Advanced financial accounting PowerPoint presentation. In this presentation, we will discuss foreign currency transactions get ready to account with advanced financial accounting, foreign currency transactions. So remember when we’re thinking about foreign currency transactions, we’re thinking about them from the perspective of the US company in US dollar. So we’re have our currency that we’re making our financial statements in, we’re measuring all the stuff on our financial statements with the measuring tool that we need to be using, that’s going to be the US dollar, that’s going to be our standardization. And then anytime we have foreign currency transactions with something other than US dollars, then we want to see them from that perspective, right? Because when we put them on our financial statements, just like anything else, just like inventory, if we were to value units of inventory, or to value stocks and whatnot, we need to value them in terms of our measure into a which of course is the US dollar.

So we have the economic activities denominated in a currency other than the entities recording currency. So if we have transactions, then therefore Of course, we haven’t transactions taking place. You can almost think of it like a bartering situation, right? We’re trading something other than the currency that we basically do business with, right. And so then we have to value just like we would anything else in terms of the US dollars. So that could include purchase or sale of goods or services, imports and exports, when the prices are stated in foreign currency. So if we’re purchasing something in foreign currency, then of course, the assumption then is that we’re going to be paying foreign currency, right, we’re going to be paying something and that would be similar to a barter situation, because we’re paying in something other than the currency that we are using. And therefore we will have to value what it is we exchange foreign currency with the use of the US dollars. If we purchase something and 44 US dollars and spend US dollars. Or if we sell something in terms of US dollars, then if we’re going to get paid in terms of foreign currency, I should say if we’re going to get paid and something in foreign currency, that’s that would mean that we’re receiving Something in like a barter type of situation that We’re then gonna have to value just like we would inventory or stocks or anything else in our measuring tool that being the US dollars. Then we have the loans payable or receivable and foreign currency, same kind of situation there, there’ll be a foreign currency transaction purchase or sale a foreign currency forward exchange contracts. We’ll talk more about forward exchange contracts and they’ll really come together once we start to think about them in context with practice problems. I highly highly, highly recommend looking at practice problems with foreign exchange currency transactions, and especially if you’re going to get into the point which we will with forward exchange contracts and the concept of hedging the risk of you know, foreign currency variations and whatnot. Then we have the purchase or sale of foreign currency units. Once again, these are going to be foreign currency transaction. So foreign currency transactions, transactions denominated in a foreign currency need to be translated into the currency. The reporting company uses for financial statement purposes. So again, just like anything else, if it’s a foreign currency, it’s a little bit deceiving because we say, hey, it’s currency, it’s like cash. It’s liquid like cash. It is very liquid. It’s a very liquid asset. And we can’t spend it and you know, and purchase things in the similar fashion. But it’s not the thing that we use to measure our financial statements. If we’re measuring our financial statements in US dollars, we got to measure our financial statement in one standardized unit. It wouldn’t make sense for us to measure our financial statements. If we were to measure something like how high is a is a basketball hoop or something, it wouldn’t make sense for us to say that it caught it’s so many feet and so many yards at the same point in time. That doesn’t, you know, it doesn’t, you know, it doesn’t make any sense to use different measuring tools, we have to standardize the measuring tool, our measurement tool US dollars, therefore, the foreign currency, although it isn’t, it’s like another measuring tool. to us. It’s just gonna be it’s gonna be basically another kind of asset or liability The thing that we’re going to have to value in terms of the US dollar. So then we’re going to say, this means that account balances denominated in a currency. That is not the entities reporting currency needs to be adjusted to reflect changes in exchange rates during the period at each balance sheet date. So at the at the end of each balance sheet date, if we have anything on the books that that, you know, we had to revalue. For example, if we have a payable on the books that we’re going to be paying in foreign currency, or if we have a receivable on the books in which we’re going to be receiving foreign currency, then it would be similar to if we had stocks or bonds on the books at that point in time, right? Because if I had stocks on the books, and I know that they’re publicly traded stocks, then because there’s a market for it, I can then go in there and say, hey, look, the current rate is this. I have the ability to do that with stocks because they’re standardized. If they’re traded on a publicly Stock Exchange, I can go back in there with a balance sheet date, and say, hey, look, there’s been gain or loss? How do I know? Because these are publicly traded items, people are trading these and they’re the same thing that I have. Therefore, there’s, you know, I know what the rate is at this point in time. That’s not the same thing as if we had something like a building. Notice if we had something like a building, then we have a problem there. Because the building is unique in nature. We don’t have there is no other building just like that building. There’s no market that’s going to tell us exactly what the value of that particular building is because it is unique. And that’s why we have this concept of depreciation and whatnot. And that’s why there’s some some problems. There are some questions as to whether we should be revaluing something to the current value or not or if that’s possible, or when it’s possible. With regards to stocks that are publicly traded, we tend to start to lean towards the tendencies to lean towards what we should be revaluing this thing because we know what the current market rate is given the fact that there’s a market currencies a similar kind of situation, we know the exchange rates because the people are exchanging them all the time. And we’ll do a similar kind of process will say, Well, given that case, if we have an accounts payable or receivable, where we’re going to be paying or receiving in foreign currency, then we should revalue that at the balance sheet date to whatever the current, the current rate is, at that point in time to properly reflect the financial statements as of that point in time, the adjustment needed to equivalent US dollar values will be a foreign currency transaction gain or loss for the entity when exchange rates have changed. So whenever we present value, something, we have the same kind of problem that you might think of having if you had stocks, right. If you’re revaluing the stocks, obviously, obviously, if we have not yet sold the stocks, and we revalue them saying they’re now higher or lower than they were before, we know that because of the stock market, then we have a difference that we’re gonna have to deal with on the other side of things, which would be typically a gain or loss. So we got to record the gain or loss somewhere. Well, same thing here. If we’re saying The receivable or the payable has now increased or decreased due to the difference in the value of the currency being received or paid and our current measuring tool value the dollar, then the difference is going to have to go somewhere and typically that’s going to go to the income statement as a foreign currency transaction a gain or loss.

