Posts with the Robert Steele CPA tag

One Rule for Increasing and Decreasing an Account Balances

Once we understand the normal balance of an account, represented by the image below, there is only one rule we need to know to make an account go up or down.

The rule to make an account balance go up or down is: do the same to go up and opposite to go down.

The rule of, do the same to go up and opposite to go down, may seem abstract at first but once we have the normal balance cheat sheet above it is easy to apply. The one rule means that an account with a normal debit balance will be increased by another debit because a debit is the same thing as the normal account balance and an account with a normal credit balance will be increased by a credit because a credit is the same thing as the normal account balance. Conversely, an account with a normal debit balance will be decreased by a credit because a credit is the opposite thing as the normal account balance and an account with a normal credit balance will be decreased by a debit because a debit is the opposite thing as the normal account balance.

Like most thing, the one rule is best learned through doing, by running through examples of transactions again and again.

Fortunately we have some examples of transactions here.

AICPA seeks input for new framework on valuation of financial instruments

The new guidance aims for clarity, consistency and transparency https://t.co/LxcrsEh7r6

— JournalofAccountancy (@AICPA_JofA) July 6, 2017

Companies grapple with leasing standard complications

Companies are starting to grapple with some of the unexpected complications of the new lease accounting standard. https://t.co/01Pd8OFucU

— Accounting Today (@AccountingToday) July 6, 2017

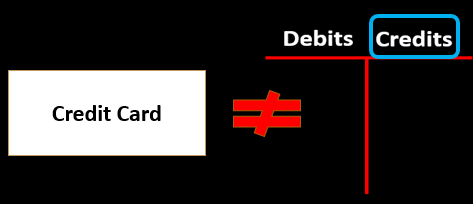

The True Meaning of Debits and Credits

Although learning how debits and credits work is not an easy process, learning the definitions of debits and credits is and easy process. Debit can be defined as “recorded on the left side” (John J. Wild, 2015) and credit can be defined as “recorded on the right side” (John J. Wild, 2015). Note that these are partial definitions of debits and credits from the text, Fundamentals of Accounting, Wild 22nd, but they are the important parts, the parts that define what debits and credits are, the rest of the definition explaining what debits and credit do.

The definition of debits as, recorded on the left, and credits as, recorded on the right, implies something to be recorded on, some kind of board, paper, account, or ledger. A T-account can be imagined as the board, or ledger, used to record debits and credits, the debits being recorded on the left, the credits being recorded on the right.

When thinking about debits and credits in the context of financial transactions, entering financial data, and creating financial statements the definition above is the only definition we should have in mind. It is difficult to limit our thoughts and definition of debits and credits to the amount recorded on the left or right side of a T account, or ledger, reducing all notions of debits and credits to no more placeholders, similar to the black and red pieces on the checker board. The black and red pieces on a checker board have no real meaning, the pieces in no way holding the rules, or idea, of the game of checkers, but when we see checker pieces we think of much more than black and red placeholders. We think of the game and how it works.

The same is true when we hear the terms, debit and credit, the terms often having a meaning to us which is so much more than the placeholders they actually are. The difference between how the concepts of debits and credits relate to accounting and how the concepts of checker pieces relate to the game of checkers is that most of us learned how to play the game of checkers while also learning the definition of what checker pieces are, but most of us have not fully learned the game of accounting, although we have heard the terms of accounting pieces used in many different contexts, the accounting pieces being debits and credits. The fact that we have learned terms related to debits and credits apart, or outside, of the accounting game leads to false, or incomplete, understandings of what the words mean.

When learning how to record accounting transactions, we need to get back to the core definitions, requiring us first to unlearn definitions we may have picked up in our lives, definitions which may not be complete. These definitions can be revisited and understood from a new perspective once we know how debits and credits are used to record transactions.

An example of the term credit being used in a misleading, or incomplete, way is when we think about credit cards, credit terms, or a bank increasing our account with a credit. These uses of the phrase credit are derived from the original meaning of the word, the definition of the amount on the right side, but have come to mean different things to different people. After we learn accounting transactions and see how debits and credits are used in them, we should revisit these terms to understand the origin and evolution of their meaning in different contexts.

