It’s not good for your back.

If somebody up there really needs something they can come down so you can give laterally rather then up. . .

especially if you are giving something heavy.

I Don’t Think Anybody Should Ever Give Up

It’s not good for your back.

If somebody up there really needs something they can come down so you can give laterally rather then up. . .

especially if you are giving something heavy.

I Don’t Think Anybody Should Ever Give Up

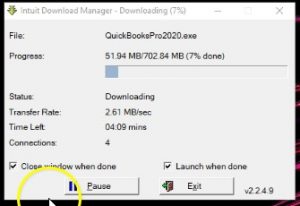

This presentation and we will go through the installation process for QuickBooks Pro 2020. And prior presentations that we have downloaded the software, we’ve actually purchased the software from the Intuit website, the owner of QuickBooks, we have downloaded the software. And now the download or installation software is on our computer on our machine. We’re now just going to run that system in order for it to then install the actual QuickBooks program. This is the icon that we downloaded.

0:30

Remember that this is not the actual QuickBooks program. This is the installation program. This would be very similar that if you had the CD that you would purchase from my box in a store that would have the installation, then once you enter that CD, it would then have to be running in order to install the program. Same concept here, this is the icon and we have to run we should simply be able to double click on it in order to run it.

0:52

That’s what we’ll do now. Double click QuickBooks is a fairly large program. So note it will take some time and note that if you when you’re running QuickBooks, you want to make sure that the machine is capable of being able to handle QuickBooks it is a larger program to run. Next we’ll see a screen that looks like this, we have Welcome to the install shield wizard for QuickBooks financial software Pro Series 2020 r1.

1:16

The installation wizard will help install QuickBooks financial software Pro Series 2020 r1 on your computer to continue, click Next. And we will simply do so next. So within the installation process that then says Welcome to QuickBooks desktop, this wizard will guide you through your installation. Please close it any open programs, especially virus protection programs before continuing.

1:41

If you have some type of virus protection programs, sometimes they can cause a problem with the installation process, then, of course, you want to be able to look through the terms read through the terms. And then we need to be able to accept the terms or else QuickBooks will not run the process. So we’re going to say that we want to accept the terms of the license agreement and then can you forward. Next, they have the license and product numbers, you’ll find these numbers on your packaging or your confirmation email.

2:09

So note, once again, these are those numbers that I’ve told you that we’re going to have to see it that we will be seen again, which we saved and we printed, you should also have an email with those numbers as well. When we installed the information, we saved these numbers, we made a screenshot of them, we put them in a Word document, we printed them, the word document looks like this, where we used a screenshot. And if you didn’t do either of those, check your email, hopefully it’s there.

2:32

We’re going to need these numbers. Anytime we try to enter this into a new machine. If we had another machine and we’re going to try to put this software on we would need it once we’re done, we would of course, select Next. So I’m going to enter that data and select Next. Now, next we can choose the installation type. For most people, the Express version will be fine. So if you’re a small business and you’re putting this on your machine, typically you would want the recommended Express version.

2:56

If you look at it, however, you’re going to replace the current version, use existing settings and copy preferences. So it’s going to say hey, what do you currently have in the current system, I’m going to copy the settings and preferences, in essence, and use that current settings in the new version. So you don’t have to basically update everything. If you have some networking needs, if it’s going to be on a server specially if you can have multiple users that will be using it at the same time, then you probably want to contact your IT expert and go through the custom setup and make sure that the network is set up properly.

3:28

In other words, if you’re just going in there with one user at a time, and especially if you’ve had the software before it’s on one computer, then typically you would think that the Express system would be best it’ll copy the prior preferences on it, and then put in the the new system for it. If you have multiple users.

3:45

However, in a more advanced accounting system, then you might be putting it on a server and may need to customize and network options with the custom location upgrade Advanced Server options. Also note if for whatever reason, you wanted to have the 2019 version and the 2020, then you might want to look into more customizations as well. This could happen if you were working with a bookkeeper if you’re a bookkeeping firm, and someone was to give you the 2019 file and you want it to return it to them. In other words, you can always update the file. So if they gave me a backup in 2019, I can update it to 2020.

