QuickBooks Online 2021 short term investment sale, including the recording of the gain or loss related to the sale of the short term investment. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our great guitars practice file, we’re going to be opening up our financial statements that being the balance sheet and income statement. So let’s go up top and duplicate our tabs to start off right clicking on the tab, duplicate the tab, we’re going to right click on the tab again, duplicate the tab.

Posts with the stocks tag

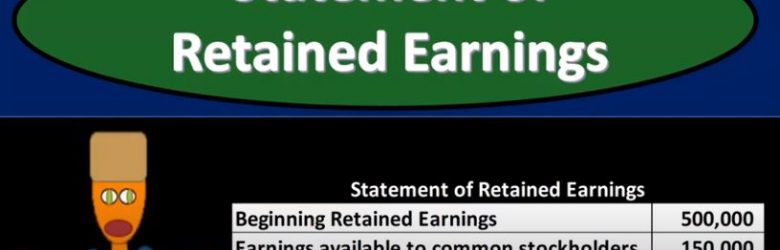

Statement of Retained Earnings 230

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the statement of retained earnings Get ready, it’s time to take your chance with corporate finance statement of retained earnings. So remember that as we think about the financial statements in total, the financial statements are basically answering questions that users of the financial statements would have. So for example, if we were thinking about investing into a company, the financial statements would help us answer the question as to how does the company stand at this point in time? How does the company look from a financial standpoint at this point, that is the balance sheet, the balance sheet gives you the assets, liabilities, equity, assets minus liabilities, being basically the book value being basically where the company stands at a point in time.

Types of Business Organizations 120

Corporate Finance PowerPoint presentation. In this presentation, we will discuss types of business organizations, including the corporation, partnership, and sole proprietorship Get ready, it’s time to take your chance with corporate finance types of business organizations. Now, as we go through here, note that we’re focusing in on corporate finance, and therefore on the corporate type of business organization, but many of the concepts that we will learn will be applicable to all types of business organizations. Therefore, we want to have a general idea of the different main kind of components or main types of business organizations. So those will include a sole proprietorship, partnership, and a corporation.

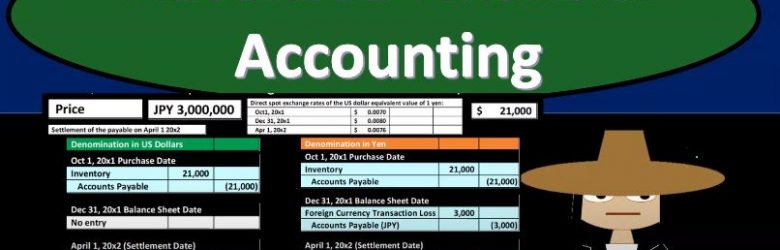

Foreign Currency Transactions

Advanced financial accounting PowerPoint presentation. In this presentation, we will discuss foreign currency transactions get ready to account with advanced financial accounting, foreign currency transactions. So remember when we’re thinking about foreign currency transactions, we’re thinking about them from the perspective of the US company in US dollar. So we’re have our currency that we’re making our financial statements in, we’re measuring all the stuff on our financial statements with the measuring tool that we need to be using, that’s going to be the US dollar, that’s going to be our standardization. And then anytime we have foreign currency transactions with something other than US dollars, then we want to see them from that perspective, right? Because when we put them on our financial statements, just like anything else, just like inventory, if we were to value units of inventory, or to value stocks and whatnot, we need to value them in terms of our measure into a which of course is the US dollar.

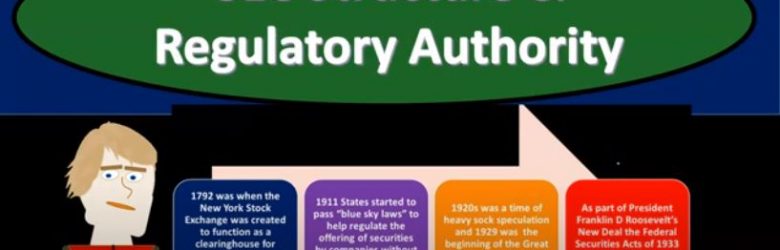

SEC Structure & Regulatory Authority

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss sec structure and Regulatory Authority get ready to account with advanced financial accounting in sec structure and regulatory authority, Securities and Exchange Commission the SEC What is it? It’s an independent federal agency It was created in 1934. It’s going to regulate and it does regulate the securities markets, the SEC helps maintain an effective marketplace for companies issuing securities and for investors seeking capital investments. Now we’ll take a look at a brief history of leading up to the creation of the SEC and a little bit about the SEC itself. So if we have an understanding of the history, then it gives us a little bit better of an understanding of why the SEC does what it does today and how it how it was created or came to be. So in 1792, was when the New York Stock Exchange was created to function as a clearing house. For the securities trades between its invit its investors. So now we have the New York Stock Exchange that will function as the clearing house. But then in 1911, states started to pass, quote, blue sky laws in quotes to help regulate the offerings of securities by companies without a solid financial base. So in other words, they saw a need for regulation, now that you have the securities that are on the New York Stock Exchange and can then be offered basically, to more to the public, more people will have access to purchasing them and putting capital into the market, then there’s a lack of transparency, the people that are putting money in maybe doing it solely on speculation, and we don’t have the information to really support the claims possibly that could be made by the stocks that are that are being traded and therefore, you could have situations and did have situations where you had stocks that had no supporting you know, value or very little supporting value to them.