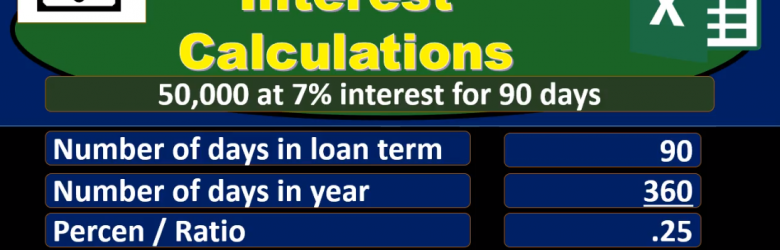

In this presentation, we will take a look at how to calculate simple interest a few different ways. As we look at this, you may ask yourself, why are we going over this a few different ways, why not just go over it one way, the best way. And let us learn that well and be able to apply it in each situation. While one way does work in most situations. In other words, we will probably learn one way have a favorite way to calculate the simple interest and apply that in every circumstance. It’s also the case that when we look at other people’s calculations or technical calculation, they may have some different form of the calculation. For example, I prefer away when I think about the calculation of simple interest to have some subtotals in the calculation and have more of a vertical type of calculation the way we would see if done in something like a calculator. If we see a type of equation in a book, then the idea there is that Have the most simple type of equation expressed in as short a way as possible. And that typically is going to be some type of formula. And that formula will often not be showing the subtotal.

Posts with the remember tag

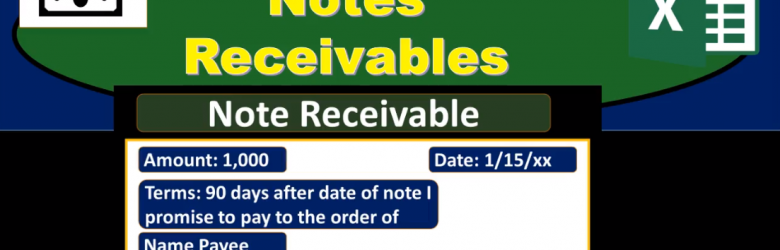

Notes Receivable

In this presentation, we will take a look at notes receivable. We’re first going to consider the components of the notes receivable. And then we’ll take a look at the calculation of maturity and some interest calculations. When we look at the notes receivable, it’s important to remember that there are two components two people, two parties, at least to the note, that seems obvious. And in practice, it’s pretty clear who the two people are and what the note is and what the two people involved in the note our doing. However, when we’re writing the notes, or just looking at the notes as a third party that’s considering the note that has been documented. Or if we’re taking a look at a book problem, it’s a little bit more confusing to know which of the two parties are we talking about who’s making the note who is going to be paid at the end of the note time period? We’re considering a note receivable here, meaning we’re considering ourselves to be the business who is going to be receiving money. into the time period, meaning the customer is making a promise, the customer is in essence, we’re thinking of making a note in order to generate that promise, that will then be a promise to pay us in the future.