4:28

But then if I gave them the backup, again, they couldn’t use what I give them on their system, if I give something from 2022 2019 software, they will typically not be able to use it on the older version. If they give something from 2019 to 2020. However, we will be able to use it but to do so will have to update the software. And therefore if I was to give something back, they wouldn’t be able to use it on their side.

4:53

So it’s a one way system that you can advance the material typically up to the current version, but you can’t go back then and open it in the prior version. Now I’m actually going to use the advanced system because I do want to have QuickBooks 2020 and 2019. Therefore the differences the default setting here replaced the version selected below with the version I’m installing here, versus I’m going to change that I’m going to say I want 2020 installed on my machine and 2019. And this is the reason I’m going to go into the more complicated type of setup. So I’m not going to mess up with the networking system here, it’s still on the machine.

5:30

But I am going to make that slight change. If you want to just simply replace 2019, then you can go to that express method. So I’m going to select Next. It’ll then give us one last check, we’re ready to install. And we’re going to say all right, install it, let’s do it. Once again, this installation process could take some time, they’ll typically go through some information down below.

5:51

Welcome to QuickBooks, desktop 2020, work faster, get paid faster, they have the new flow tools. So they’ll often when you’re looking for QuickBooks, see if you will have to have some add on type of features, those add on features, of course being the payroll type features, maybe things like purchasing checks that would be associated or be going along with the QuickBooks system.

6:12

So we’ll just sit and go through the installation process. Now. At the completion of the process, we hopefully get a message such as this, which says congratulations, QuickBooks desktop has successfully installed, I’m going to go ahead and close this look for the QuickBooks desktop icon. And then we can open it from there. So I’ll close this up. We didn’t see the QuickBooks icon here, which will be this green icon with a QB it’s got QuickBooks Pro 2020, down below.

6:41

Now oftentimes, when you’re going to open this thing back up, it wants you to restart the computer. So we’re going to restart the computer and then we should still have this icon here. This then is going to be the icon that we can double click on to open up the actual software. So note, this is the icon that that looks like what it looks like to run the software as opposed to the icon at the beginning of this presentation, which is the installation software.

7:07

Also note that QuickBooks is a little bit different than other types of software when we think about word, or if we think about Microsoft Excel, where we oftentimes go to the actual file, open up the file, which then opens up the program of Word or Excel to run the file that we selected. In other words, if we want to open up the letter that we wanted to go to, we double click on the actual letter of the file, which then opens up the program, which will open up the file, typically with QuickBooks will usually just opened up the software first.

7:38

Even though we could have multiple different software programs within it, you can possibly you can go to the actual file and open it in a similar fashion as Microsoft Word. But usually that’s not the case. Usually we open up the program, and it will simply open up the previous file that we were using. If we only use one QuickBooks file, it will always be at that location. Just remember that we want to make sure that we know where that location is of the actual file, not just the QuickBooks software. So that’s going to be here, we’re going to go ahead and restart the system.

8:14

We have now restarted the system note we have the two icons on the desktop, this is QuickBooks 2020, QuickBooks, 2002 and 19. Right beside it, so it is possible to have both of them on your system. And there are some times when that might be advantageous. You’ll recall that this is the system or the icon of the item that we used in order to run the program. In order to open up the program, we can of course, just simply double click on the icon.

8:40

As I do I get a pop up here says activate QuickBooks desktop now activate QuickBooks desktop. Now to continue using QuickBooks desktop without disruption and receive product updates as they become available. We can continue and learn more, I’m going to begin and activate the we then get a confirmation your activation is now complete, we can then provide a review to QuickBooks to see how they did.

9:05

Also note as we go through the setup process, we may get some more items that you might see pop up this could change over time that will be included. Do you want to add payroll? We’ve seen that a few times? Do you want to add checks or other types of resources? These are types of items that are going to be paper items typically, that can run and print out of the QuickBooks system, and therefore they match up well. So they’re basically asking, would you like to purchase checks?

9:29

Would you like to purchase them other stamps or printing supplies that could coincide or work well with your office products such as QuickBooks, we didn’t have an item saying how QuickBooks desktop uses your internet connection about QuickBooks, desktop and your internet connection. Now remember, the QuickBooks is on the desktop, but it does get updated a lot. So because we want to be on the most latest system, it’s going to have to connect to the internet in order to do that. So we provide feature called automatic update, which is turned on by default.

