In this introductory presentation, we will start where every introductory presentation should start, and that is what is in it for us. Why would we want to learn accounting? What are the reasons for learning accounting? We are going to start off to answer that question and say because it’s, we will return to this after we see the objectives. The objectives been, we will be able to at the end of this presentation, list and describe reasons for learning accounting, list and explain types of accounting list and describe types of entities. Back to our question, why would we want to learn accounting? I’m gonna say the first reason is, because it’s fun.

00:42

This may not be the first thing that popped into your mind, this may not be the first reason you’re actually here taking this course in accounting, but I want to start off with this premise for a few different reasons. One is that it can be fun, there are areas within accounting that can be enjoyable to do and to one To focus in on those areas because that will make the process of learning accounting more enjoyable to do. So we will get into the more traditional reasons for learning accounting, what is in it for us? What can we get out of accounting? How will it help our lives. But first, let’s take a look at this fun factor. Accounting can be compared to accounting to putting together a puzzle, a puzzle can be an enjoyable task, although at first glance, it would look like a rather tedious task to put a bunch of puzzle pieces on a table and actually put them together.

01:32

But the process of putting them together is an enjoyable task. And many aspects of accounting will be much the same in that we will have different components, we’ll have to put those components together in certain ways in accordance with a set of rules. And we may have to reorganize those components knowing that they will fit in a different format. Just as we know the puzzle pieces will fit together in order to match the image on the box. We can also compare the accounting to learning something like music, music has a lot of patterns to it, we have to learn the patterns, whether we learn those patterns in terms of an actual song pattern, or the progressions in terms of chords, or the progressions in terms of notes that we need to learn, we have to learn something before we get to the enjoyment of actually playing something.

02:19

That’s usually the difficult part, that learning part, that memorization part before we get to the actual task of playing something. And the same thing is true. With accounting, we’re gonna have to learn some memorization how to set things up before we can use that to get enjoyment out of the process. And in order to apply it for practical purposes. We can also compare accounting to something like a game of checkers. And notice that a game of checkers is played on a spreadsheet something that an accountant will appreciate there, we’re going to play the game of checkers. On a spreadsheet, we’re going to move these pieces in accordance to a set of rules.

02:54

First thing we need to know in order to play the game of checkers is to learn those rules first rule rules? How do you set up the board? Where do you put the pieces? Then how do you move those pieces that will be much the same in accounting, we’re gonna have to learn the rules of setting up the board. Where do we put the pieces, then to learn the rules for moving the pieces, if you’ve ever taught someone a game of checkers, or if you remember learning a game of checkers, that first process learning how to put the pieces together and where to move them is the difficult part. After we know that it becomes much more enjoyable to play the game. The same is true with accounting.

03:30

Also note that if we were to play a game like chess, it would be much more complicated to learn those rules to first set up the board. But it’s a lot more difficult to master chess and therefore, we actually get more long term enjoyment from a game as chess because of the complication that is there after we learn those rules. The same is true for accounting there’s there’s we’re never going to master the game. But we need to know the ground rules before we can play the game and then continually continually To improve within it. Other reasons for learn accounting, if you’re a student, then this course is going to be the basics. So if you’re going into the first accounting course, you probably want to take this and you can learn the accounting concepts before you go into the course accounting will be something that will accumulate upwards.

04:18

Therefore the fundamentals I compared to something like a sports, if you’re playing baseball, just playing catch, you’re going to play catch every game, whether your first practice, second practice, or if you’ve been playing for 10 years, you’re still going to be playing catch, you’re still going to be digging out ground balls, you’re still going to be doing batting practice. Those are the fundamentals. And whether you’re a first year student or you’re working in the accounting department, it’s always good to go back to the fundamentals, even reviewing the fundamentals myself. I learned new things just doing that all the time. It’s good refresher to hap so if you’re going into the course you really want to pick those up because you can’t move forward until you learn these concepts. These are concepts that will be needed throughout the entire process.

05:00

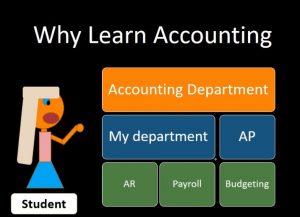

As of accounting, no matter where you go within accountants, just like playing catch are going to need to be going back to the fundamentals every time. If you’ve already in an accounting class, or if you’re an advanced accounting class, it’s always good to have a course that is ready and available to go back to in order to revisit those fundamentals, those core concepts will go through the accounting cycle here. And this is something that can provide that process and that information. If you work within an accounting department, then it’s often the case where an accounting department especially for larger corporations, you may work in a specific area and use specific software. And and that’s because of separation of duties. And many times we don’t really see the big picture.

05:43

And a course like this will go through the big picture, meaning it’ll go through the normal accounting cycle that all companies go through, and therefore whatever department we are in, we’ll get a better idea of what the other departments are doing. For example, there’s an accounts payable department accounts receivable payroll, we might have different budgeting areas, it really depends on the size of the company. But whatever the the amount of compartments we have within the accounting department, learning the overall cycle will help us relate to those different departments. It will also help us understand what we are actually doing. Oftentimes, if we have data entry, then we’re entering data and we may not really know what the software is doing.

