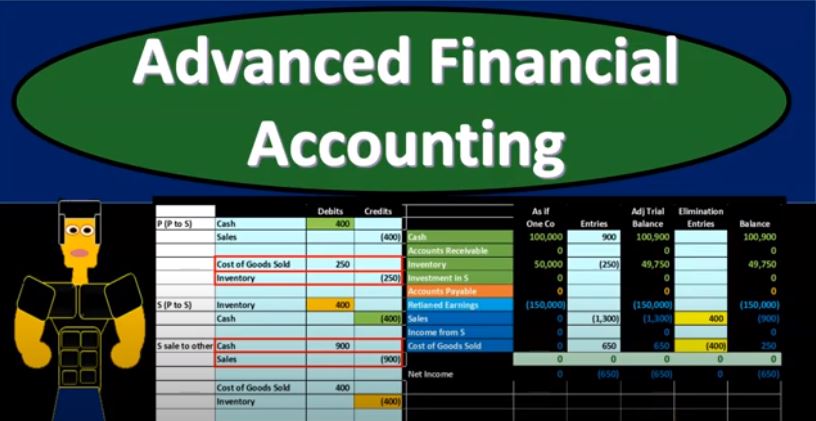

Advanced financial accounting. In this presentation we’re going to discuss an intercompany transaction where a parent makes a sale to a subsidiary and then the subsidiary resells it. In other words, we have this intercompany transaction, we want to think about how that is constructed. And then how we can do the reversing entry for it or a consolidation entry in the case of a consolidation of a parent and subsidiary in a consolidated financial statements, get ready to account with advanced financial accounting. So within a situation where we have a sale from P to s, and then S sells it to an outsider remember that as it goes to the outsider, that’s going to be the legitimate type of so that’s the arm’s length transaction, the sale from PETA is not so and therefore we kind of have to eliminate that. Now if it’s been sold to an outsider, then we have a situation where the inventory is still gone. There has been a sale being taken place. And so we so that’s good, but we still have to do the reversal of part of that intercompany transfer and it’s gonna boil down At the end of the day, basically debiting, the revenue account reversing revenue, and reversing the cost of goods sold. So this is the boiled down version. Now if you think about it, you might say what happy because if p sales to s, then you’re going to like debit cash credit, you know, you’re going to credit the sales, and then you debit cost of goods sold, and credit inventory and then asked is going to be recorded cash, and then they’re gonna be recording, then the other side go into inventory, and then right, there’s more, and then they made the sale to the outsider. So how do we boil this down? How does the intercompany boil down to just this right? We kind of kind of have an idea of that in our mind.

So we could do this as easily as possible. So if we if we start to think about this in terms of just the calculation and then we’ll look at journal entries for Well, when there was a sale that from P to s, let’s say these are the numbers the sale from P to s was sales price 400. The cost was 250 of the gross profit is 150, which is 38% gross margin which is 150. divided by 400. So then what happens is we said that s sells the inventory, meaning SK is now selling it to an outside party. So this is the legitimate sale, you know, like a, like an arm’s length transaction. This is this is not. So now we got they’re gonna have 500 cash, or sales price cost 400 gross profit is going to be 100 or 20% of their sales price. We’re going to be talking about the scenario from the sale from P to s to an outsider. So parent sales to the subsidiary, subsidiary sales to an outsider from S to the outsider, that’s an arm’s length transaction from P to s.

02:41

That’s not an arm’s length transaction and we basically you know, need to make an elimination entry for that. Now you can think about this you can think but there’s a kind of a lot going on here. When you think about this you’re like okay, well when P sold the s right you got debit to like let’s say cash credit to credit to sales, debit to cost of goods sold credit to inventory. And then the subsidiary would have debited inventory and credited and credited cash. And then you had the subsidiary made the sale, which mean when they made the sale, they must have debited cash and credited sales debited the cost of goods sold and credited until a lot, there’s a lot going on. And when we boil this down, however, we’re not going to reverse the whole thing. We’re basically going to boil this down to as easily as we can think about it as possible, which will, in essence, be this transaction, we’re going to reduce revenue, revenue will be reduced debit in revenue and crediting the cost of goods sold. So remember, as we do this, we’re saying that the inventory was sold, it’s no longer on the books. And we’re kind of boiling down this intercompany process. We’re not reversing all the intercompany transactions, you could think Well, why don’t we reverse all the intercompany transactions and then record it properly as if it was the sale to the outside party? We could do that. It would take a long time to do that. So what we want to do is think about the process and how can we boil it down to its simplest format. So let’s think about this in terms of just like a calculation first. So let’s say that P sold the s, what happens? The sales price, let’s say it’s 400, cost 250, gross profit, then it’s going to be the 150. That’s going to be the difference. And then what’s going to happen, and I’m not going to record I’m not going to show what happens on SS books, what’s going to happen on SS books at that point in time, is they’re going to increase their inventory, and they’re going to they’re going to pay cash for it. We’re just looking at the sales transactions here. So then we’re gonna say, all right, then s when s sells it to the outsider, they’re going to say sales are going to up by 500.