10:00

So by default, QuickBooks will be updating. So if you notice your computer like running slow or doing something funny, at some point in time, it may be that of course QuickBooks is running, connecting to the internet in order to get that automatic update. Update ensures that you’ve got the latest QuickBooks updates and improvements. What are my options, leave an automatic update on means that you agreed to receive product updates from an automatically via your internet connection.

10:29

If you want to learn more, or turn off these features, go to the Help menu and click this item. So you might want to set it up and you say hey, I’d like to turn off the automatic updates, I’d like to tell it when to update. And that in that if that’s what you would like that you’d have to turn on a default turn off the default setting, which are to have the automatic updates to be downloaded automatically.

10:51

What happens when QuickBooks desktop needs to access the internet, QuickBooks is web enabled, some features required internet access, it will open in a browser window. If QuickBooks can’t find a connection, it may ask you to establish one for details on how into it respects your privacy. See these issues below. Obviously, the fact that it’s going to end from QuickBooks and the Intuit website downloading data from the website, we want to make sure that’s a secure connection.

11:20

Typically, you would think QuickBooks being into a large company, they would have that a fairly secure connection, but you want to basically check the terms you can go into more detail on that and select okay here. Normally, when you open QuickBooks, it’ll open to a screen such as this or to the prior company file you were in. Typically it’ll open to a screen such as this, this will give you a window of the latest type of set of documents or QuickBooks files that had been open.

11:47

So if you only work with one company file, in other words, even after the install, you will have this page which will have the latest file or the file that you typically work on. You can open it up directly from here. Remember that we opened up the software, the files are separate from the software, the QuickBooks files. If we only have one company, then QuickBooks will be recognizing that company we can just simply go into it although we want to know where that file is on the computer. Next time we’ll go into more detail about these items within it. The software is installed this time

In this presentation, we will walk through the purchase process and the download and installation process of QuickBooks Pro 2020. Therefore, we will be purchasing QuickBooks Pro 2020. From the Intuit website, Intuit is the owner of QuickBooks. As we go into this. Note that you can purchase QuickBooks from other locations such as Amazon, other types of stores. However, note that

0:25

Intuit is the owner of QuickBooks, if you would like to purchase it directly from the owner, then you would want to go to the Intuit website. You also want to make sure and check into whether or not you can get discounting codes related to the QuickBooks desktop possibly be lowering the price related to it.

0:44

If you are a student, and you want to use QuickBooks for a student related purpose, then you may be able to get a free version for a limited time typically something like a year, which is something you definitely want to look into. If that applies to you. You may also be able to purchase QuickBooks in a store and get the physical copy of QuickBooks that you would then get a disc that you can then apply or download into your system.

1:10

So you can actually go to a store such as Office Max Office Depot, typically be able to purchase the software at that location and then install it into your machine, we here are going to be purchasing it once again, from the Intuit owners website. Note that ultimately, we are purchasing the desktop version, not the online version, therefore, we’re going to be able to download we’re gonna have to download the installation program, which if you purchase QuickBooks would typically be the thing that would be on the DVD or the CD that would be provided with the purchase within the box, we’re going to have to download that installation program.

1:47

And then we will go through the installation process installing that program. In this presentation, we will be purchasing and downloading the installation format. And then in a future presentation will go into the installation process of it. The website we will be going to will be intuit.com.

2:05

Remember Intuit is the owner of QuickBooks, you probably want to go there or at least visit their directly if you want to be purchasing QuickBooks or are considering the purchase of QuickBooks, whether it be there or at another location. If you are a student and you want to get a version of QuickBooks temporary, or usually a temporary version, in order for practice for students that which may last something like a year, you could go to this website, we will include this website in the description as well.

2:32

Or you can do a search for into it for students. And you should be able to find and see whether you have the discount codes for it. And if that’s something that applies to you, again, great tool for that. So here’s the Intuit website for students that if we scroll down, we see the students at accredited academic institutions are eligible for a one year student registration, college, university and trade school students, please complete the form below tick, confirm eligibility and unlock your free license for QuickBooks desktop.

