QuickBooks Online 2021 adjust opening balance equity accounts. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars a practice problem, we’re going to continue on entering our beginning balances into our QuickBooks system. In prior presentations, we’ve been taking this trial balance, we’ve been entering all the beginning balances in these accounts, our objective and goal being to enter the beginning balance account by account, and then having the other side be placed by QuickBooks in the equity section in one way or another, either by putting it into the default account of opening balance equity, or into an income statement account as of the prior year to the one that we’re going to start our business in.

Posts with the Debit tag

Net Assets Released From Restriction 172

This presentation we will record a transaction related to net assets being released from restrictions. In other words, we have net assets that had some restrictions put on them, we’re going to be spending money in such a way that it will be releasing the net assets from restriction will record the journal entry to move those net assets from a restricted area to unrestricted so that they can be used and reflected on our statement of activities and statement of net position. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard. Let’s head on over to our Excel worksheet to see what our objective will be. We’re over here in tab 10. So tab number 10. On the Excel worksheet, you’ll recall in previous presentations, what we have done thus far is we’ve been thinking about recording transactions in terms of journal entries, the accounts that are affected, and then putting them into our trial balance.

Allocate Expenses to Categories Part 2 171

https://youtu.be/H1D3e6dKlTI?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

This presentation, we’re going to continue on allocating our expenses by category by function, including by program, admin, and fundraising with the use of our tax feature within our accounting software, get ready to go with aplos. Here we are in our not for profit organization dashboard, we’re going to go on over to our Excel file to see what our objective will be. We’re continuing on with the allocation of our expenses, you’ll recall the objective being that normally we have our expenses broken out in the statement of activities here. And we need to break them out both by function and what they’re used for by nature and by function.

Allocate Expenses to Categories Par 1 170

https://youtu.be/F4FtVtXckPo?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

This presentation and we’re going to start breaking out our expenses by nature. In other words of what the expenses are used for with the use of the tags, the categories being the education, the community service, the administrative and the fundraising for that 4020 2020. Being the allocation percentages, we will be using, get ready, because here we go with abalos. Here we are in our not for profit organization dashboard, we’re going to be heading on over to Excel to see what our objective will be.

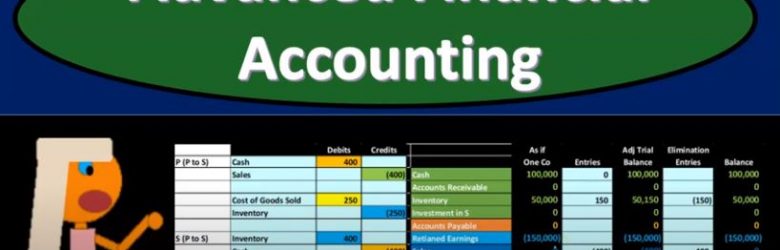

Sale From Parent to Sub Sub Has Not Resold

Advanced financial accounting PowerPoint. In this presentation we will discuss a situation where there is a sale of inventory or transfer of inventory from parent to subsidiary, the subsidiary not having yet sold the inventory. So in that sense, we have an intercompany type of transfer. When we consider the parent and subsidiary as a whole with regard to a consolidation process, the parent sold to the subsidiary the inventory, the subsidiary still holding on to that inventory has not resold it externally at this point, get ready to account with advanced financial accounting. What we want to do now is think about the transaction on p side and then on SSIS, and then what the elimination entry will be. So there’s a couple ways you can think about this, you can kind of memorize what the elimination process will be what the elimination entry will be and put together worksheets to do that elimination process kind of by just routine by just filling out the worksheet. And then you also want to analyze the worksheet and think about it in detail in terms of what is actually happening.

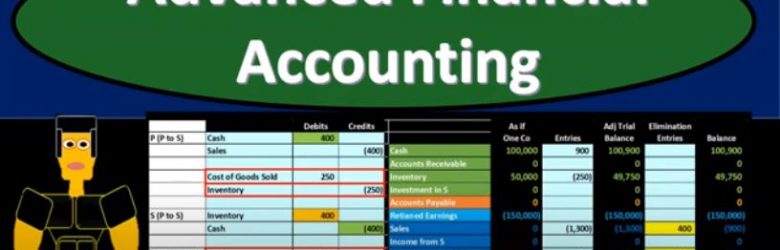

Parent Sale to Sub & Sub Resold

Advanced financial accounting. In this presentation we’re going to discuss an intercompany transaction where a parent makes a sale to a subsidiary and then the subsidiary resells it. In other words, we have this intercompany transaction, we want to think about how that is constructed. And then how we can do the reversing entry for it or a consolidation entry in the case of a consolidation of a parent and subsidiary in a consolidated financial statements, get ready to account with advanced financial accounting. So within a situation where we have a sale from P to s, and then S sells it to an outsider remember that as it goes to the outsider, that’s going to be the legitimate type of so that’s the arm’s length transaction, the sale from PETA is not so and therefore we kind of have to eliminate that. Now if it’s been sold to an outsider, then we have a situation where the inventory is still gone. There has been a sale being taken place. And so we so that’s good, but we still have to do the reversal of part of that intercompany transfer and it’s gonna boil down At the end of the day, basically debiting, the revenue account reversing revenue, and reversing the cost of goods sold. So this is the boiled down version. Now if you think about it, you might say what happy because if p sales to s, then you’re going to like debit cash credit, you know, you’re going to credit the sales, and then you debit cost of goods sold, and credit inventory and then asked is going to be recorded cash, and then they’re gonna be recording, then the other side go into inventory, and then right, there’s more, and then they made the sale to the outsider. So how do we boil this down? How does the intercompany boil down to just this right? We kind of kind of have an idea of that in our mind.

