Corporate Finance PowerPoint presentation. In this presentation we will discuss the percent of sales method, the percent of sales method been a tool that can help us with our projections out into the future help us to think about where we will stand, think about what our balance sheet accounts will be in the future. If we, if we estimate some type of growth into the future also help us to determine whether or not we may need additional funding to support our growth plans that we have set in place. Get ready, it’s time to take your chance with corporate finance percent of sales method. Now this method can be a little bit confusing when you first look at it in the calculation or formula for it can be a little bit intimidating as well, I highly recommend to get a better understanding of this formula and how to apply it to go through the practice problems, we will have practice problems related to this formula in terms of Excel problems, as well as working through the practice problems and presentations in one note.

Posts with the long term liabilities tag

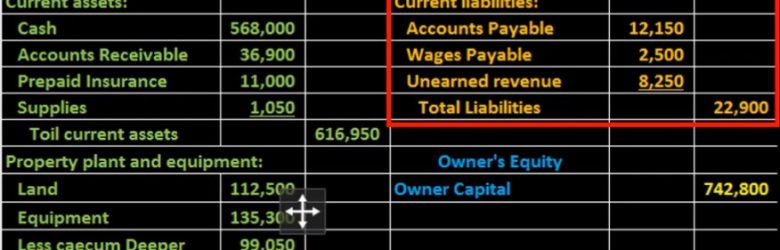

Balance Sheet Liability Section Creation From Trial Balance 14

Hello in this lecture we’re going to create the liability section of the balance sheet. In prior lectures, we have taken a look at the assets in terms of first current assets and then property, plant and equipment and given us the total assets at that time, then we are now going to move on to liabilities, and that will be part of the second part of the balance sheet meaning it’ll then sum up to total liabilities and owner’s equity. We are going to be taking this information of course from the adjusted trial balance the adjusted trial balance in the format of debits and credits, we are now formatting it in the format of the accounting equation. Still the double entry accounting system just in two different formats, just reshuffling the puzzles so that different readers can understand the financial statements even though they don’t understand debits and credits.

Purchase Equipment with Debt 8.77

In this presentation, we’re going to purchase equipment with debt. In other words, we’re going to purchase equipment and finance the entire thing. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Let’s first start off by opening up our reports this time. So I’m going to go down to the reports down below, we’re going to be opening up our favorite report that being the balance sheet report. So let’s open up the balance sheet. Going to change the dates up top those from a 10120 to 1230 120 January through December 2020.

Consolidate Loans 8.02

This presentation and we’re going to consolidate two loans and reflect that in our bookkeeping. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to start off by going to our reports down below and taking a look at the balance sheet, we’re going to be opening up our balance sheet report to consider the loans that we currently have on the book. I’m going to scroll back up top, we’re going to change the dates up top from a one a 120 to 1231 to zero, and then we will run that report. I’m going to then duplicate the tab up top.