3:04

Now that would be perfect for a course like this, because then you have basically a year that you can complete the course as you would have the software along with it during that time period. If you do not have any of those options, I would recommend then just simply go into the

3:19

Intuit website@intuit.com. You’ll note that into it has multiple software’s that they own, including QuickBooks, turbo tap, and other types of tax software. Here, of course, we’re going to be looking into QuickBooks. Now note that as we go into QuickBooks, it’ll typically be advertising the QuickBooks Online.

3:37

And as you think about this, you might be saying, Well, why are they advertising QuickBooks Online? Is it the fact that QuickBooks desktop will be going away? Given the fact that QuickBooks desktop is a substantial portion of the revenue source for for into it does not look like QuickBooks is going to go away anytime soon. But clearly, the preference there is to basically be marketing to quickly books online.

4:00

So just note that when you go to the website, you will typically be guided to the QuickBooks Online at type of version, we’re going to scroll all the way down to the bottom of the page where we can get a simple list of all the different types of QuickBooks versions that are there.

4:15

So I’m going to go down through all the type of advertisements, this is all the stuff that’s going to be included, I’m going to go all the way down to the information at the bottom, now I have a maximize screen, if your screen was not maximized, then you would see it in this format, let’s just check it out real quick, it would look like this, you’d have the products on the on the left, we’d have the features and the resources. Now these are all going to be basically a list of the products that into it has and of course once again, what’s on top QuickBooks Online.

4:44

So QuickBooks Online QuickBooks self, QuickBooks Online, advanced, then we’re going to go down to the desktop versions for the Mac, we’re going to be considering the desktop version here, we’re going to be considering the desktop version for the pro feature. Now also note that it was thought for a while that the Mac version, they might be you know doing away with because they were fading out of the Mac version. But it looks like they have updated the Mac version here.

5:10

So you should be safe with the Mac, it should look very similar to Pro, although just because of the difference between the systems, the Windows system, and the Mac, there could be differences within the format. I do if you have if you don’t have a preference, or if you’re not really a Mac user, and you’re thinking about which one to use, I strongly advise that you go with the pro if you can, if you’re not a Mac user, I know you’re a Mac user that you want the Mac for dinner.

5:37

But I mean if you can if you if you don’t have any other things that pulling your decision. The reason is because most people that use QuickBooks, most accountants are using the pro or a Windows type of system. Most accounts have Windows type system. So the pro version is by far used more and more widely used by the people that are experts in the system, although again, they should be much simpler and functionality. So we’re going to go into QuickBooks Pro. Within QuickBooks Pro, we’re looking at the pro 2020.

6:10

You also have the Pro Plus 2020. Again, if you look at the features, as we seen in a prior presentation, same features, but the plus adds the unlimited customer support support, automatic data backup and recovery and access to the latest features. Also note that either version then is going to go through the option of the payroll or the unlimited support, which you could then add on to it as opposed to over here we have to payroll and the cloud based access.

6:39

Now these are going to be those add on items, we’re not going to be adding them on here or we will not be needing the payroll or the other item will be using the manual payroll to work through it. So all we need is just the Pro, we’re not going to need any add ons. As we go through our practice problem. The current price as we make the video here is going to be the 299 nine, if you could find a discount out there, look forward, get one if you’re a student at an accredited university, and you want to use this simply for practice purposes, then you can look into that option as well.

7:11

When you add the pro plan to the cart, it will try to ask you if you want to add on the payroll because that’s going to be a very common add on. So if you have employees and you’re Of course can have to decide whether or not you have to you want to add on the payroll, you don’t necessarily have to because you may not be doing payroll within QuickBooks, you may decide to have an outside payroll service such as a dp or paychecks some other outside service to help you out with the payroll.

7:36

So as you purchase the QuickBooks, note that you want to be considering whether or not you have employees, you want to be considering whether or not you need to process things like w two forms, and quarterly payroll taxes and then consider whether or not you want to do that within the QuickBooks system, or use some external source. In order to do that. We’ll discuss that in a bit more detail as we go through the problem.

