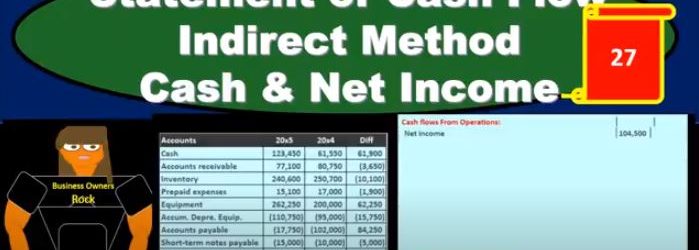

This presentation, we will start to construct the statement of cash flows using the indirect method focusing in on cash and net income. This is going to be the resources we will have, we’ll have that comparative balance sheet, the income statement, and we’re gonna have some added information. In order to construct the statement of cash flows, we’re mainly going to be working with a worksheet that we’ve put together from a comparative balance sheet. That’s where we will start. So we’re going to find a home, this is going to be our worksheet. We have the two periods. So we have the current year, we’ve got the prior year, and we’ve got the difference between those activities. Now our goal here is to basically just find a home for every component on this difference section. So that’s going to be our home. Why? Well, we can first start thinking about cash. What are we going to do with cash? That’s the main thing. This is a statement of cash flows here. So where are we going to put cash? that’s actually going to start at the bottom, we’re going to say that’s going to be our in numbers. In number we know it’s going to be cached. Now, we’re going to recalculate it. But it’s useful for us to just know and we might just want to put there, hey, that’s where we’re going to end up. That’s where we are looking to get. And now what we really want is the change.

Posts with the represented tag

First In First Out FIFO Explained

Hello in this lecture we’re going to be taking a look at first in first out inventory method, we will be selling coffee mugs and we won’t be specifically identifying the coffee mugs. In this case, as we’ve talked about in a prior lecture of this time, we’re going to be using a cost flow assumption VAT cost flow assumption being the first in first out assumption this time to set up this problem in any cost flow assumption, I highly recommend putting together a worksheet that worksheet including headers of purchases columns, and then we got the cost of merchandise columns, then we have the ending inventory. I highly recommend setting up a worksheet like this, whether it’s by hand or in a computer or in Excel because it answers all the types of questions that could come up with an inventory cost flow type of assumption within those sections, we will then have the quantity and then the unit cost and the total cost we’re gonna have, if we sell something, we’re calculating the cost of that sale.

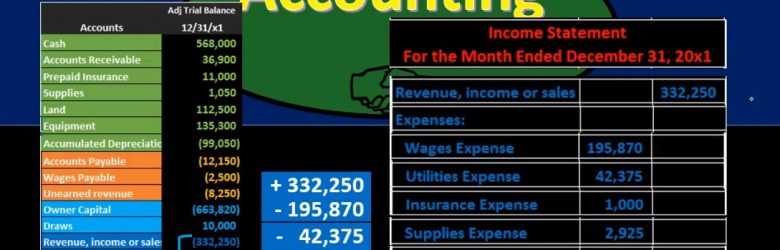

Income Statement from Trial Balance 16

Hello in this presentation we’re going to take a look at the creation of the income statement from the trial balance. First, we want to take a look at the trial balance and consider where the income statement accounts will be. When looking at the trial balance, it will be in order we have the assets in green, the liabilities in orange, the equity in light blue, and then the income statement accounts including revenue and expenses. That’s what we are concentrating here we’re looking at those income statement accounts. And that is what will be used in order to create the financial statements to create the income statement. Note that all the blue accounts represents the equity section. So the income statement really is going to be part of total equity. If we consider that on the balance sheet, then we’re really looking at a component of this capital account.