07:22

So here’s a quick example here. And again, the best way to really get this is run through examples. We’ll have many example problems in Excel and in just one note presentation examples but recommend running through those assume as us assume a US company purchases pounds from its bank on January 1 2000, zero for use in future purchases from a foreign company. So the amount the amount that we’re going to get is 6000 pounds is it going to be foreign currency units, we’re going to say their pounds direct exchange rate is going to be $1 and 20 cents for each pound. Assume that US company purchases pounds from its bank on January 1 2000, zero for use in future purchase from a foreign company. So we’re going to be giving pounds then. So the amounts we’re going to get is going to be 6000 pounds. So the direct exchange rate is $1 and 20 cents for one pound. So if we want to get one pound, we’ve got to pay in dollars $1 and 20 cents, so the payment to the bank, then if we were to record the payment to the bank, we’re going to be paying $7,200 in order to get the 6000 pounds. In other words, we’re going to say, all right, we need 6000 pounds, and we’ve got the direct exchange rate, which basically is in dollars, right? It means Hey, if you want 6000 pounds, this is the price, basically per pound, right? And so we’re going to take that 6000 foreign currency units and multiply them times the direct exchange rate 1.2 that means it’s going to cost us in dollars 7200. So again, the scenario being we can imagine They were the US company. We’ve got we see something in London or something like that. And we’re saying, Hey, we want that. And the price tag says 6000 pounds, we’ve got to pay them 6000 pounds, we can’t pay them in dollars, we need to pay them pounds. So we’re gonna say, okay, we need 6000 pounds. What’s the current exchange rate? Well, the direct exchange rate is 1.2. So it’s gonna, if we want to get one pound, it’s going to cost us $1 and 20 cents, therefore 6000 pounds is going to cost us 6000 times the direct exchange rate of $1 and 20 cents or $7,200, we spend the $7,200 in order to get the 6000 pounds.

09:36

When we get the 6000 pounds. We don’t put it on our books on the on our books for financial accounting, in terms of pounds, because we that would be like us trying to measure something with two different standards or units of measures, right, we’re trying to measure our financial statement, we have to use one standardized system to do that. And that’s going to be the US dollar. So we didn’t So it and it’s just like anything else. So note what we got are 6000 units you can think of them. If we had inventory units, if we got 6000 inventory units, we wouldn’t we wouldn’t put the inventory units on our books as 6000 units of inventory, because again, we can’t measure in inventory units, we have to measure them in dollars. Or if we were to purchase equipment or something like that we wouldn’t put the equipment on the book as one forklift. It’s really pretty much the same thing. If it was stocks or something like that we would revalue them. So we’re going to do the same thing we’re going to put on our books, the foreign currency in units. And I think one of the closer examples is basically stocks, you can think of it as stock because they fluctuate in a similar way. And you’d say, well, we’re going to put that on there in the value of US dollars, which in this case is the 7200 US dollars. So this would indicate then that we’re holding on to foreign currency, in this case, six 6000 pounds, we have 6000 pounds, which we’re valuing in terms of US dollars. $7,200 just as we would if we had stocks, if we had so many stocks of a company, we would say this is how many stocks we have. That is valued in US dollars, not in not in like the number of stocks. Okay, so now we have 7200 on the books for foreign currency units, which represents the dollar value of the 6000 pounds, which we are actually holding what now as time passes, then the exchange rate is going to differ, it’s going to change we’re going to end we’ll call it the spot rate right now is going to change that would be the current exchange value. And so if we’re holding on to 6000 pounds at a later point in time, if you know any future day just like stocks, the price is going to change at any given time. We’re not going to change it every day, you know, to reflect the current value, although we probably could, because again, at any given time, there’s a current market for it just like if we were talking about publicly traded stocks, but that would be too tedious for us to do. We would typically do it when we need to when we need it to make a transaction and or at the balance sheet. Dates right.