7:58

Once you purchase QuickBooks note, if you do not add on the add on, you can of course added on at any time, QuickBooks will be happy to tack on the payroll for you. So you can add it on later, we’re going to continue now without the payroll, I’m going to scroll down continue without the payroll. So then within the cart, we’ve got the fulfillment method, it will be a download.

8:17

So remember, this is going to go on to our computer, we will be downloading the installation package that will then have to install which should be just as easy as basically putting a CD into the computer and then it basically runs by itself, we’ll just have to get the installation on our desktop, find it which should be on the desktop and then double click on it installing that installation package.

8:40

So everything looks okay here, we then go to the checkout system, then of course, we have the payment information that we would have to fill out related to completion of the purchase process. Once that had been entered would you would then say review the order down below. Once you’ve completed the purchase, you’ll have this confirmation.

8:59

Now it’s very important within the confirmation that you save this data, I would actually do a screenshot and or print the information down here. So we’re going to scroll down these two numbers or you’re going to need when you install it. So you want to have these numbers, I would print this information out I wouldn’t even just write it down and actually print it out.

9:18

You could print it to a cute PDF printer if you want to save it in a PDF format as opposed to printing it to a paper printing. Although you can print it on paper too. If you have a PDF printer or a cute PDF printer, which is a free PDF type of program that will basically be able to run anytime something needs to be printed and instead of printed will then save that document as a PDF file.

9:43

So and you can find that by typing in into a search field cute PDF printer, you should then be able to find something to download the free program in order to do something like this. So this is one option, you can then print this information so that you have the detail related to it in your system. It’ll then give the download type of information where then you can then save it as a PDF file.

10:06

Another option you can have is to just use a screenshot and that’s what I will do. Now I’m going to open up Word for example, here’s a Word document. And what I’ll do is I’ll use this snippet of the screen format in order to just do a screenshot, I’m going to go to the Insert tab, the third tab over, I’m going to be in the illustration group, I’m going to go to the screenshot, and then scroll down to a screen clipping.

10:29

What this will do is it’ll minimize everything I have open and then go into the prior screen I was in so it jumps back over here. And it gives me this little highlighting field, we’re in this x where I can then snippets a screen portion. So I’m just going to draw a box around the amount of the items I want to snip, which is those. And that then will give us a file here that another another way we can save these numbers, make sure that we have them so that we can then use them as we go through the installation process.

11:00

The next thing we’ll do is download so of course we need to download the software This is going to be downloading the installation package then once it downloaded will have to run it in order to install the program in a similar fashion as if we had a CD. So we’re going to select Download. And now I’m in Chrome, therefore it’s going to open down here so it opened up in this little Taskbar if you’re in Firefox, you’ll have a little drop down up top. If you’re in Explorer, then you’re going to have a different type of bar I believe of top there so depends on the browser.

11:32

Now you can open this by clicking on it, I’m actually simply going to take this from the browser and drag it on to my desktop. So I actually have this whole file with the setup file on the desktop. So I can then run it from the desktop. So I’m going to left click on this, I’m just going to drag it on to my desktop. So now it’s going to be on my desktop. And then I would like to run it from that location on the actual physical desktop. So this is what the icon looks like on the desktop.

12:00

Now if you if you just clicked on it and you happen to just run it straight from there, it should run fine. But I’d like to put the actual installation program on the desktop and then run it from that location. That’s what we’ll do next time.

3:17

And we can track inventory in all of them. Notice within the enterprise, we have advanced inventory items here. This is another area when we have advanced type of inventory tracking depending on the industry we are in where we may need more specialization within the software, anyone anytime we need more specialization, that’s when we basically generally need to be upgrading the type of accounting software we use in order to customize it to those specialized needs.

3:44

Inventory can be one of those areas where we have specialized needs lyst limits, we have the pay tending 1099 contractor. So it’ll help us to generate those 1099. Again, with all three of them, those meet most of the basic needs of most business is those are all included. And Pro, that’s what we’ll be concentrating mainly on in this course, advanced features and premier and enterprise include forecasting with those items. So forecasting into the future, industry specific features.

4:16

And again, this is usually when you need to go beyond basic accounting software, such as pro because you need some kind of customization. Next, we have a mobile inventory barcode that’s only going to be in the enterprise to help us to be tracking that inventory.

