QuickBooks Online 2021 purchase and finance equipment and add sub accounts. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re going to be opening up a few reports up top balance sheet income statement trial balance,

Posts with the purchasing tag

Purchase Order & New Inventory Item 8.15

QuickBooks Online 2021 purchase order and new inventory item. In other words, we’re going to add a new inventory item as we create a purchase order. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re going to be entering a purchase order as we do so we’re going to add a new inventory item and add a new vendor.

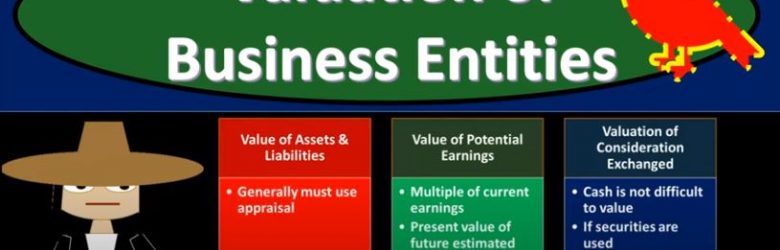

Valuation of Business Entities

In this presentation we’re going to talk about valuation of business entities when there’s going to be an external expansion. In other words, a merger or consolidation, get ready to act because it’s time to account with advanced financial accounting. We’re continuing on with our discussion of external expansion. That means we’re have two separate entities that are going to be combining in some way shape or form. The two types that we want to keep in mind at this point is the acquisition of assets and the acquisition of stocks. So if the acquisition of assets we have one company acquired another assets using negotiation with management, so that means you have two separate entities and one entity is basically going to be purchasing the assets of the other entity versus the acquisition of stock, where we have a majority of outstanding voting shares is generally required, unless other factors result in the gaining of control. So in other words, you have two entities, one entity in essence buying a controlling share or controlling ownership over 50% typically 51 and above. Have another entity. So from an accounting perspective, then the question is, well, how are we going to value the assets and liabilities. Now when we think about the assets and liabilities, we may have to use an appraisal oftentimes, in order to do so because remember, if you’re talking about some assets, they might may be on a fair value method, because you might be talking about cash or something like that, or possibly stocks or investments in that way, that may be easy to value with a market method. However, if you’re talking about things like property, plant and equipment, then it’s going to be more difficult to know what the value is. That’s the problem because there hasn’t been a market transaction for that exact same piece of equipment for some time.

Inventory Costs

In this presentation we will discuss what will be included or should be included in inventory costs. So when considering inventory cost, clearly we have the cost of the inventory which would be included. But there are other components that we want to keep aware of. And keep in mind that could be included in the cost of inventory as we record that inventory cost that purchase price or the amount in dollars of inventory on the financial statements. One is going to be Do we have to pay for the shipping costs and that typically will have to do with the terms of fo B shipping point, or fob destination is going to be a common question that is asked and a common factor in practice that we need to consider.