12:00

So we would have adjusting entries basically at the month end or a year end at a point in time when we need to revalue it in order to make basically a transaction. For example, if we were to spend the 6000 pounds, we would want to revalue it basically at that point in time and then make and then spend it at that point in time using the reflective current valuation at the point in time that the transaction is recorded so that we can reflect on our books in dollar equivalence, what the transaction is doing. So later on when one of those things happens when either we want to spend the pounds or at a balance sheet date, we’re going to have to check what is the current exchange rate so that we can revalue our our pounds in a similar way, as if we had if we had stocks or bonds and we wanted to revalue them at at any given point for for similar reasons. So now on July 1 2000, zero, we’re going to say the exchange rate is now one point one. So if it’s 1.1, right, now we’re going to have some adjustment, we’re going to say, all right, well, now we’ve got 6000 pounds, and we multiply that times the exchange rate of 1.1. And that’s going to be 6600. We had put it on the books at 7200. And now it’s really valued at 6600, given the current exchange rate, so if I subtract this minus the 7200, we’re going to get a $600 difference, that’s $600 difference, it’s going to result in a loss that we’re going to have to record and if we think about it, why would it result in a loss? Well, because before it took $1 $1 and 20 cents to get one pound to buy one pound, and now it takes $1 and 10 cents to buy the one pound. So now we’re saying that the foreign currency the pound has now gotten weaker, right? Because to get one pound, it only costs $1 and 10 cents and before it costs $1 20 cents, so the pound has gone. cheaper or is weakened relative to the dollar, the dollar has gotten stronger relative to the pound. We’re talking here about kind of like an investment we’re holding on to pounds. So we’re holding on to something that has gone down in value. So that means that we’re going to have a loss. So we’re then going to have a debit go to the foreign currency transaction loss, the credit then go into the foreign currency units. And that means that that 7000 that we had on the books before the 7200 minus the 600, is going to give us the 6600, which once again was the 6000 times the current rate of 1.1, the 6600. Now you can also calculate this difference, and it’s useful to know by taking the difference between the rates. So we’re going to say 1.2 minus 1.1 times the 6000 pounds that we have on the books there’s that 600 again, so we’ll do many transactions like that. In our practice problems highly recommend going through the practice problems, import export, foreign currency, no forward contracts.

15:08

So we have then what’s going to be, you know, the general process that we’ll go through. First, we’re going to have the transaction date. So we’ll record the purchase or sale transaction at the US dollar equivalent value using the spot direct exchange rate. So let’s say we have a purchase that we took that took place at this point in time. And let’s say we purchase inventory or equipment or something like that. And we’re going to pay for it on account, meaning we haven’t paid for it yet. We’re going to pay for it in the future. But we’re going to we’ve received the inventory or the equipment at this point in time, we’re going to put it on the books at this point in time using the spot rate the current exchange rate, even though we may have an accounts payable in that case on the books that we’re not going to pay until some future point. So typically, again, we’re kind of valuing what we’re purchasing in that case, using the spot rate meaning the current rate at this point in time. We’ve got the inventory, we have the equipment, then we’re going to record it, even though we haven’t yet paid for it. And that then will result in the fact that when we when we pay for it later in a foreign currency, then there could be some fluctuation in the foreign currency, you know, valuation by the time between the time that we purchase something and the time that we make the payment. So then if we have a balance sheet date, let’s say this will typically be the end of the year or the end of the month, when we typically do adjusting entries at the end of the time period. So, after the transaction in the first one here, we may have an accounts payable or receivable on the books, which mean which is in foreign currency, meaning we might have bought something on account at which point we might be paying something in the future in foreign currency or receiving something in the future in foreign currency. That means, as of the balance sheet date, we’re going to have to make an adjustment because there’s going to be a change of course to the difference the spot rate from the date of the transaction to the balance sheet date, so we’re gonna have to adjust the payable or receivable to its US dollar equivalent and end of period value using the current direct exchange rate. So obviously we’ll have to revalue our our receivable or payable if we’re going to receive or pay in foreign currency using the current exchange rate, the current spot rate recognize any change gain or loss for the change in rates between the transaction and balance sheet dates. So notice what we’re doing here is we have this like in our example, if I was saying that we purchased inventory or equipment, we put it on the books using the original spot value, meaning we valued it using the current transaction, you know date to value the equipment at that point in time. Then if we revalue the accounts payable because we haven’t yet paid it at a later point, you might have a question you might say, well, doesn’t that mean that the equipment that we purchased or the inventory repurchased was valued kind of incorrectly.

