QuickBooks Online 2021 bank reconciliation mythbusting. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our gray guitars practice file, we’re going to be going into the bank reconciliation process. But before we do so we want to discuss some common misconceptions about the bank reconciliation process, which we can characterize as myths about the bank reconciliation process. And any good myth will have some element of truth within it.

Posts with the tie tag

Deposit From Sales Receipt & Receive Payment Forms 7.35

QuickBooks Online 2021 deposits, recording deposits that are going through the sales receipt form and the receive payments form and going through undeposited funds. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars a practice file, we’re going to be recording deposits. Before we do so let’s open up some of our reports being the balance sheet income statement trial balance, going up top to the tab, right clicking on the tab and duplicating the tab, we’re going to do it two more times. Right clicking on the tab again, duplicating the tab one more time right clicking on the tab and duplicate the tab, we’re then going to be opening up the trial balance in the tab to the far right by going to the reports on the left hand side.

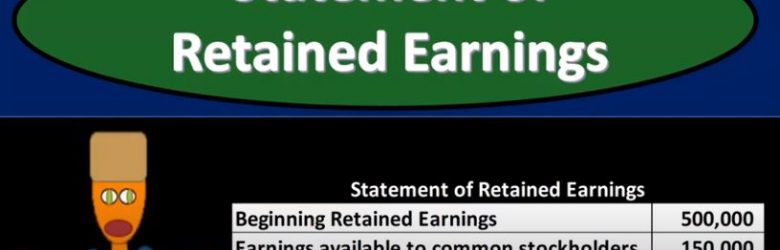

Statement of Retained Earnings 230

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the statement of retained earnings Get ready, it’s time to take your chance with corporate finance statement of retained earnings. So remember that as we think about the financial statements in total, the financial statements are basically answering questions that users of the financial statements would have. So for example, if we were thinking about investing into a company, the financial statements would help us answer the question as to how does the company stand at this point in time? How does the company look from a financial standpoint at this point, that is the balance sheet, the balance sheet gives you the assets, liabilities, equity, assets minus liabilities, being basically the book value being basically where the company stands at a point in time.

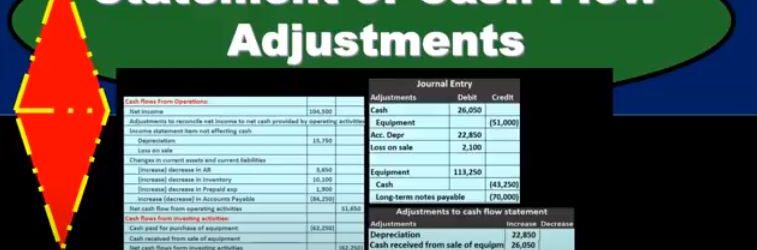

Statement of Cash Flow Adjustments

This presentation we will continue on with our statement of cash flows, we’re not going to enter the final adjustments that we will need to finalize the statement of cash flows to bring those last few numbers to the correct balances. In order to do that, we’re going to use this information we’ve got our comparative balance sheet, our income statement and additional information. We put together most of our information so far with the comparative balance sheet, which we made into a worksheet. Now we’re going to use some of these other resources, the income statement, the additional resources to make those final adjustments, those fine tunings that are needed to get those few numbers that we have left and noted into balance. And this is going to be part of the normal practice where once we get this information set up, we can then make some comparisons such as net income does it tie out, such as depreciation does it tie out on the cash flow statement to what we see here on the income statement, then we can have this other information which will be given in both problems in practice, of course, we’ll just go to the gym. General Ledger. And we’ll get this information in a book problem, we don’t want to give all the detail of a general ledger or just when we’re going over an example.

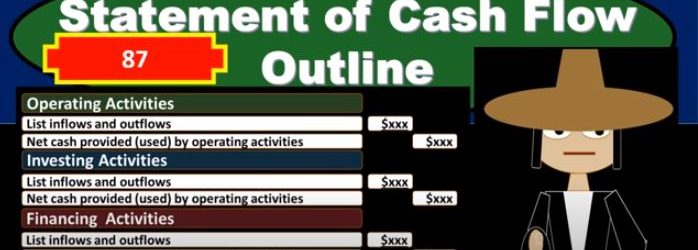

Statement of Cash Flow Outline

In this presentation, we will take a look at a basic outline for a statement of cash flows. In order to do this, we first want to give an idea of how the statement of cash flows will be generated. So we can think about these components of the statement of cash flows and where they come from. Typically, we will have a worksheet such as this that we will use in order to generate the statement of cash flows. That statement of cash flows, having three major components, operating activities, investing activities, and financing activities. Our goal here is going to be to fill out these three components and typically we will use a worksheet such as this on the left. The worksheet is just basically a comparative balance sheet that we have here that we’ve reformatted from a balance sheet to just a trial balance type format, a debit and credit type format. So you can see that we have our balance sheet accounts, and we are imbalanced by having the debits the positive and the credits be negative or debits. Minus the credits equaling zero, given it’s an indication that this period, the current period that we are working on, is in balance, the prior period, same thing. So we have two points in time for to balance sheet points the prior year, or period the prior year in this case and the current year. And then we just took the difference between these two columns. And if we have something that’s in balance, here, the debits minus the credits equals zero, something that’s in balance here, the debits minus the credits equals zero. And then we take the difference of each line item in these columns. And some of those differences, it too must add up to zero. So in essence, what we’re going to do in order to create the statement of cash flows is find a home for all these differences. And that’ll give us a cash flow, a concept of the cash flow statement. We’ll get into more detail on how to do that when we create the cash flow statement. But as we look at the outline, keep that in mind. So here’s going to be the basic outline for the state. cash flows, we’re going to have the operating activities. That’s going to include a list of inflows and outflows from the operating activities. And then we’re going to have the net cash provided by the operating activities. Now, this list of inflows and outflows for the operating activity will be the most extensive list because the operating activities are in relation to you can think of it as similar to the income statement.

Bank Reconciliation-Accounting%2C Financial

Hello, in this lecture, we’ll discuss a bank reconciliation. At the end of this, we will be able to describe what a bank reconciliation is perform a bank reconciliation, make a needed adjustments to our books in the reconciliation process, as well as record those adjustments. So this is going to start off the bank reconciliation process. We’ll start off with, of course, the bank statement. So the bank statement is going to come from the bank, generally, it happens at the end of the month, although we could get it electronically at any timeframe. But typically, it’s still good to get it as of the end of the month so that we can have a set timeframe as to when we’re going to reconcile our account and deal with the timing differences at that time. So this bank statement coming from the bank is going to be as of the end of February in this case, and we’ll have a typical information on a bank statement, which will be that we will have the beginning balance, and then we’re going to have the additions to it generally our deposits and then we’re going to have the corrections to it.