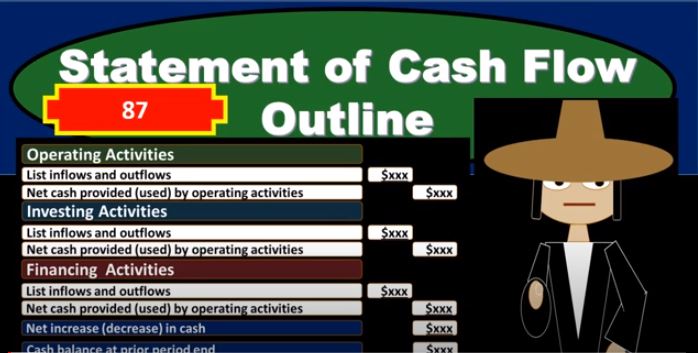

In this presentation, we will take a look at a basic outline for a statement of cash flows. In order to do this, we first want to give an idea of how the statement of cash flows will be generated. So we can think about these components of the statement of cash flows and where they come from. Typically, we will have a worksheet such as this that we will use in order to generate the statement of cash flows. That statement of cash flows, having three major components, operating activities, investing activities, and financing activities. Our goal here is going to be to fill out these three components and typically we will use a worksheet such as this on the left. The worksheet is just basically a comparative balance sheet that we have here that we’ve reformatted from a balance sheet to just a trial balance type format, a debit and credit type format. So you can see that we have our balance sheet accounts, and we are imbalanced by having the debits the positive and the credits be negative or debits. Minus the credits equaling zero, given it’s an indication that this period, the current period that we are working on, is in balance, the prior period, same thing. So we have two points in time for to balance sheet points the prior year, or period the prior year in this case and the current year. And then we just took the difference between these two columns. And if we have something that’s in balance, here, the debits minus the credits equals zero, something that’s in balance here, the debits minus the credits equals zero. And then we take the difference of each line item in these columns. And some of those differences, it too must add up to zero. So in essence, what we’re going to do in order to create the statement of cash flows is find a home for all these differences. And that’ll give us a cash flow, a concept of the cash flow statement. We’ll get into more detail on how to do that when we create the cash flow statement. But as we look at the outline, keep that in mind. So here’s going to be the basic outline for the state. cash flows, we’re going to have the operating activities. That’s going to include a list of inflows and outflows from the operating activities. And then we’re going to have the net cash provided by the operating activities. Now, this list of inflows and outflows for the operating activity will be the most extensive list because the operating activities are in relation to you can think of it as similar to the income statement.

02:25

For an accrual basis, what we’re trying to do is get to net cash provided by operating activities, which is kind of like net income on a cash basis. So that means that were most of the activities that we do is going to be here because that’s normally what the reporting is in terms of activity. That’s what the income statement does. It reports activity as opposed to the balance sheet, which reports where we are at a certain point in time. So then we have the other investing activities. Those will include inflows and outflows, there’s going to be less involved in the investing activities. And of course, those will include investments, like if we were to invest in stocks and bonds or something like that. But they also include investments in assets like fixed assets like property, plant and equipment. So we just got to be aware of that. And the investing activities, property, plant and equipment will be they’re typically going to be less activity that goes on in the investing activities, then, of course, in the operating activities, then we’ve got the financing activities. And those are going to we’re going to list the inflows and outflows of the financing activities. And those are going to be things that are usually just to get capital in the business or to pay pay back capital or pay back the owners. So these are going to be things like loans related to loans, taking out a loan, or getting money from the owner, whether that be from selling stock in the company issuing stock, or if it’s a sole proprietorship or partnership, the owner just putting money into the company, or paying back money such as debt. or paying back money to the owners like dividends or draws. So those are going to be the three categories we’re going to have.

04:06

And when we put the information into these three categories, we got to think of the our worksheet that we saw in the prior slide and think, okay, where are each of these activities going to go or each of these areas is going to be operating, investing or financing. So whenever we think about the cash flow statement, we always want to be thinking, operating, investing and financing, and which which area to these, whatever cash flows we have fit into, and we’ll discuss a thought process on how to do that, we’ll put together a cash flow statement in order to help us do that. We have the typical kind of format when we put together a cash flow statement of any kind of statement, whereas we subtotal it on the inner column. And then we will we list the accounts in the intercom, and then we give a subtotal so we’re going to list out the activity for operating activities. And then give the subtotal in the outer column. These two columns are not going to be debit and credit related. It’s a financial statement, we don’t deal with debits and credits on the financial statements of plus and minus financial statement. So these two columns simply deal with, this is going to be a list of the subcategory. And this is the summary of the subcategory. And that’s going to be it. And then if we have these outer columns, net cash provided by operating activities, cash provided by investing activities and cash provided.

05:34

In this presentation, we will take a look at an outline of the statement of cash flows. In order to understand the outline for the statement of cash flows, we want to get a quick example of how we’re going to format the statement of cash flows. We’re going to take something like this worksheet on the left side and we’re going to be putting this information into the three categories of the statement of cash flows, operating activities, investing activities, finding And activities. We’ll get into more detail about this worksheet, but it’s a good idea to just have some preliminary notion of this concept. As we look through the outline of the statement of cash flows. This is basically going to be a comparative balance sheet that we put back into a debit and credit format that we have here. And we have the current period and the prior period, we can see that we are in balance because the debits minus the credits equals zero for the current period, debits minus the credits equals zero for the prior period. And then we’re basically taking the difference between each of these line items. And that gives us the difference for each line item on the balance sheet accounts. And if this column debits and credits equals zero, and this column debits and credits equals zero, then the difference will also equals zero. Now what we’re going to do in the statement of cash flows is really just going to take each of these categories and we’re going to find a home for them. So our question is always going to be these categories here which kind of rubber Present cash flow. And we’ll talk about more how that can be. How can we tie? What does this mean in terms of cash flow? How does this tie into cash flow? We’ll talk more about that.

