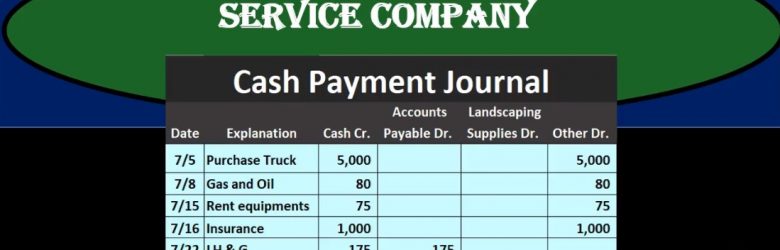

In this presentation, we will take a look at a cash payments journal for a service company, the cash payment journal we’ll be dealing with transactions where we have cash payments, that’s going to be the factor that will be the same for all transactions with cash payments meaning this column here cash payments will always be affected wish they kept cash payments journal cash payments journal will be used when using more of a manual system rather than an automated system. However, it’s good to know what the cash payments journal is, even if using an automated system because it’s possible that we or it’s very likely that we would need to run reports that will be similar in format to a cash payments journal. And it’s useful to see this format or how different types of accounting structures can be built.

Posts with the payment tag

Accounts Receivable Transactions – Accounting Equation 167

Hello in this presentation we will record transactions related to accounts receivable recording the transactions using the double entry accounting system in the format of the accounting equation that equation of assets equal liabilities plus equity objectives at the end of this we will be able to list at transactions involving accounts receivable and record transactions involving accounts receivable using the accounting equation. We will go through some examples of the accounting equation and recording transactions related to accounts receivable quick review of the accounting equation we have assets equal liabilities plus equity as the accounting equation. We then need to start memorizing those accounts that fit into those subcategories of assets, liabilities and equity.

Accrued Interest Reversing Entry 10.25

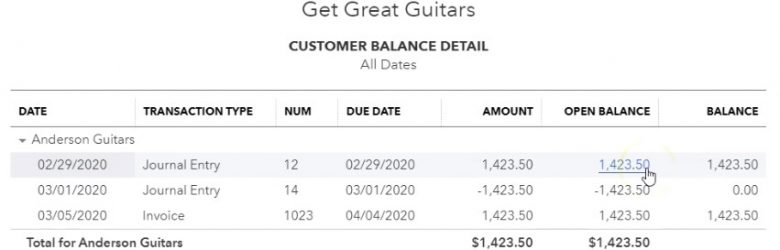

This presentation and we’re going to enter a reversing entry related to accrued interest. Let’s get into it within two, it’s QuickBooks Online. Here we are in our get great guitars file, we’re going to go down to the reports on the left hand side, we’re going to be opening up this time the trusty trial balance, we’re going to be typing in up top to find the trial balance the trial balance, and then we’ll find it and then I’m going to open that up. Then we’re going to change the dates up top, we’re going to change the dates from Oh 1120 to 202 29 to zero.

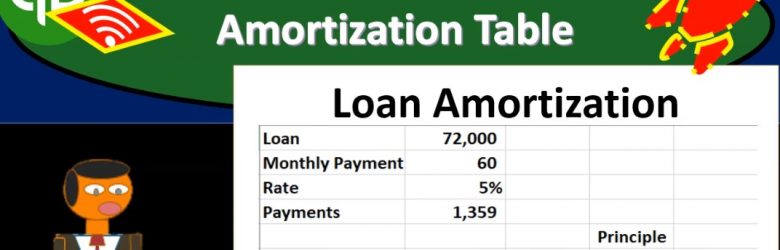

Loan Amortization Table 8.03

This presentation and we’re going to create a loan amortization table. And this will help us to track our loan payments and break out the principal portion and the interest portion of them. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to first start off with our reports, we’re gonna go down to the reports down on the left hand side and then we’re going to be opening up our favorite report that being the balance sheet report, opening up the balance sheet report scrolling up top, we’re going to be changing the dates from a 10120 to 1230 120. Then we’re going to run that report. Then I’m going to close up the hamburger to get it out of the way so I don’t doesn’t bother me and I’ve got the 125 on the zoom holding down control scrolling up to get there.