06:24

This will give an idea of what the software is doing, the more understanding we have of what the software is doing, the more valuable we are in the accounting department because if there are problems, we’re not just entering data, we can actually go in and see what is happening and be a problem solver. And those are the more valuable skills. The core accounting skills are also helpful with personal finances. So the same idea in terms of accounting is applicable to personal finances as well as business finances. One of the first things we will do is separate the personal from the business and we’re going to focus in on the business accounting but On the personal side, the same things can be applied, it’s just that we have a different objective.

07:05

And therefore the same principles can be applied to personal finances as well, which is an area that everybody needs some understanding of accounting and other reasons for learning accounting. If you’re a student, or if you’re thinking about continuing your career somewhere within accounting, accounting has a lot of different areas in it. So it might be thought that if you work in accounting, you go work in accounting department, and that’s all you can do with it. But really, the accounting department and the accounting field has grown a lot. So there’s a lot of different areas you can go within the accounting field. For example, if you graduate in accounting, the most traditional path might be the CPA license and get certified. As a C as a CPA.

07:47

You could continue to the MBA these are kind of a typical paths for students to take. once they graduate. In an accounting major, they may either go for a CPA license and or an MBA license. The CPA license is really a nice option to have. Because oftentimes, it’s not as costly as an NBA license and can provide a lot of value in terms of job seeking skill. So, you have that available, whereas some other professions may not have that type of certification option available which can be very marketable. There’s also a chartered Global Management accountant and certified management accountant. These are geared towards managerial accounting, so we can focus our career more towards managerial accounting. And again, look for these certificates which can be very valuable in terms of job placement, to show employers that we have the skills needed, and they’re oftentimes take less time and money than in a traditional MBA.

08:43

We also have bookkeeping, we can go into bookkeeping, we can go into different departments, like accounts receivable, accounts payable, payroll, these are all specialties that we can do if we if we do bookkeeping, we’re probably thinking we’re, we’re working with smaller companies, and we’re doing more of the bookkeeping, that’s kind of a specialty You might be an entrepreneur. If we work in a larger company, we could specialize in accounts receivable, accounts payable, payroll is becoming a bigger and bigger topic all the time as new laws are being put on the book payroll is become a specialty in and of itself. We can also have public accounting. So that’s audits and taxation area that we can work in. And entrepreneur, we can be working for ourselves, and we can apply these accounting skills to our personal business. So the accounting skills are really applicable. And there’s a lot of different areas, we can go within accounting.

09:33

If you’re taking this course and you’re already in one of these areas are focused in one of these areas. These are going to be the core fundamentals you’ll need in order to expand to any of these types of areas. If you’re a student and you’re just starting in accounting, then you can think about going and continuing with accounting. At some point in time, you’re going to have to specialize and these are the types of things you’re going to want to think about. accounting is still a very broad major, and you’re going to Want to narrow that broad nature down to something either related to one of these also by industry, you might want to work in construction versus merchandising industry, you might want to break it down by whether the company has inventory or not. But there’s there’s a lot of options within the field of accounting. Also, accounting is just good in terms of mental capacity. So things like math skills and thinking about puzzles.

10:27

Oftentimes, people actually enjoy doing those. And it’s also good for your brain just to work through puzzles and work through problems to work through math problems. Accounting isn’t so much a math problem is more related to a puzzle like it’s putting pieces together, moving different pieces around. Once you learn how to use software like Excel, then it becomes a lot more like a puzzle. We’re just basically kind of moving the pieces around in many areas of accounting, and that’s really good just mentally it’s just really good practice to do those types of activities. What is accounting? accounting is going to be the compilation of information that is going to be financial transaction related. For example, we may have invoices or bills, we’re going to compile those financial transactions in something such as using debits and credits.

11:15

This is a trial balance. So all of our financial transactions, we need to compile that information in some way that is useful. We can imagine all the transactions, we have all the all the transactions we make in terms of cash transactions every day, that we’re going to have to compile that data, we need a way to put that data in a format that we can then use it in order to make decisions. So the end product generally will be financial statements, financial statements, including the balance sheet, the income statement, the statement of equity, the statement of cash flows. These are typically the end product for financial accounting. And the goal of this end product is that it’s in a format. It’s taken this financial data that we have been putting together.

12:00

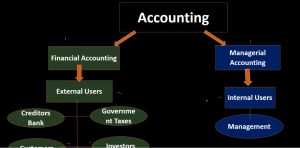

We needed to do throughout a certain time period a month or a year. And it’s putting that information into a relevant form for us to make decisions. And for other users to make decisions. external users such as creditors, such as vendors, such as banks, there’s going to be two broad categories of accounting we want to think about when considering accounting. We can break these categories up into many different subcategories but these are the two very broad categories you want to have in mind when considering accounting, that will be financial accounting, what we will be focusing in on here, and managerial accounting. Financial Accounting is going to deal with external users, whereas managerial accounting is going to deal with internal users.