18:02

In other words, shouldn’t we put that change in the valuation of the currency into the cost of the machinery or the equipment? And the general rule is no, we’re not going to we’re going to value the machinery or equipment at the point in time that it was purchased even though we had not yet paid for it using the current exchange rate. And then later, when we revalue the accounts payable or accounts receivable, we will record the gains and losses on the books rather than basically revaluing what, what like we purchased so we’ll see examples of this, though there are some exceptions to this when we start to look a little bit later, but that’s going to be like the general rule. So settlement date. So then we have the settlement date when we actually in our example pay off the payable or if we pay or if we receive the receivable and we’re talking like in foreign currency, so now we’re going to pay off the payable and we have to pay in foreign currency not in dollars. So then we have the Adjust a foreign currency payable or receivable for any changes in the exchange rate between the balance sheet date or transaction date and the settlement date, exchange gain or loss will be recorded, record the settlement of the foreign currency payable or receivable. So at the settlement date, then we have to do the same kind of thing because now we’re going to be paying off so we bought something on account. Now we’re going to be paying it in the future. And we’re going to have to revalue then once again, as of the point in time that we make the payment the accounts payable, so that it reflects the current exchange rate at that point in time, so that we can then pay in foreign currency and it’ll be reflected correctly. So basically, you can think about it this way. If we had the payable, then we’re going to pay for it at the end here.

19:47

So we have to revalue our payable to what the current exchange rate is using the current spot rate at that point in time, then we’re actually going to have to get the foreign currency by basically paying cash and getting foreign currency if we don’t have that on our books, and then we’re going to have to and then we’ll pay off the payable using the foreign currency right and we’ll settle it and we’ll settle it out. So before we can pay off the payable in foreign currency, in other words, we have to revalue what our payable is reflected in dollars to reflect the proper exchange valuation. And then we can basically pay it off in foreign currency or record our receivable in foreign currency. So we have a two transaction method. So this sees the purchase or sale of an item as a separate transaction from the foreign currency commitment. So we’re kind of we’re kind of imagining although these things are kind of Linked In reality, we’re seeing them as basically two different two different things. The foreign currency exchange gains or losses from the revaluation of assets or liabilities denominated in foreign currency need to be recognized in the income statement of the period the exchange rate changes, although there are a few exceptions to this general rule. So you can see and basically, in our example, we’re kind of differentiating the changes in the foreign currency to the purchase of, or the sale of whatever we’re our foreign currency transactions related to. So if we purchased equipment or inventory, then then what we’re saying is the purchase of inventory, we’re trying to keep it kind of separate from the fluctuation in the valuation. So in other words, once again, we put the inventory on the books, at the point in time that we got the inventory, even though we had not yet paid for it or the machinery, even though we had not yet paid for it. We’re going to pay for it at a later time in foreign currency. But we’re recording it as of that point in time. When we got it using the current exchange rate. And we’re not going to touch the value. We’re not going to revalue the the equipment or the inventory that we purchased even though there’s going to be fluctuations in the the rate and there will be exceptions to that when we start talking about hedging and forward contracts and whatnot. But that’s the general general rule and then when there’s fluctuation and say the payable between the point in time that we got the inventory and we pay it, we’re not going to revalue or adjust the value of the inventory, but instead just simply record gains or losses with with regards to the different valuations of the foreign currency transactions, so we’re kind of thinking of them as as kind of separate in that in that sense.