An example of how life experiences can lead to an incomplete understanding the terms debit and credit is a bank agreeing to eliminate a charge on a customer’s balance by saying they will credit the customer’s account. This transaction causes the customer to think of the term credit as a good thing, an increase in their checking account balance. While the credit does represent an increase to the client balance the accounting definition of credit is an amount reported on the right side of a T account or ledger, the bank reporting an amount on the right side of their ledger. When we see the bank statement, we see the bank recording credits as an increase to our account balance but from the bank perspective increases to our account balance are not assets but liabilities, representing the bank owing money to the customers.

As we learn how to record debits and credits, the definition of debits and credits as just amounts recorded on the left and right side of a T account or ledger is another area we ask learners to have faith in the system, to trust that these simple definitions are correct. Having patience and holding back on spending too much time analyzing other preconceived definitions of debits and credits until after we have learned how to record transactions often helps prevent these preconceived definitions from slowing down the learning process. Once we understand the accounting game and how debits and credits are used to play it, we will be better equipped to fully understand any definitions we previously had about debits and credits and analyze how they line up and or fit within the definition of debits and credits.

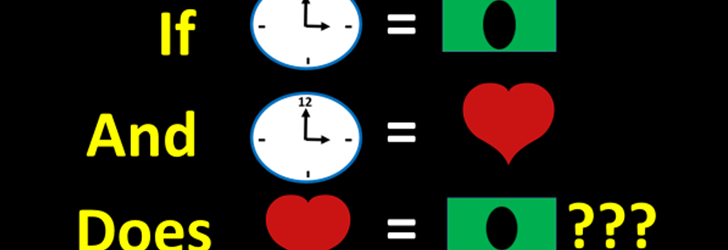

Time = Money, Time = Love, Love ≠ Money ???

I have never really questioned the saying, time is money until I started hearing time compared to other things, such as “time is love” by Josh Turner. If time is money and time is love, this will lead us to reason that love is money. Now I’m not saying that Josh Turner was implying that love is money, a song title of Love is Money probably needing to be moved to another genre of music to be successful, but why doesn’t this reasoning work?

How is it that time equaling money rings true but love equaling money does not?

The first step to this kind of problem is to drill down on some definitions, definitions often being something we take for granted, something we believe is fully understood until asked to define a term fully. For example, asking a professor of physics to define time may result in a very long response leaving us with more questions about time than answers, asking an economist to define money may result in a detailed discussion about what the traits of money are, and asking a poet to define love may result a few hours of poetry to illustrate the non-explainable. An attempt to define these terms, however, is where we will start.

What exactly are money, love, and time?

According to Merriam-Webster money, love, and time can be defined as:

- Money is something generally accepted as a medium of exchange, a measure of value, or means of payment.

- Love is a strong affection for another arising out of kinship or personal ties.

- Time is the measure or measurable period during which an action, process, or conditions exists or continues.

When asked why time equals money many of us would respond that both have value and are therefore at least similar, if not the same. Money is a measure of value according to our definition of money and time is a measurable period. The link between time and money may actually be that we need the concept of time to measure performance and money is a standard unit of measure. In other words, we cannot measure something like revenue without the concepts of time and some unit of measure, like money, because revenue is a measure over time.

When asked why money does not equal love, money not equaling love being a response I’m assuming most would give, many of us would respond that there is something about the concept of love that cannot be measured in the units of dollars. Maybe part of the reason for this is that there is not the same connection between love and time as there is between money and time, love not being something that can be accumulated over time in the same way that revenue can. In other words, it is difficult to measure performance over time using love as the unit of measure, although we do try and do this. For example, when analyzing somebody’s life, we may ask the question of whether she was well-loved as part of our analysis, part of our measure of her life.

From an economic perspective, love would not work well as money because, although love can be thought of as storing value, love, defined as a strong affection, is not a good medium of exchange, strong affection not being something we can trade for a loaf of bread.

In conclusion, although there are links between time, money, and love:

Time ≠ love ≠ money

but

Time = Money & Time = Love

may be useful phrases in normal conversation as long as we are careful to avoid insinuating the logical conclusion that of these statements, that

Love = Money

to avoid the conversation taking an unintended turn.

Overtime rule remains a concern to business leaders

Overtime rule remains a concern to business leaders (from @BaltBizOnline) https://t.co/UKYsMklzaY

— Bill Sheridan (@BillSheridan) July 3, 2017

https://lnkd.in/gSaubmv

https://lnkd.in/g3BY2N9

https://lnkd.in/e77p7eB