Acquisition Accounting Bargain Purchase

This presentation we’re going to continue on with our discussion of acquisition accounting, and this time focusing in on a bargain purchase, get ready to account with advanced financial accounting. First off, we can basically think of the bargain purchase as the opposite of goodwill. So in a prior presentation, we talked about the concept of goodwill within an acquisition, which would be resulting if the fair market value of the amount that was given like basically the purchasing price was greater than the fair market value of the net assets. So in other words, we take we look at the books of the company that’s being acquired, we’ve revalue their assets and liabilities to be on a fair market value, then assets minus liabilities, the equity section, the net assets now at a fair market value, we take a look at that. And if there’s a consideration that’s given that is greater than that amount, that then would result in goodwill. Now goodwill is quite common, because it’s unlikely even if you even if you re assess all the assets and liabilities to their fair value. Then you would typically think that the price would either be that that would be given the the amount that would be exchanged, the fair market value of the consideration would be the same as the assets minus the liabilities at fair market value, or more, because there’s some type of goodwill, that’s going to be that’s going to be in the organization. Now, you might be thinking, Well, what what if it was the opposite? What if you took the fair market value of the net assets, and the amount that was given the exchange amount was less than the fair market value? Now that could happen, but just note that that’s a lot more unusual.

Creating a Statement of Cash Flow-Indirect Method-Accounting%2C financial

Hello in this lecture we’re going to talk about creating a statement of cash flows using the indirect method, we will be able to define a statement of cash flows, create a statement of cash flows explain a process of creating a statement of cash flows designed to limit mistakes and define the indirect method. So what we’ll do is we’ll work through basically a problem and look through the statement of cash flows. We want to think about a few things we want to think about how to create a statement of cash flows, we want to think about a few definitions of what is a statement of cash flows, we want to kind of explain what the purpose is of a statement of cash flows and going through the process can help us to do that. Also want to point out that creating the statement of cash flows can help us with setting up a problem in such a way that we can limit the amount of mistakes that we will make. So a statement of cash flows is something that in a lot of firms, people generally often have problems to create the statement of cash flows. And it’s good practice to go in there and and create the statement of cash flows and try to create a system in which it’s easy for us to have checkpoints and see where a problem is going to happen.

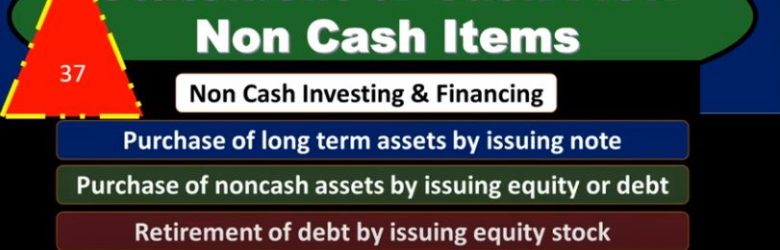

Statement of Cash Flow Non Cash Items

In this presentation, we will take a look at the statement of cash flows non cash items. First question, why would we be looking at non cash items when considering a statement of cash flows? We’re gonna go through a list of non cash items first and see if you can recognize a trend in these and why we might be linking them to a statement of cash flows discussion, then we will explain more fully on the idea of looking at non cash items when considering a statement of cash flows. So, some examples of non cash items would be the purchase of long term assets by issuing a note the purchase of non cash assets by issuing equity or debt, the retirement of debt by issuing equity stock, lease of assets in a capital lease transaction and exchange non cash asset for other non cash asset. Consider these examples and note some of the common features including the deal with investing and financing activities. and think through why we might be linking them to a statement of cash flows. We’ll go more fully through this by giving an example of the purchase of long term assets by issuing a note, an example that we can then apply out to the rest of these items. So what are we going to do with these non cash items, we’re going to report them at the bottom of the statement of cash flows or report them in a note related to the statement of cash flows. So we’re going to have to say in some format, or other, hey, look, these are some non cash items that we’re linking to, for some reason, the statement of cash flows.

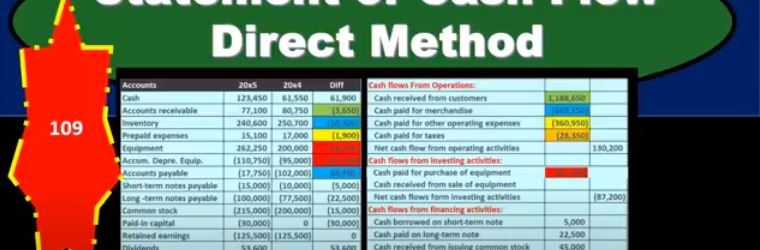

Statement of Cash Flow Direct Method

In this presentation, we will take a look at the statement of cash flows using the direct method. Here’s going to be our information we got the comparative balance sheet, the income statement and some additional information. And we will use this information to put together our worksheet which will be the primary source used to create the statement of cash flows using the direct method. This is going to be our worksheet. Now most of this worksheet will be similar to what we have done for the indirect method, in that we took the difference in the balance sheet accounts. So we’re taking the current year and the prior year, the current period, the prior period, all the balance sheet accounts, we’ve got cashed down to the retained earnings for the balance sheet accounts. But we’re also in this case going to give us the income statement accounts for the current period. So in other words, we’re going to break out the retained earnings the amount to its component parts, meaning we’ve got net income being broken out on the income statement. We’ve got sales cost of goods sold, the income statement accounts. So it’s going to be our same kind of worksheet here, we’re going to be in balance, we’ve converted it from a plus and minus format, we’ve removed all of the subtitles as we did under the indirect method.