22:24

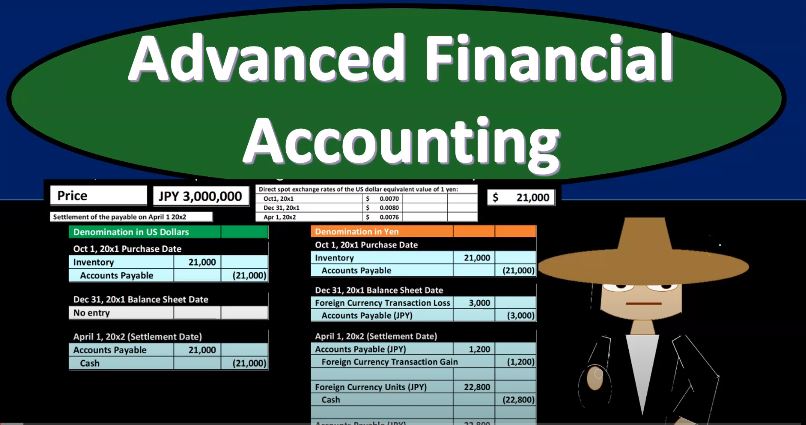

Let’s take a quick look at an example here and like I said, I do recommend going over many example problems that we will have so we’re gonna say October 1, we have 2000 x one US company purchases goods on account from a Japanese company, the price is going to be 3 million yen, so 3 million yen, and then we have the settlement of the accounts payable is going to be on April 1 2000 x two. So then we have the direct spot exchange rates of the US dollar equivalent value of one yen. In other words, one yen on October 1 is equivalent to point o $7. And then on December Which is going to be our balance sheet date, where we will have to revalue is going to be one year’s worth point oh $8. And then on April 1, one yen is worth point oh seven $6. So therefore, if we pull out the trusty calculator here, let’s pull up the trusty calculator, pull out a smaller calculator that wants to big. So we’re going to say if we have the 3 million, and then multiply that times the current exchange rate on October times point O seven, that’s going to give us our 21,000. So our $21,000 if we value it, as of as of October when the transaction took place, so if we didn’t have foreign currency, and we just record it as normal, like a normal transaction that happened in dollars, let’s say that we purchased we purchased the inventory on account, no foreign current currency problems taking place, we would simply say that we have the inventory on the books and then the Credit would be going to the accounts payable. And we’re not, we’re not thinking about foreign currency here, we’re then just going to say that there’s no adjustment at the balance sheet date, because we don’t have to adjust the accounts payable due to the fact that it’s in dollars, it’s valued correctly, or it’s valued in our valuation. So then we’re going to save that, when we pay for it on April 1, then we’re going to be debiting, the accounts payable, decreasing the accounts payable and paying it off in cash. And that’s the whole cycle, no problem thing is over. Now, let’s say that we’re going to be purchasing this thing, but we’re going to be paying for it in foreign currency. What’s the added step? What’s the added problem that’s gonna happen here? Well, we’re still gonna put the inventory on the books, but we’re not going to be paying for it in dollars, we’re going to be paying 3 million yen. So we’re going to say, all right, well, that means that if we’re going to pay 3 million yen, we got to say, Okay, I’m going to put that on the books and recognize the payable at 3 million times the current exchange rate or spot rate, which will be the 21. So we’re still We’re going to record it on the books at inventory 21,000. But we’re not going to be paying $21,000 we’re going to be paying in yen.

25:08

And then we’ve got an accounts payable, which we should reflect that in, that’s in Japanese yen, which I should have a JPY or something to indicate that the accounts payable is not going to be in dollars, it’s going to be in yen. So this 21,000 reflects the fact that we’re going to be paying something worth 21,000. But we’re not actually exchanging dollars, we’re going to be giving the 3 million yen which currently has an exchange rate to us of the 21,000. So we have to put it on our books at the current valuation, even though we’re going to be paying in something other than dollars. Then we’re going to say at the balance sheet date at December 31. We have to revalue the payable the payable is now on the books at 21,000. But that really reflects 3 million yen and now the value of the gym has changed. So just like if we were talking about you know stocks that are changing on the market, we can now see what that change is because we did because it’s a similar market type of transaction, we can say alright, well now as of December that that accounts payable is not properly valued. According to the current exchange or spot rate, the current spot rate is point oh seven. So we’re gonna say alright, if I take that 3 million times point, Oh, I’m sorry, point oh eight is the current rate. Now it’s at 24,000. And it’s currently on the books at 21,000 to 24,000 minus 21,000 is going to give us a $3,000 difference, that $3,000 difference is going to be a loss. And why is it going to be a loss? Well, because before the rate was one yen was worth point, oh $7 and now we have one yen it’s worth point. Oh $8. Therefore, the yen has gotten stronger. There’s more dollars to the yen right? The yen is worth it. more dollars, so the yen has gotten stronger, but we’re going to be making a payment in yen in the future, right, so we’re gonna have to pace with something that has now gotten stronger relative to the dollar, which means that it’s a loss to us, we’re going to be a loss.