04:39

Now, so they sold it for 500. And the cost of goods sold is going to be 400, which represents the price that s bought it from P from so and then the difference, there’s going to be the 100. So if we were to add those up, then you’d say all right, well, if I add those up, the 400 and the 500 means there’s 900 here of sales price. And then the cost of goods sold is going to be the 250 and the 400 for the 650. So you can see that’s not correct, that’s going to be basically overstated. Due to this basically intercompany transaction. Now this transaction is legitimate to the extent that it went to an outside party. However, it’s not completely correct. So how can we fix this thing? Well, if you think about this, you can see the green items, these are the ones we want to keep, we want to keep the cost of goods sold for us. And we want to keep the keep peace cost of goods sold, and sales price. So in other words, when it went from P to s, the cost of goods sold here is actually correct, because this was the original cost of goods sold that between the two entities it was purchased for, and then when it was sold, we want the sales price, the sales price that was sold from S to an outsider, whatever we got from the outsider, someone not related is an arm’s length transaction. So this 500 is legit amount, this intercompany transaction, then the 400 just went to ourselves. So at the end of the day, we want the sales price to be 500. The amount we got from someone outside the organization and the cost the original cost to the to the entire entity, which would be the 250. For a gross profit of the 250, we’re going to be removing the yellow, which is going to be P sales and SS cost of goods sold, because p sales simply went from, you know, selling to an intercompany transaction. And then the cost of goods sold for s when s sold the cost of goods sold their cost of goods sold represents the amount they purchased it from from P. So what we need is to know what p purchased it from because that’s going to be the original amount. So from a you know sales minus cost of goods sold standpoint, this is what it looks like. Now if we look at the journal entries, it gets even a little bit more complex here because you’re saying Alright, if I look at the journal entry though, if we say p two s one What’s gonna happen, you’re going to debit let’s say cash or accounts receivable, credit sales for 400. And then you got the cost of goods sold, and the inventory involved. So notice here when we think about the journal entry, we’re now we’re considering the other components inventory, and cash in our in our calculation.

07:19

Now, of course, when when you then have when you look at S, what’s going to happen with S, they’re going to debit inventory for the 400, and credit cash. So we’ll take a look at that in a second. I don’t have that here now. But then when s sells it, they’re going to debit cash for the 500 credit the sales for the 500 debit cost of goods sold, and credit the inventory for the 400. So if you were to add those up, again, from just the two journal entries, if I ended up cash in the cash sale, sales and so on, you get cash 900 sales 900 Cost of Goods Sold 650 inventory 650. Again, this is a little distorted and I’ll show a better example of this. Because we’re not taking into consideration SS calculation of the purchase of the inventory. But again, you can see this, this has a problem to it. And the question is, well, how am I going to reverse this thing? What’s the reversing entry going to look like? And you might say, well, I should reverse this entire thing. And I should reverse this entire thing because both of them aren’t quite right and the basically the inventory transaction and then put it on the books in the proper transaction, which would be, you know, a debit to, to cash, ultimately, the 500, and a credit of the sales of the 500, and then a debit to cost of goods sold of the 250 and credit to inventory the 250. Right, I could reverse the whole thing. And then and then record it properly. But you know, that will take too long for us to do in a reversing entry. So in essence, this is going to boil down to something that looks like this revenue, debit 400 and we’re going to credit cost of goods sold. Now I’m going to look at a small example here and then we’ll try to put together a systematic way to do this when we do the long run kind of problems. So let’s think about this in just a small example. And to do that, let’s imagine that we’re not even two companies. Let’s imagine we’re going to record like a sale to ourselves in the same company and just see what’s what’s going to be the distortion in the books if we, if we say yeah, I sold something to myself, and then I purchased myself and then I recorded myself paying myself and, and recording the inventory. So let’s say p sales to s and we’re representing the company we are P and S here, okay, so si p sells the s what would happen? debit cash, credit sales, debit Cost of Goods Sold credit inventory, so cash goes up by the 400. Sales goes up by the 400. Cost of Goods Sold goes up by the 250. Inventory goes up by the 250 net effect on net assets 150 increase, this is an increase, not a loss. This is the 400 sales price minus the cost of goods sold of the 150. Then we’re going to say And I’m going to record on my same books, I’m going to pay myself for the inventory that I bought. And then I’m going to record the inventory now at the inflated amount of the $400, rather than the 100. So now I’m going to say all right now i’d paid myself so cash goes back down to zero.

