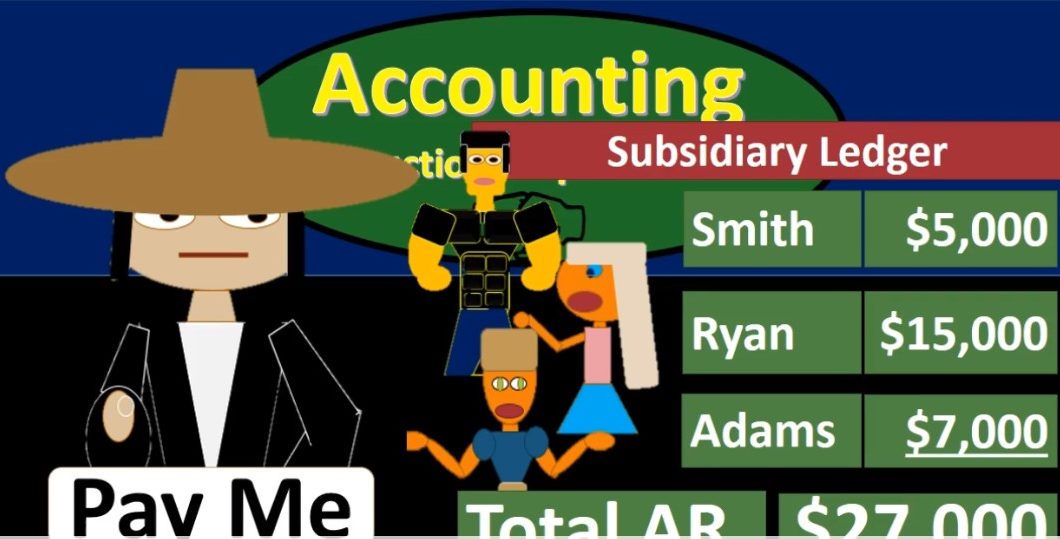

Hello, in this lecture we’re going to talk about the accounts receivable subsidiary ledger, the subsidiary ledger being the ledger that will be backing up the account of accounts receivable showing on the trial balance with 27,000. In it, in this case, accounts receivable being that accounts that represents what is owed to us. If we were the owner of the company, we might ask our accounting department, how much money do people owe us? In this case, it would be 27,000 would be the reply. Next follow up question would most likely be who owes us that money? And have we called them when are we going to get paid that money? In order to answer that question, we cannot look at the normal backup balance for all accounts that being the general ledger accounts. If we look at the GL we do get some detail in terms of the activity that has happened. However, that activity is not going to be in terms of who owes us the money. It’s in terms of date.

00:51

So every account has the general ledger which does give very good detail but not the detail we need in this case. What we will then need is that Information broken out by customer which will be in terms of a subsidiary ledger such as this. For example, it might say that Smith owes us 5000. And Ryan owes us 15,000. And Adams owes a 7000 for a total of the 27,000, the accounts receivable subsidiary ledger matching the general ledger matching the trial balance which of course would match the balance sheet. It’s important to note that this information is all put together using the same data. So the general ledger is often thought of as how we create or put together the information which the end result will be reported in terms of the trial balance, we can put that same data the same general ledger data into the subsidiary ledger.

01:41

That’s what we’ll do in this process. also important to note that because of that relationship, when we look at the end result, meaning the accounts receivable account in terms of the trial balance or the balance sheet, we can sort that data and backup that data in terms of a general ledger or a subsidiary ledger. Let’s take a look at some transactions for This transaction is a familiar one, we’ve seen it before we’re going to invoice the client. So we’re going to do work on account. Therefore accounts receivable is going to go up the IOU is going to go up with a debit, and we’re going to credit the income account, I’m going to post out the income accounts, I’m not going to post it to the general ledger account, it would have one but we want to focus in on the GL for the receivable. So if we post out that income, first, income would increase increasing revenue. For that time period, when the invoice was issued. accounts receivable, we’re going to first post it to the general ledger.

02:31

So the general ledger for accounts receivable increasing by that 35,000, which would then increase the total and the accounts payable GL to 35,000. And of course, the same would impact on the trial balance, increase in the trial balance to that 35,000. We can see then that after this journal entry, we have 35,000 in accounts payable, we have 35,000 in the general ledger, but we also want to see that information in terms of who owes us the money and in order to do that We have the subsidiary ledger broken out by client by customer. And we want to post the same information that same 35,000 to the information by customer. So it’s the same as the GL, except it’s a bit more detailed in that it’s by customer and then by date, and if we post that out, we see the 35,000 is owed by Smith. Now we have a total in the subsidiary ledger 35,000 total on the general ledger of 35,000, as well as in the trial balance and what would be on the balance sheet of that 35,000.