12:46

This can be confusing because it is the case that managerial accounting is going to use much the same data that we will be using in financial accounting in order to make those managerial decisions. However, the Financial Accounting is geared towards the external users, those been creditors. So if we want to get a loan, the government in the form of taxes is one way that government would need the data, possibly customers, and investors, especially if we’re publicly traded, we’re going to need to provide this information to investors. Because these individuals are outside of the company, they don’t have intimate knowledge of the company. And they may not have the same kind of level of trust within the numbers that are within the company. Therefore they have they have different needs in that they need some more standardization of the numbers, and they need more regulation of the numbers.

13:38

So although the numbers are going to be the same basis on which those financial transactions being the basis on which the managerial data will be set, the financial accounting data will have much more regulations. It’ll be much more strict in terms of how exactly are we going to put these financial statements together? What exactly Does a balance sheet look like? How is it put together? What does an income statement look like? How is it put together, we need to have very strict rules so that these external users can have a good idea of what it is they’re looking at. In terms of managerial accounting, we’re geared towards management, the internal users, management is still very concerned with those same financial transactions.

14:22

So we’re going to use those same financial transactions. However, we’re not tied down to having to make the financial information exactly the same as the financial statements, we may start there, that’s going to be usually the bigger base, the broader base, the big picture, but we might want to compile that data in different types of ways using different types of reports, often narrowing down in different areas. So we can make decisions in terms of how different departments are doing in comparison to the business as a whole, for the reason that the managerial accounting is internal and they have intimate knowledge. of the of the industry.

15:02

There’s not as much regulation within managerial accounting managerial accounting is regulated by best practices, we’re going to do what we think is best, we’re going to follow those best practices in order to make the best decisions, business entities, types of business entities will include the sole proprietor, that’s where we’re really going to focus on here is the sole proprietor. Note that the principles of the transactions will be the same for our other type of entities. But the sole proprietor is a good place to start, because it will focus in on the equity section of one individual for the entire equity section, which will simplify the process a bit. The downside of a sole proprietor is that there’s generally liability problems in terms of there’s less liability protection than say a corporation. The pluses to a sole proprietor are that they’re very easy to form.

15:55

So the sole proprietor in terms of the total businesses The US is by far the largest number of businesses in the format of the sole proprietor. However, the revenue if we broke out the revenue, the corporation would be the greatest revenue generator. So the corporation generates the most revenue in terms of total dollars for the US economy. But the sole proprietor in terms of number of businesses is by far the largest mainly due to the fact that there’s ease in terms of being a sole proprietor meaning if we just start doing business, in essence, we are a sole proprietor, and we have our certain responsibilities. And one of those is to pay taxes on any revenue that any net income that we’re gonna have basically any taxable income, then we have a partnership, also very easy to form. It’s similar to the sole proprietor we had the similar liability problems, but now we have two people involved.

16:55

So the same ideas that we will put together in terms of a sole purpose. header will be applied to a partnership, the major difference between a sole proprietor and a partnership will be the equity section. So when you move from looking at transactions from a sole proprietor to a partnership, we’re usually not going to go back to the things that are the same meaning, we don’t need to go and revisit how to record the utility bill, or how to record an invoice, or how to record payroll, those are the things that are going to be the same. What we focus in on when we move from a sole proprietor to a partnership are the things that are different. The equity section is different meaning the value of the company now has to be broken out between two or more individuals. So a partnership could have two or more individuals. And we want to make sure that we’re allocating the information to those two or more individuals.

17:49

That’s going to be a very important component of the partnership. Then we have the corporation. The corporation is actually a separate legal entity. So it’s Legally a separate entity. From an accounting standpoint, this isn’t a whole lot different because from an accounting standpoint, we actually treat all businesses as separate from the owner. So when we work the books, the business will be treated separate from the owner in terms of the sole proprietor and the partnership. However, the corporation from a liability perspective is also a separate entity, which mainly has the benefit, one of the main benefits being that there’s more liability protection within the corporation than either the sole proprietor or the partnership. It’s also often easier to generate capital within a corporation in terms of selling stocks for an equity interest within the corporation.

18:45

Again, when we move to the corporation, all those most of the transactions are going to be the same. We’re not going to redo how to record the utility bill again and the payroll bill, all the normal transactions that we typically do will remain the same the dollar amounts may differ in terms A large corporation will differ in terms of a large corporation and say a sole proprietor or a small sole proprietor. But the essence of the journal entries will remain much the same in terms of recording the payroll or recording the utility bill. What will differ will be once again the equity section because who owns the corporation, the shareholders own the corporation, and therefore, we’re going to have to break out that equity section by the owners who in this case will be the shareholders. We are now able to list and describe reasons for learning accounting list and explain that types of accounting list and describe what types of entities