07:09

But once we look at each of these cash flows areas, we didn’t we then need to determine are these going to be areas that are going to go to the operating activities, investing activities, or financing activities. So let’s take a look at an outline of a statement of cash flow. So we can see how this will look in terms of a financial statement format, we’re going to have operating activities that will be the top of our statement of cash flows, it’s kind of like where most of the information will be. The operating activities are just going to have a list of inflows and outflows. And then we’re going to have net cash provided or used by operating activities. Notice we have some generic terminology here because the terms will differ if we have a cash inflow or a cash outflow. Now hopefully in the operating activities, we have a cash inflow, because this is going to be the major types of activities of the company. So Typically here, we’ll have a cash inflow. And we’re going to say provided by cash provided by because cash hopefully went up. However, if there’s a cash outflow if there’s a decrease in cash for the time period, which is possible, we’re going to use the term used in. So notice that when we make a kind of a generic format, a generic worksheet, we’re basically going to use the terminology both provided by and used in, so that we can format our worksheet. The operating activities is really where most of the information should be because the operating activities is similar to an income statement that has been flipped from an accrual basis to a cash basis. So net cash provided by operating activities is kind of like net income on a cash basis.

08:47

Because this is an activity statement. This is reporting activity over time. It’s similar to the income statement and therefore this section should be where the most of the activity will be. Then we’re going to have interest vesting activities. And we’re going to list inflows and outflows. And then we’ll have net cash provided or used by investing activities. same format that we’re going to have here. There should be far fewer investing activities. However, obviously, that’ll deal with like investing if we were to invest as a company in stocks and bonds, but it also deals with investment in long term assets such as property, plant and equipment that will go into the investing activities. Then we will have the financing activities same concept, listing inflows and outflows are the financing activities that will have the net cash provided or used in the financing activities. So our major goal when we think about the cash flow statement, and we have questions about cash flow, is usually which of these categories is it going to belong in? When we think about a cash flow? Is it operating? Is it investing is it financing? We will go through a thought process and a later presentation in terms of how can we best determine whether something is operative Investing or financing. And note that the default is obviously always going to be operating as our first kind of question. Is it operating? If it’s not operating, then is it investing? And then is it financing operating having to do with cash flows related to similar transactions as the income statement.

10:18

So if we’re talking about a cash flow that deals with something that would normally be a normal operation, revenue and expenses related, but cash flow related to them, probably operating, investing activities can be dealing with the investments in stocks and bonds and things like that normal types of things we think of as investments, but also having to do with investments in long term, fixed assets like property, plant and equipment, financing activities having to do with things that we’re using to finance the company. We’re trying to generate capital money in the company that we can use to run the business, or we’re paying back capital or money to run the business. So if we’re taking out a loan, or if we’re getting issuing stock or we’re getting money from investors or we’re paying back alone, we’re paying back the investors with dividends or draws. Once we have this information, you can note that the normal format is similar to any financial statement, we’re going to group this information in the inner column. So this is a subcategory of operating activities will list all the operating activities in the inner column, and then we’ll sum will total them up in the outer column. So these two columns do not represent debits and credits. Like any financial statement, they’re not going to show debits and credits because we don’t want to have to explain debits and credits to normal readers the financial statements. So we’re going to convert the debits and credits into a plus and minus format. And then we’re gonna have these two columns be the subtotals.

11:45

So that means these totals in the outer column then this is going to be net cash provided or used operating activities. net cash provided or used in investing in net cash provided or used in financing. If we add or subtract those up, whichever way they be going. terms of cash flow, then we’re going to get the net cash increase or decrease in cash net increase or decrease in cash. That’s going to be these three items here. This is really what we’re looking for in the statement of cash flows, because this is the activity, this is what happened. We’re looking for that change in cash cash has changed. How did it change? Well, here’s the story of how it changed in terms of these summary stories, operating, investing and financing. And then here’s the more detail in terms of those three categories of what happened, what’s going on with this change. But we don’t want to just report this cash change, because if we did so, then redo the financial statement would have to do some math in order to tie everything out. They’d have to subtract that comparative balance sheet cash on the first period to the next period to see what the change is to make sure that this number ties out to it and we would like to have something at the bottom of the cash flow statement that readers can tie out easily and say okay, these I see how these two statements are related. So what we’ll do is we’ll take this change. And we’ll, we’ll add to it the cash balance at the prior period. And so we’re going to say, here’s the difference, here’s what changed. Here’s what the cash was at the beginning of the time period, which is the same as the end of the last time period. And then that’ll give us cash flow at the end of the period. So then this cash flow, then is what will tie out to the balance sheet. So it’ll it’ll match what’s on the balance sheet. So again, this is really what we’re looking for.

13:27

We’re looking for the change the activity, what’s going on. But we want to tie it out to the bottom line number on the balance sheet. So people have a very easy check. They can just go right to this bottom line number and say, Okay, yeah, that matches the balance sheet. It looks like this whole thing ties out I see where this fits in. If we think about this in relation to our worksheet, which we had basically two time periods of comparative balance sheet here, current period prior period, then we can see that this whole activity down here matches up with our activity up top. Remember we have the current period information prior period. The difference We’re really looking for that difference because that’s showing the activity that’s going to be here. But then we’re going to tie it out to our cash at the end of the time period because that’s what will be reported on the balance sheet. So we’ll get into this worksheet more as we go through, we’re really going to be working with the differences column. In order to help us determine what the cash flows from operating activities, investing activities and financing activities will be