In this presentation, we’re going to talk about special journals and subsidiary ledgers. First, we’re going to list out the special journals and talk about when we would use them, why we would use them and how they fit into the accounting system. The special journals are basically going to group types of transactions. So when we think about all the transactions that happened during the month, we typically see them in order of when they happen in the accounting system, we’re going to record transactions in other words, by date as they occur. But if we are able to group those transactions into special journals that can simplify the process.

00:37

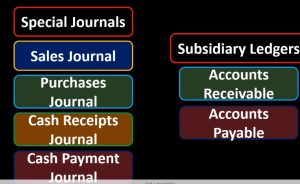

The types of special journals will typically be a sales journal. So we’re going to recruit we’re going to group sales transactions in other words into the sales journal. Then we have the purchases journal, so when we make purchases, we will group those items in the purchases journal, the cash receipts journal, so any transaction where we receive cash cash is going up. We’ll go into The cash receipts journal, and then the cash payments journal, anytime where the cash is going down when we have cash payments, we’re looking at the cash payments journal. Now why would we do this? We’ve seen accounting systems in the past either a manual system or an automated system where we haven’t seen so much of the special journals. Why would we want to implement special journals? The special journals are usually going to be used when we’re using more of a manual system, because it’s going to be designed to limit the type of data input that we have to put in place.

01:33

Now if we are using an automated system, it’s still really important to know different types of accounting systems such as special journals for a few different reasons. One is that when we process reports and print reports, we often want to see them in a similar fashion as the special journals that we will see as we make the information and to it’s good to see how different types of accounting systems can be set up to be able to tell what accounting system would be best in a certain situation. And in order to know what is crucial to an accounting system, and what can differ in an accounting system and how to make those differences and those changes those tweaks into whatever accounting system that we are putting together.

02:14

So when we think about this as compared to a manual system where we enter everything into the general journal, this is going to save time by allowing us to set up special Ledger’s, which allow us to put less information into the ledgers our allow us to not have to put a debit and credit in each transaction as we go and not force us to post that then to the general ledger, and then to create the financial statements, but instead to wait until the end of the time period, sum up what is in the special journals and then record that activity. We’ll talk about that in more detail as we look at these special journals, one by one. We also want to take a look at the subsidiary ledgers and these are going to be things at anytime. Need some added need to it that’s not given it by its controlling account, typically the general ledger account, then we want something like a subsidiary ledger.

03:09

The examples that we will be working with are the accounts receivable, subsidiary ledger and the accounts payable subsidiary ledger. Now these are going to have a similarities in that, for example, the accounts receivable subsidiary ledger is going to give us more detail than we find on the balance sheet or the trial balance or the general ledger. In other words, if we were to see an amount for accounts receivable on the balance sheet, say 10,000 that would represent people owning the company $10,000. However, the fact that it’s on the balance sheet doesn’t give us a lot of detail. We could get more detail by going to the general ledger as we can with any account and that would give us the detail by date. But of course what we really want is the detail by customer and in order to get the detail by customer we need another type of ledger to do so we’ll call that an accounts receivable subsidiary ledger similar story can be made for the accounts payable in that accounts payable represents who we owe money to. But the amount on the balance sheet doesn’t tell us much more detail than that how much we owe to somebody. If we want to know more detail, we can go to the general ledger, which will give us detailed by date order of transactions that made up that amount on the balance sheet. But we also want to see it by who we owe, we’ll call that by vendor. So those are going to be the subsidiary ledgers. We’ll get into a little bit more detail. Now in terms of the special journals and the subsidiary ledgers.

04:38

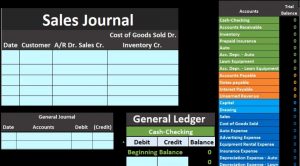

The sales journal could look something like this. Now remember, what we’re doing here is we’re grouping everything together. We’re going to take all these transactions and anything that has to do with a sales journal type transaction, instead of recording a debit and credit into the general journal, posting it to the general ledger, creating the trial balance and the financial statements as we go. We are just gonna post this to the sales journal, which is designed just to accommodate a very limited type of transaction meaning only the transaction that has accounts receivable, and sales can go into this journal. Note the name is a little deceiving thing, because really, it’s the sales on account. If we made a sale for cash in other words wouldn’t go into the sales journal even though we made a sale because we got cash and therefore it would go in the cash receipts journal. So we’re going to have to very limited transaction here it has to be a sale for on account to go on the sales journal here.