10:16

So cash goes back down to zero, because this is netting out here, we paid ourselves for the inventory, which is and what happened with the inventory, we put it on the books for the 100 or the 400. And it originally was 250. So the net effect here being the 400 minus the 250 is now inventory is overstated. So at this point in time, if we made a sale to ourselves, what would be the net effect? Well, we would have an inventory would then be overstated. The sales are overstated by the 400. And the cost of goods sold is overstated by the 250. That’s that’s the net effect and notice we haven’t made the signal Yep, the inventory is still on the books here. So now we’re going to record as selling to the outsider, which is the arm’s length transaction, the actual legitimate sale, we’re going to record this. Basically, it’s the same set of books again here. So we’re going to say, All right, now they’re still to the outsider for $500. So cash goes up by the 500. Sale happens have the $500, then and that that’s basically legitimate now, right, because we got this money from someone outside, this is not someone inside the organization. So the cash that actually was received was the 500. And then the sale is going to be the 500, which again, legitimate because this is something outside the cost of goods sold, however, is not correct, because we got the cost of goods sold for the 400, which is what it was purchased for, and then the inventory going down by the 400. So if we record this out, then here’s the net effect of cash and on all the transactions we’ve done thus far, the net effect on the inventory, the sales and the cost of goods sold. So if we consider this now We’re going to say all right, well, basically here the cash from the original sale from P to s the intercompany transaction nets out to the cash down here the cash that was recorded on you know by s with cash we sold to ourselves and then the actual cash that was received when we sold it outside is legitimate.

12:19

So that 500 it all nets out. It’s it that looks good, right right there. So then we’re going to say the inventory is at the is at the 250. So the inventory we could see that we originally sold it intercompany the 250 to the intercompany. And this was the legit inventory right here at the 250. Right when we did the intercompany sale. Then we had the inventory recorded on the books by P for the intercompany sale would at 400. The 400 it’s not correct right the 400 is too high because it was an intercompany sale should be on the books at the 250 but this this inventory here nets out against the inventory was sold when they actually sell it at the end of the day, which means that this 250 is actually correct, because if they sold it at the end of the day, then the net effect on the inventory will be basically the purchase price, the original purchase price. So cash is correct inventory is correct. However, the sale is overstated. So if we think about the sales, what happened is we had the 400 sales over here. And then we had the intercompany sale as well of the 500, which is going to be that 900. So the sale is overstated. What does it need to be we want it to be that 500 here, and the cost of goods sold is going to be overstated. So this is overstated, and the cost of goods sold is overstated, because we had the 250 here, and then we have the 400 for the 650. What do we want the cost of goods sold to be we want the cost of goods sold to be this 250. So we need to basically bring the cost of goods sold to the 250 from the six From the 650, and we need to bring the sale to the proper amount, which is going to be the 500. So at the end of the day, you can see all this, all this activity basically happened, you might say, well, to reverse this, I can reverse basically this entire thing, right, I can reverse the intercompany transaction and then record the sale properly, which would be a debit to cash of 500, and credit to sales, and then a debit to cost of goods sold of the 250 credit to inventory.

14:27

So you could reverse the entire thing and then do that. Or you could just adjust these two accounts, which in essence, is just this adjustment, debit in sales for the 400 and credit the cost of goods sold. So that’s of course what we’re going to end up doing here. We’re going to end up doing this basically elimination entry. So at the end of the day, then if we did this elimination entry, we’re going to say all right, so sales, this is going to be the elimination column, we’re going to debit the 400 for the the sales item, bringing us down to the 500 For 500, which is the actual sales amount to the 500 to the outside party, and then the cost of goods sold, were going to be taken down by the 400. So there’s going to be the 400. That’ll bring us down to the 250. So we basically brought it down by the you know, the entire intercompany sales amount here to sales and cost of goods sold. And that basically works out because at the end of the day now, now we’ve got the $500. So the 500 is is what was sold to the outside and the the cost, the internal cost, your original internal cost was that 250 that was purchased by P so that means that we’re left with at the end of the day what we want basically as we saw and you know at the beginning of this or in a prior presentation is basically to eliminate here or be left with in essence, the the sale to the outside the sales half is correct. This is our normal sales journal entry. The sales half is correct cash going up by 500 sales going up by 500 But then the cost of goods sold side of the transaction for the intercompany sale, which has the original cost of goods sold, debit the 250 credit inventory. So again, you could think about this as well, this elimination entry should have been eliminating this entire thing, right? eliminate all this just reverse the entire thing and then record this, right, you could think to do that, or you can boil this thing down, and basically get to this transaction, debit sales 400 and credit the cost of goods sold 400