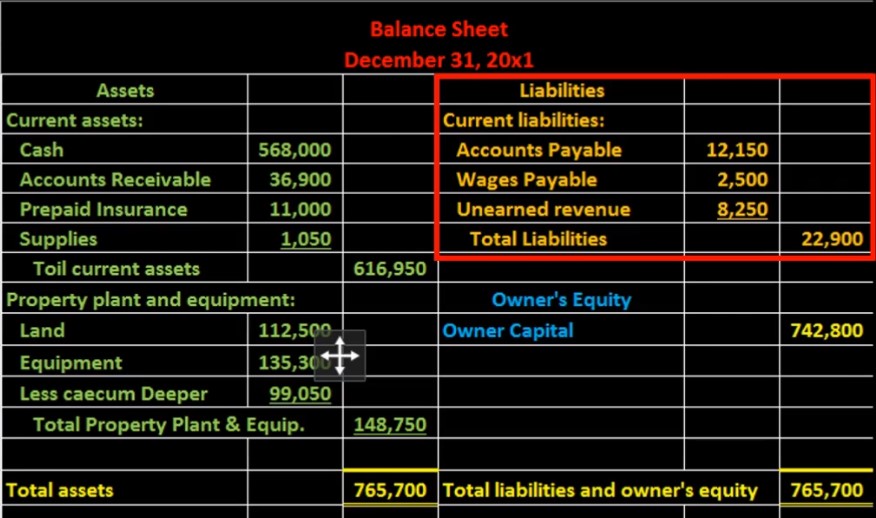

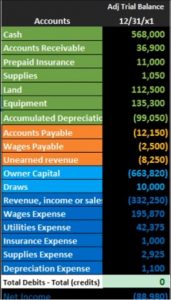

Hello in this lecture we’re going to create the liability section of the balance sheet. In prior lectures, we have taken a look at the assets in terms of first current assets and then property, plant and equipment and given us the total assets at that time, then we are now going to move on to liabilities, and that will be part of the second part of the balance sheet meaning it’ll then sum up to total liabilities and owner’s equity. We are going to be taking this information of course from the adjusted trial balance the adjusted trial balance in the format of debits and credits, we are now formatting it in the format of the accounting equation. Still the double entry accounting system just in two different formats, just reshuffling the puzzles so that different readers can understand the financial statements even though they don’t understand debits and credits.

00:47

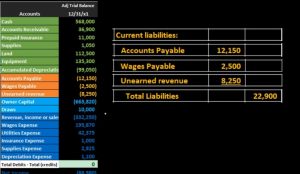

We will then be focusing in on the liabilities the orange accounts here. We will start off with the subcategory of liabilities, that is current liabilities, those are going to be liabilities that will be due within a year’s time. periods we have to pay something or do some work within that year’s time period. That is what makes it current. They use time is basically an arbitrary number. The idea of it is that we want to know what’s going to be due shortly. So that we know that we have the assets, hopefully the current assets that will be liquid enough to pay off those current liabilities. That’s the idea of breaking out the liabilities between short term liabilities, current liabilities, and long term liabilities, those that will be due past a year’s time period. Notice that we have the colon here that it is representing that it is the subcategory, and then we’re just going to pull in our numbers. So we have the current we have the accounts payable, we’re just pulling that number in. Note that the credit is represented on our trial balance in terms of brackets.

01:43

But when we pull that into our financial statements, no brackets, we’re not having debits and credits, we’re putting it on the inner column and not because it’s a debit or credit, but because we’re just going to list it out there. So we’re converting from debits and credits to a plus and minus format. And so we’re just adding up the lives abilities and putting it in plus and minus, we are going to pull over the wages payable, same thing, this number, we’re just pulling that over. And then the unearned revenue, we are pulling that over note that we are indenting these, and then we will put the total in the right hand side. So we’re going to say the 12,001 50 plus the 2500 plus the 1002 50 gives us that 22,900. Note that we have total liabilities here, rather than having total current liabilities. Why is that? Because we don’t have any long term liabilities. So rather than us having total current liabilities, and then saying we don’t have any long term liabilities, we’re just going to say, Hey, this is going to be the subcategory of current liabilities. And then that includes all liabilities including current and non current.

02:46

If we had long term liabilities, we would then have a total current liabilities subcategory, and then we would be lifting out the loan term liabilities and have a subcategory for those so that can be a bit confusing when we don’t have Any long term liability so keep that in mind. If we plug that back into the balance sheet we now have the liability section we have created the current assets, the property plant equipment, we have the total assets, then we have the liabilities we now will be moving to the owner’s capital section, the owner’s equity section, and that will then give us the total liabilities and equity finishing out the balance sheet and then we’ll dive into some more detail about this number in the capital account.