Advanced financial accounting PowerPoint presentation. In this presentation we will discuss periodic reporting requirements for publicly traded companies get ready to account with advanced financial accounting, periodic reporting requirements, companies that have more than 10 million in assets and whose securities are held by over 500. Persons must file annual and other periodic reports to provide updates on their economic activities. So remember the general rule here we’re talking about publicly traded companies that have a benefit of being able to be publicly traded to the public on the exchanges. And in exchange for that we want to see some more basically transparency, and therefore you’ve got the filing process that needed to take place. We see some regulation by the SEC that we talked about in prior presentations. And then going forward, we want to keep and maintain the transparency the information so that there’s both the investors and the companies have the information necessary in order to enter into a agreements. And therefore we’re going to need some continuing reporting, what are the what’s going to be the requirements in terms of the continuing reporting. So once again, companies that have more than 10 million in assets and whose securities are held by over 500 persons must file annual and other periodic reports to provide updates on their economic activities. And that’s going to increase that transparency so that investors know what is happening and they can invest with full information to do so. three basic periodic reporting forms used for this updating our form 10 k form 10 Q and form eight K. Let’s start with the form 10 k form 10 k is the annual filing to the SEC the Security and Exchange Commission.

Posts with the transparency tag

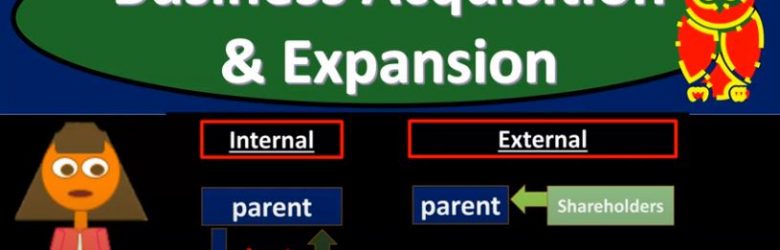

Business Acquisition & Expansion

In this presentation, we’re going to discuss an Introduction to Business acquisition and expansion, get ready to act, because it’s time to account with business, Advanced Accounting, advanced financial accounting will have to do with the concept of expansion and the accounting related to it. So first we need to know well, what is expansion? What are the types of expansion that can take place? What are the problems with regards to the accounting for it? And then what type of accounting principles can we apply in order to deal with the accounting related to those problems? So when we think about expansion in general of a business, we’re thinking about the growth of a business, typically, you have either internal expansion or external expansion. So those are two categories of expansion. We want to start to visualize in our mind and we got our mind our mind is visualizing a business that is trying to expand how are they going to do that? Are they going to do it with some type of internal growth or some type of external growth? Then we want to think about the legal structure of the of the expansion for example, an expansion often results in a parent subsidiary type of relationship. So, we have different legal entities that are associated in some way shape or form.