4:30

And then we have the QuickBooks priority cycle, again, in the enterprise, the enhanced pick and pack in the enterprise, again, these having to do with typically inventory flow type of items and managing those types of systems. And then of course, we have the multiple users when we think of the pro and this is another big consideration that that could limit which type of package we want. We have the QuickBooks desktop user desktop version, enterprise we have the 30 users.

5:09

And when we think about the users, what we’re talking about here is it allows more than one user at a time. So in other words, if you have an accounting system, and you have multiple people working in the accounting system, obviously you want them all to be able to access the QuickBooks system at the same time as opposed to basically one person being able to be in the QuickBooks system on one computer, and then them having to log out before the next person can get into the system.

5:36

So you want to basically, when you have a larger department, of course, you want to have more users that can access that data at the same time. Next, we have add ons. Now the add ons can be included is exactly what it says or what it sounds like we have the QuickBooks that would then be purchased.

5:51

And then you basically have the add ons that could be purchased and acquired on top of the price of whatever type of system of QuickBooks we use. We have the upgrade to plus in the add ons, all the features of Pro with over $399 worth of added value and their added value, get unlimited support plus access to QuickBooks experts.

6:16

This can be nice, because the support that you do get if you were to simply call QuickBooks and you had QuickBooks Pro is limited to the amount of support you have. Now there’s a lot of other support that you can use with QuickBooks, many people are very familiar with QuickBooks very popular software.

6:32

So there’s a lot of people that you can you can go to in order to get help with the QuickBooks system. But if you want to go to Intuit itself, and call them they have a lot of resources to online resources and whatnot will talk about in future presentations. However, to get actual live direct support is not as easy with QuickBooks directly.

6:52

And you can get more of that with the plus feature, safeguard your most valuable information with automated data backup and recovery, get access to to the latest features and updates. So you always have the latest version. The next add on is the pay employees in essence, the payroll.

7:11

So when we think about these systems, note that the payroll is an add on. So you would buy whatever kind of QuickBooks desktop version you would have, you would have to then add on the payroll if you need payroll. And part of the reason for that is there’s some customization with the type of service you would need for payroll, therefore, the payroll would be added over and above.

7:31

Now, we will look at payroll and will actually look at payroll with the free version or manual version within the QuickBooks system. So you won’t have to purchase it which is a great for testing payroll not good if you actually want to run payroll because it can be quite complicated payrolls, even with a small amount of employees, something that you typically would want help with.

7:52

So pay employees and E file, pay employees with free direct deposit and create unlimited paychecks easy pay and file federal and state payroll taxes, print and file w two at your end. So the payroll is going to be another one that would be an add on.

8:09

And then we have the remote hosting the remote hosting and remember, we’re on the desktop version, then it’s less easy for us to basically access it from multiple location as it is we were on the cloud version, in which case we would just access the cloud.

8:26

The remote version can help us with that if we have people at multiple location or we are going to multiple locations, we might be able to set up then the added service of remote hosting. That would be lower cost network with reliable hosting access on the go. Your data is stored in the cloud not at your office making access easy and convenient password protect connections and ongoing it maintenance. So that would be the hosting option here.

8:55

So again, we here will basically be using the pro version or the features net sorry for the pro version. That’s what you would need to make sure to have all the features available. We won’t be getting into a lot of detail with the added features or any with the premier or enterprise although we might add some information later to says add on to the course for those too, but the Pro is what you need for if you want to follow along with the course.

9:21

Also note that you don’t need to add on even for payroll although we will be looking at payroll because QuickBooks does provide a manual payroll option, which gives us all the features which is great to use, but it doesn’t do some of that automatic stuff. That’s really helpful to double check your work within the system. So QuickBooks Pro, that’s what we’ll be using here.

This presentation and we will take a look at QuickBooks desktop options. In a prior presentation, we talked about the fact that if you’re looking to purchase QuickBooks, it can be confusing because there are a lot of options for it.

0:13

The first step and breaking out those options, as we seen in a prior presentation is generally to consider whether we want a desktop type of version of QuickBooks or an online type version of QuickBooks. We’re now thinking about the desktop type version.

