QuickBooks Online 2021 short term investment sale, including the recording of the gain or loss related to the sale of the short term investment. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our great guitars practice file, we’re going to be opening up our financial statements that being the balance sheet and income statement. So let’s go up top and duplicate our tabs to start off right clicking on the tab, duplicate the tab, we’re going to right click on the tab again, duplicate the tab.

Posts with the normal tag

Profit & Loss, P&L, Income Statement Overview 3.10

QuickBooks Online 2021 Profit and Loss P and L income statement overview. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive practice file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in Craig’s design and landscaping services practice file, we’re going to go into the profit and loss or income statement by going to the reports down below, we’re going to be opening up the standard profit and loss which should be in your favorites because it is a favorite report, profit and loss report, otherwise known as an income statement, sometimes called or referred to, in short as the P and L,

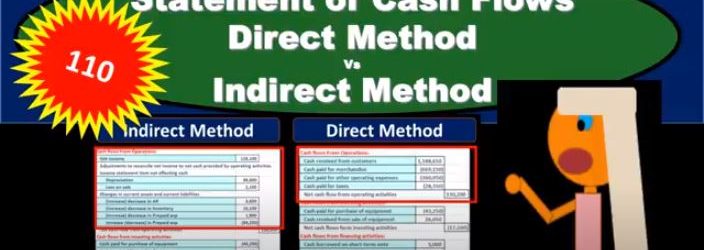

Statement of Cash Flows Direct Method Vs Indirect Method

In this presentation, we will compare and contrast the direct method versus the indirect method for the statement of cash flows. It’s important to note that when we’re comparing the direct and indirect methods, we’re really only talking about the top part, the operating activities portion of the statement of cash flows. In other words, the investing activities and financing activities and in result will remain the same, we’re going to end up with the same result, which of course, will be the Indian cash that we can tie out to the balance sheet. And we’ll have the change of cash here, which is really kind of the what we’re looking for in the statement of cash flows. What’s going to differ is the operating activities, why are they going to differ? Why would we have the operating activities differ? Remember that the operating activities have to do with kind of the income statement you can think of it basically as the income statement being reformatted to a cash flow statement versus an accrual statement. So the income statement that we use is on an accrual basis, and we recognize that Revenue when it’s earned rather than when cash is received expenses when expenses are incurred rather than when cash is paid, that’s gonna be on an accrual basis.