05:36

If we sold inventory, and we have a perpetual system, we would also have the cost of goods sold and inventory. Note we can just record this with one line item here. In order to do that we don’t need four accounts as we would when we record the journal entry, we can just record it into these two amounts here. We also don’t need to post it until the end of the time period, at which point we’ll sum everything up and then Make one transaction to the general journal for the entire time period, whether it be the day, the week or the month, we’ll be working with a month’s worth of data. So we’ll enter this into here for the entire month and then just make one journal entry for the entire month’s worth of data. So that should save a lot of data input time.

06:17

Then we’ll post that information to the general ledger as we would in a normal process as being the controlling account and use that to generate the financial the trial balance which we’ll use to create the financial statements. similar process for the purchases journal, purchases journal again a very specific type of journal here so anytime we make a sale, I mean, anytime we make a purchase on account, so it’s going to be in this case just inventory if we’re a merchandising company we make a lot of purchases our accounts payable In other words, all has to do with inventory purchases. Then this is a very nice journal because we can just record this in one journal entry format. One journal format here when Rick record into the journal here Rather than making a debit and credit into the general journal, and having to post that to the gym to the general ledger each time.

07:08

So once again, we just record this information every time we make a purchase here, and then post it for the entire month or the entire period, whether that be the day, the week or the month we’ll be working with a month to the general journal. Remember that this although it says purchases doesn’t mean purchase for cash only means purchase for accounts payable if we purchase for cash, it’ll go into the cash payment journal. So we’re going to we’re going to be able to save time by recording all this into this journal then making the general journal at the end which will be the total of all the transactions they’re using that then to create the general ledger or post to the general ledger the activity for the entire period in our case the month and then make the trial balance from that as well as the financial statements. Then we have the cash receipts journal similar to type of process notice it does look a bit more complex, because there could be more than one really restrictive thing we get cash for.

08:07

So the cash receipt receipts journal will group transactions by the process of receiving cash. So that’s going to be anytime we receive cash that’s going to be the driving format. Now hopefully we receive cash or this will be most effective if we receive cash for a limited amount of things such as if we make a lot of cash sales, then this journal will be very effective if we if we get a lot of our cash receipts are all coming from accounts receivable, this will be effective. However, if we get cash from kind of random areas, we’ve taken a loan out or the owners putting money into the business and stuff like that, then we might have some other type of accounts and we might have to post it into other and summing this up could be a little bit more complicated, resulting in at the end of the time period, a general journal, the total of each of these accounts being a bit more complex than it would for example, the The sales journal or the sales journal, which is going to be pretty straightforward in terms of the journal entry.

09:06

So this one could look a little bit more complex. And again, these journals work best if we can really categorize our expenses well, and then track all the same expenses and not need any kind of extra columns here or not need too many extra columns. So we’ll talk more about that when we go specifically into the cash receipts journal and work through that. Then we would do the same thing here we’re going to record the general journal to the general ledger, using the general ledger then to create the trial balance which would then be used to create the financial statements. Finally, we have the cash receipts journal, same kind of story here, we’re going to group all these transactions together at this time by the common characteristic of the cash payment is the cash payments journal. So anytime, in other words, cash goes out of the company, we would record it here to the cash payment journal. Again, it’s a bit more complex of a journal because we could be paying For many, many different things, cash payments, probably the most diverse type of thing we have within our journals because we could be paying for different things such as different types of expenses.

10:11

But it’s best to have the journal if we have a limited amount of transactions, meaning if our cash payments are going for something in particular, most of the time, such as buying supplies, or buying merchandise or always paying off on account, that’s when the cash payment journal will be most effective. And in any case, we’re going to do the same thing. We’re going to enter this information into the cash payments journal, anytime we’re paying cash and that’s transaction. And then we’ll take the totals and record that to the general journal using that 10 to to post to the general ledger that will then be used to create the trial bounds and financial statements. Now we’re also taking a look at the subsidiary ledgers and remember, that’s going to be the accounts receivable and payable. So for example, if we look at the receivable subsidiary ledger and this would be applicable to any type of system that has accounts receivable or payable, meaning even if we’re using an automated system, we need more than just the general ledger data.