0:27

So we’ve made the decision here, we want the desktop versus the online. Now we’re going to be considering the different options with regards to the desktop version, desktop version of QuickBooks include QuickBooks Pro, QuickBooks Premier, and QuickBooks enterprise. For most small to mid sized businesses, QuickBooks Pro is enough to meet their needs. That’s what we will be focusing in on for the most part, the type of activities that you can do and can be done within QuickBooks Pro.

0:57

For more advanced features, of course, then you would go to the books per premiere. And then for more advanced features to the enterprise, you can take a look at these features at the Intuit website into it is the owner of QuickBooks, the link here is quickbooks.intuit.com, slash desktop.

1:16

If we scroll down to some of these features, that will give you some information on what will be included within these features. And so obviously, the items that have a check in all three are going to be the ones that are going to be included in either of the items that we have. If you look at any of these three versions of QuickBooks, unlike the difference between QuickBooks desktop and QuickBooks Online, and they will look much the same.

1:40

They’re basically all the desktop version, it’s simply the case that the the advanced versions here have more features to them. So in other words, if you get good at using QuickBooks Pro, you will be able to go to QuickBooks enterprise, it’s not going to look completely different, you’re not going to be going where is this type of item that I used to know where it wasn’t pro as you might do?

2:01

When you go from QuickBooks desktop to QuickBooks Online, so the format will be the same. The added the premier and enterprise will just have more features to the features then include the new features for 2020, which we’ll discuss in a later presentation, we have the track income and expenses, which are included in all of them the invoices, which will be included in all of them, obviously invoicing, we can run the feedback and all of them, we can have the estimates in all of the versions.

2:29

Obviously with their reports, the advance of the reports, there’s 100 plus reports in the Pro, again, that usually fits the needs for most type of businesses will need advanced reports for premier and enterprise.

2:41

That’s usually the case when we have more specialized type of industry reports that we need. And or we’ve grown to some size where we have different regional reports or those types of things where we would need more advanced type of reporting systems,

2:54

we didn’t have the track sales tax and all of them, which is an important feature because we have to track and pay them sales tax that’s included in all in all of the versions, managed bills and accounts payable, which of course is important time tracking, which we may or may not use within the system, but it will be included in all the features will talk a bit about time tracking as we go through our work.

3:17

And we can track inventory in all of them. Notice within the enterprise, we have advanced inventory items here. This is another area when we have advanced type of inventory tracking depending on the industry we are in where we may need more specialization within the software, anyone anytime we need more specialization, that’s when we basically generally need to be upgrading the type of accounting software we use in order to customize it to those specialized needs.

3:44

Inventory can be one of those areas where we have specialized needs lyst limits, we have the pay tending 1099 contractor. So it’ll help us to generate those 1099. Again, with all three of them, those meet most of the basic needs of most business is those are all included. And Pro, that’s what we’ll be concentrating mainly on in this course, advanced features and premier and enterprise include forecasting with those items. So forecasting into the future, industry specific features.

4:16

And again, this is usually when you need to go beyond basic accounting software, such as pro because you need some kind of customization. Next, we have a mobile inventory barcode that’s only going to be in the enterprise to help us to be tracking that inventory.

4:30

And then we have the QuickBooks priority cycle, again, in the enterprise, the enhanced pick and pack in the enterprise, again, these having to do with typically inventory flow type of items and managing those types of systems. And then of course, we have the multiple users when we think of the pro and this is another big consideration that that could limit which type of package we want. We have the QuickBooks desktop user desktop version, enterprise we have the 30 users.

5:09

And when we think about the users, what we’re talking about here is it allows more than one user at a time. So in other words, if you have an accounting system, and you have multiple people working in the accounting system, obviously you want them all to be able to access the QuickBooks system at the same time as opposed to basically one person being able to be in the QuickBooks system on one computer, and then them having to log out before the next person can get into the system.

5:36

So you want to basically, when you have a larger department, of course, you want to have more users that can access that data at the same time. Next, we have add ons. Now the add ons can be included is exactly what it says or what it sounds like we have the QuickBooks that would then be purchased.

