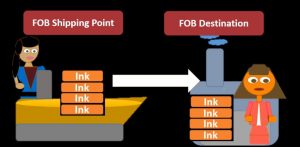

In this presentation we will discuss what will be included or should be included in inventory costs. So when considering inventory cost, clearly we have the cost of the inventory which would be included. But there are other components that we want to keep aware of. And keep in mind that could be included in the cost of inventory as we record that inventory cost that purchase price or the amount in dollars of inventory on the financial statements. One is going to be Do we have to pay for the shipping costs and that typically will have to do with the terms of fo B shipping point, or fob destination is going to be a common question that is asked and a common factor in practice that we need to consider.

00:45

If we’re saying that something is F ob shipping point free onboard shipping point, then we’re saying that the inventory is trading hands and is the responsibility of the person purchasing or the company purchasing at the point in time. time that it is being shipped And typically, then the person purchasing would be in charge of the shipping costs to get to the point of destination or warehouse. If that is the case, if we’re paying for the shipping costs in order to get the inventory in place, it’s the same kind of circumstances as if we are purchasing a property, plant and equipment in that we need to include those costs into the cost of the inventory as we would to the cost of property, plant and equipment. If we were purchasing property, plant and equipment, anything that we had to pay for the cost of basically getting that inventory to us and ready and prepared for the sale should be a cost that is part of the inventory.

01:45

If on the other hand, we’re saying it’s fo B destination, then typically the person purchasing or the company purchasing is not responsible for the shipping costs and therefore it’s not an issue. A typical question however on it on Amazon multiple choice question will be on the shipping cost. How do you record the shipping costs? And one of the answers will typically be, you’re going to record shipping costs at freight expense, and the other would be that you’re going to record it as the cost of the inventory. And freight or shipping expense sounds really correct. If you paid for the freight, however you paid for the freight in order to get the inventory which has not yet been sold. And in accordance with the matching principle, then we can’t record the expense or should not record it. Until we have used that cost in order to help generate revenue.

02:34

We hadn’t used the cost yet. In order to help generate revenue. We only use it in order to acquire an asset inventory, which we will then use to generate revenue in the future and then expense that shipping costs as part of the cost of the inventory in the form of the expense of cost of goods sold. consignment is another thing we want to keep in mind we might get a couple questions on consignment and certain times next event industries would benefit from this kind of arrangement. So a consignment would mean for example, if we had someone that had a farm and they were producing wine, then they could sell that wine, of course, to something like a restaurant directly, the restaurant then paying for the wine, and then selling that wine to their customers. If that’s the case, then the producer of the wine would record revenue at the point of sale. However, it is possible to have a different type of arrangement, it is possible for our producer to go to the restaurant and say, Hey, I would like to sell the wine here. If you if you sell it great.

03:37

You can pay me at that point in time. If you don’t sell it, then that’s okay. We won’t charge you for it at that point in time. And if that’s the case, then we’re saying that we’re only going to have the wine in other words, the wine although it’s located at the restaurant, is still the inventory or the property of the owner of the wine the producer in this case The wine and the restaurant is just there to provide the sale and at the point of sale as they sell the wine, then they would take some of that take you know a cut of that and give the difference to the consign or so in this case we’re saying the wine producer is the consign or giving the wine to the restaurant, and the restaurant has possession of the wine. However, it’s not the restaurants inventory, and that’s the key points here.

04:29

The inventory, although it’s located at the restaurant would be the inventory of the consign or the producer in this case of the wine. The consignee is just going to be holding on to the wine and at the point of sale typically will get some type of payment of course for the service of the sale transaction and give the consign or that the revenues for the sale of the wine as well. Next we have the discount the purchasing discount Now note, this also often gets confused in terms of what is the purchasing discount between the sales discount, what if we’re the owner and we’re purchasing the merchandise that we are later going to sell, then the vendor that’s giving us the merchandise could give us a discount, and the terms might look something like this to slash 10 in dash 30, meaning we’re going to get a 2% discount if we pay within the discount period 10 days, otherwise, we need to pay within 30 days. If we do take that discount, if we get the discounted amount, then that’s going to affect the inventory meaning if this was the sticker price, and that’s what we were going to pay but we get a 2% discount, we have to then decrease the inventory of course by the amount that we actually paid for the inventory.

05:43

So we need to keep that in mind to to reduce the inventory for that discount. When we record that it can be a little bit confusing because students often get we often get mixed up when we have a sale discount and a purchase discount. The purchase discount will reduce the inventory sales discount, the discount will go to sales returns and allowances. So this is a common question common multiple choice will ask about the discount and the journal entry related to it. And it’s a common mistake that will happen that we don’t, we often miss the fact that we need to reduce the inventory by the amount of the discount. Some other costs that we need to consider would be tariffs. If we have terrorists, we’re going to consider those in terms of the cost of inventory if it’s related to our inventory, purchase, storage, also something that’s going to help us to get the inventory ready for the point of sale and therefore a cost of the inventory, insurance on the inventory.

06:39

Again, something that’s necessary for us to get that inventory and get it ready for sale. Therefore, it is a cost of the inventory. If we have damaged or obsolete inventory, then we’re going to have to go through kind of a thought process and say, Well, what happened to the inventory? What are we going to do with it? So it would look something like this, we can say Can the inventory be sold? If it was damaged inventory? Or if it’s obsolete in some way? Is it still something that is sellable? If we say that it is sellable, then we’re still going to include it in inventory. But at a reduced price, we’re going to use what they call a conservative in principle, conservative principle, meaning we don’t want to overstate our books, we want to we want to make sure that we’re basically recording at the lower price to rely realizable price realizable price that we couldn’t get on the market to sell that inventory. If it cannot be sold, then we’re going to have to not include it in inventory, we’re gonna have to write off the loss at the point of time that has been determined that the inventory cannot be sold.

07:43

Note that this is a huge component, all these are huge components, but this one in particular is a huge component to inventory. This idea of the conservatism principle because note that we typically record the inventory as most assets are the cost of inventory. And if the inventory is damaged or goes down, then that could be one something that’s not as easy to determine. And to. Obviously the company doesn’t really like the idea of having their inventory be marked down and may not have the best method or know exactly what the realizable price for the inventory that is obsolete or damaged would be. And it could be a significant factor on the financial statements to have these this inventory be written down to the appropriate price, whatever that net realizable value is