27:13

So we’re gonna have to say, All right, we’ve got foreign currency loss, this is going to be going on the income statement. So this will go on the income statement, decreasing the net income, and then we got the accounts payable is going to be increasing. Basically, the accounts payable is going to be higher right now it’s going to be at the 21,000, which was what we started at plus the 3000, which is going to be the 24,000. So once again, that 24,000 is reflecting the dollar equivalent that we’re going to have to pay at this point in time 1231 of what we’re actually going to pay in which is yen, 3 million yen. So then on four one, we’re going to have to actually make the transaction so now we’re going to we’re going to actually pay off in yen, that what we’re going to Oh which is the 3 million yen, but before we do that, we have to we validate Once again, what’s in the payable, which is currently 24,000 to the current rate, which is going to be the spot rate on the point in time that we’re going to make the payment, which is April 1 2002. So to do that, we’re going to say all right, let’s take that 3 million, again, times the current spot rate point oh seven 622 eight, what’s currently in there, the 24,000. We calculated which was the, the 21 plus the three. And so if we if we subtract that out, we’re gonna have a difference of 1200. That 1200 now is going to be again, why is it going to be again, because last time we had one yen was worth point. Oh, $8. Now one yen is worth point oh seven $6 therefore the yen has gotten less strong. It’s gotten weaker, because it’s it’s gone down. Well, you know, there’s less dollars you get for one yen, and therefore, we’re going to be paying in yen. So now we’re going to be paying in something that has now gotten weaker. Since it was before, and we’re going to be paying in that, in that unit, that’s good to us because now we’re going to be paying something that has less purchasing power than it did before. So now we’re going to say All right, now the accounts payable is going to go down and accounts payable is the credit balance, so we’re going to make it go down with a debit of the 1200. And then the other side is going to go into the foreign currency transaction game. So now we have the game on the books. So now we have we have on the books, it’s reflecting what it what it should reflect. And the other way you can calculate this 1200 is to take the difference between the rates point oh eight, minus point O Seven, six times two, 3 million. So you can calculate the 1200 that way, and once again, the current valuation in accounts payable will then be the 3 million times the point O seven, six, the current spot rate that being the 22 eight, so the accounts payable reflected correctly, but in this case, we don’t have the count. We don’t have The yen yet so now we need the 3 million yen. Because we don’t we don’t have it. So we’re going to have to get that so that means we’re gonna have to pay cash, we’re going to pay cash for the 22 eight, because that’s the current spot rate to get the 3 million yen which we promised to pay this thing in.

30:16

So we’re going to pay 22 eight in actual cash. And then we’re going to get units, we’re going to get units of foreign currency, which we’re just going to call foreign currency units, which is actually 3 million yen, which of course we’re going to reflect on our books not in a foreign currency unit but in dollars, that exchange rate being 22 eight. So now we have on our books and assets of 22 eight very liquid asset being the the the cash, right but the foreign currency, but we’re still reflecting it in US dollars just like we would if it was you know, stocks or something like that. So it’s on the books at the 22 eight. Then now that we have the foreign currency on the books here, we’re going to read we would then pay in foreign currency, so we’ve got this asset of 22 eight reflecting 3 million yen, which we’re now going to credit removing the foreign currency pain actually the 3 million yen reflecting it on our books as a decrease in the foreign currency of 2008, the US dollar equivalent, then we’ll be paying off the payable, meaning the payable will go down to zero with a debit, decreasing what was currently on the books at 22, eight down to zero, reflecting the fact that we owed 22, eight in which really reflected the 3 million yen in US dollars equivalence now that US dollar equivalent has gone down to 20 to eight because we actually paid you know the 3 million yen.

31:45

So that’s going to be a quick example when we go through the example problems on our future example problems. We will actually post this out to trial balances so you can see the increases and decreases some of these accounts if you’re not used to foreign currency will be neutral. To you, the idea of having accounts payable that reflects foreign currency is probably new to you, if you haven’t worked with foreign currencies before, so it’s really helpful to see them posted to a trial balance and I and so once you see that a few times and see these actual posted out, it will make a lot more sense. So recommend taking a look at those