03:30

That relationship always has to be there. Next transaction, we’re going to assume that we paid so the customer then paid us we’re receiving cash cash is going to increase and we’re going to credit the accounts receivable not revenue because we didn’t do the work we did the work last time we’re crediting the receivable so when assets going up, when assets going down, I’m going to post the cash first because I don’t want to focus on the cash we’re not going to be looking at the GL for cash was gonna say cash is going to be a debit increase in the cash and then we’ll focus on the receivable, which we will post to the general ledger. So that’s going to bring the balance down we can think of that in two ways one the running balance 35,000 debit minus the new activity which is a credit bringing the balance down to zero or summing up the debits 35. So I’m going to credit 35 debits minus the credit within equals zero, same activity, same thing would happen to the trial balance bringing the trial balance down to zero, meaning trial balance now zero General Ledger now zero subsidiary ledger need that same information.

04:32

So we’re just going to post that same information on GL the same thing that is will be impacting the accounts payable subsidiary ledger however, it will be there by client or customer bringing that balance down. We’re back down to zero on the subsidiary ledger for AR and the general ledger for AR and the trial balance for AR new customer with a new customer we’re going to invoice a new customer we did work invoice goes out. That means debit Accounts Receivable credit the revenue account, we’re going to post the revenue first, again, because we’re not really focusing on revenue. So although it has a general ledger account, like all accounts do, we’re just going to post it to the trial balance, increasing revenue, then we’re going to focus on the receivable, we’re going to post that out to the GL, what would that do to the GL debit to the GL the general ledger for accounts receivable going up by that 14, that would bring the balance up to 14 calculated in one of two ways we can say it’s zero running balance was zero before plus a debit bringing it up in the debit direction, or we can say the debits 35 plus 14 minus the credits of 35 brings us to the 14 same thing would happen to the accounts payable up here.

05:45

So we’re saying accounts before the trial balance is going up to 14,000. Now we see that we have 14,000. In the trial balance for accounts receivable we see we have 14,000 in the general ledger for accounts receivable and we need to post that same 14,000 This same 14,000 needs to be posted to the subsidiary ledger, but by customer in this case and that customer being Adams here, so Adams is going up by that 14. Now we have zero plus 14 plus zero brings us to that same 14, the subsidiary ledger tying out to the general ledger tying out to the trial balance, then we’re going to have another invoice we’re invoicing another customer, same thing we did work invoice in the customer accounts as he was going to go up with a debit of that 27,000 we’re going to credit the revenue. Again, I’m going to post the revenue first not to the general ledger, although it does have a general ledger account but we’re not focusing on the GL for this particular account.

06:39

But revenue would then increase in the credit direction. Now we’ll post out the receivable it’s going to be another debit to the receivable in this case, increasing the receivable we can think of that two ways the 14 prior balance plus the 27,000 current activity brings it to the 47 or 35,000 debit plus 14,000 debit plus 27,000 debit That total minus 35,000 credit total would also bring us to that 41,000. That’s the T account format. And this is the running balance format. We posted out to the trial balance, we see the same activity the 14 plus the 27. Bringing us to that 41,000 we can see that then the 41,000 on the trial balance is equivalent to the general ledger account for accounts payable 41,000. We need to post that same 27,000 to the accounts receivable subsidiary ledger, but by customer, that customer bringing Ryan in this case, bringing the balance up to 27,000.

07:35

Now we have a balance of 41 total, including the 14,000 atoms, zero for Smith, could Smith paid off the balance and 27,000 for Ryan point being that subsidiary ledger is the same data in essence, as the general ledger is just posted in a bit more detailed of a fashion. We want to be able to know that relationship so that we can build the trial balance and also we need notes so that if we are using software, we know that we can sort this data one by geo by date, but also by customer and then date. And that’s also why much of the software when we work with accounts receivable will require a customer every time we post to the receivable but the software saying hey, I can’t make a subsidiary ledger unless you assign a customer. Therefore, we’re not going to let you post to this to the receivable account unless you assign a customer