11:11

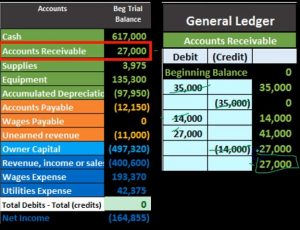

And most automated systems will do this automatically. But we need to know what the automated system is doing. And if we have a manual system, then we would have to do this manually, we would have to not only have this recorded in our journals, but also be putting this information by customer so we know who owes us money, so we could track that. So for example, if we have accounts receivable on the trial balance, that means that people owe us money. And if we can want more detail than that, we can go to the general ledger, the controlling account just as we can do for any other account on the trial balance. And it does give us a lot more detail. This is the activity that made up that 27,000 that’s on the trial balance. But all it’s doing is it’s giving this activity by date. I can guess what happened. This is probably an invoice. This is probably we got paid on on the invoice we probably made a sale here, we probably made a sale here, we got paid for this sale we made up here, and so on and so forth.

12:09

But what I don’t know very easily from this is who we made the sale to and who still has not yet paid us. Therefore we need to get to the same data the same 27,000 not by date, but by subsidiary ledger, which is going to say something like Will Smith owes us 5000 rhinos is 15 Adams owes a 7000. That’s what gives us the 27,000 and then of course we can go hey Smith, and Ryan and Adams could you we would like to be paid at some at some point in the future if it’s not if it’s not too much of a problem and go through and go through there and track it. So note that this should always match what’s on the general ledger and the trial balance. Now the same is true for the accounts payable the accounts payable is going to tell us who we owe money to we purchase something we owe money somewhere else.

13:00

We will get more detail from that, like we would with any accounts from looking at the general ledger account for accounts receivable. But again, it doesn’t give us the type of detail we need or not the type the only the type of detail we need. In other words, it gives us transactions by date, we could get information from it. This means this looks like we bought something on account, we bought something on account, accounts payable went up, we paid something off, then we bought something else again, we bought something else again, and then we paid some of it off. So that’s going to be the trend there. But it doesn’t tell us who we owe who we’re going to write a check to who do we who do we make the payment to, for this 1006 40 to know that we’re going to need the subsidiary ledger which would say something like Office Depot wheels 682 and as food will 640 and Al’s auto wheel 320 that’s what makes up the 1006 40.

13:53

That’s who we actually have to contact and pay in some format to make the account. payable go down. So remember these special journals are going to be those types of journals will use in more of a manual system. Rather than posting everything to the general journal and or recording everything to the general journal and then posting to the general ledger. Each time we have a transaction, which could take a lot of time in a manual system. We will group information throughout the month by similarities of transactions, sum them up at the end of the time period, and then make one journal entry for the entire month worth of transactions for each special journal, which will save time the typical special journals will be the sales journal, the purchases journal, the cash receipts journal, and the cash payments journal. Of course, the names give an indication of how we’re going to group this information, but they’re a bit deceiving. That sales journal only mean sales on account if we make sales on for cash.

14:55

Even though we made a sale it’s going to go in the cash receipts journal The purchases journal is going to be for purchases we made on account. If we make purchases for cash, it’s going to go in the cash payment journal. Now the cash receipts journal and cash payment journal are what they are. If If we receive cash or if we pay cash, then it’s going to go into the cash receipts or cash payments journal respectively. Then we have the subsidiary ledgers. We’ve talked about the two subsidiary ledgers, a subsidiary ledger would be needed. Anytime we have some kind of grouping of information that’s over and above what is given by the controlling account given by the general ledger, that being information in order of date of transaction. The examples that we have are going to be the accounts receivable account, where we need to know information by customer who owes us money. And the accounts payable accounts where we need to know information by vendor. Those two things being something not shown on the balance sheet or the controlling account that general ledger account.