5:51

And then you basically have the add ons that could be purchased and acquired on top of the price of whatever type of system of QuickBooks we use. We have the upgrade to plus in the add ons, all the features of Pro with over $399 worth of added value and their added value, get unlimited support plus access to QuickBooks experts.

6:16

This can be nice, because the support that you do get if you were to simply call QuickBooks and you had QuickBooks Pro is limited to the amount of support you have. Now there’s a lot of other support that you can use with QuickBooks, many people are very familiar with QuickBooks very popular software.

6:32

So there’s a lot of people that you can you can go to in order to get help with the QuickBooks system. But if you want to go to Intuit itself, and call them they have a lot of resources to online resources and whatnot will talk about in future presentations. However, to get actual live direct support is not as easy with QuickBooks directly.

6:52

And you can get more of that with the plus feature, safeguard your most valuable information with automated data backup and recovery, get access to to the latest features and updates. So you always have the latest version. The next add on is the pay employees in essence, the payroll.

7:11

So when we think about these systems, note that the payroll is an add on. So you would buy whatever kind of QuickBooks desktop version you would have, you would have to then add on the payroll if you need payroll. And part of the reason for that is there’s some customization with the type of service you would need for payroll, therefore, the payroll would be added over and above.

7:31

Now, we will look at payroll and will actually look at payroll with the free version or manual version within the QuickBooks system. So you won’t have to purchase it which is a great for testing payroll not good if you actually want to run payroll because it can be quite complicated payrolls, even with a small amount of employees, something that you typically would want help with.

7:52

So pay employees and E file, pay employees with free direct deposit and create unlimited paychecks easy pay and file federal and state payroll taxes, print and file w two at your end. So the payroll is going to be another one that would be an add on.

8:09

And then we have the remote hosting the remote hosting and remember, we’re on the desktop version, then it’s less easy for us to basically access it from multiple location as it is we were on the cloud version, in which case we would just access the cloud.

8:26

The remote version can help us with that if we have people at multiple location or we are going to multiple locations, we might be able to set up then the added service of remote hosting. That would be lower cost network with reliable hosting access on the go. Your data is stored in the cloud not at your office making access easy and convenient password protect connections and ongoing it maintenance. So that would be the hosting option here.

8:55

So again, we here will basically be using the pro version or the features net sorry for the pro version. That’s what you would need to make sure to have all the features available. We won’t be getting into a lot of detail with the added features or any with the premier or enterprise although we might add some information later to says add on to the course for those too, but the Pro is what you need for if you want to follow along with the course.

9:21

Also note that you don’t need to add on even for payroll although we will be looking at payroll because QuickBooks does provide a manual payroll option, which gives us all the features which is great to use, but it doesn’t do some of that automatic stuff. That’s really helpful to double check your work within the system. So QuickBooks Pro, that’s what we’ll be using here.

.10 QuickBooks Desktop Vs QuickBooks Online

People around the world are celebrating today as International Day of Sign Languages. Taxpayers who sign in American Sign Language can visit YouTube anytime to see IRS ASL videos. The IRS ASL Channel is one of three on YouTube. Each channel offers info about a wide range of tax topics.

https://accountinginstruction.thinkif…

All the videos on the ASL channel are presented by someone signing in ASL. Each video also includes audio and closed-captioning. The videos appear in several playlists sorted by topic. One of these playlists specifically highlights the services the IRS provides for people who are deaf or hard of hearing. There’s a series of videos in this playlist for ASL interpreters who need to learn appropriate tax terminology in ASL.

Here are other playlists on the IRS Videos in ASL YouTube channel:

Tax Tips – features videos on general tax topics to help people understand their tax responsibilities.

ID Theft – includes videos about ID theft that help people recognize scams and know what to do if they think their identity was compromised or stolen.

Small Business – videos to help business owners find out what tax credit, deduction and law changes may affect their business.

IRS Tax Pros – playlist featuring videos for and about tax preparers.

More information:

U.S. Dept. of Health and Human Services: National Institute on Deafness and other Communication Disorders

NIDCD: American Sign Language

WASHINGTON — As Dorian threatens and with the peak of hurricane season just ahead, the Internal Revenue Service reminds everyone to develop an emergency preparedness plan. Taxpayers, whether individuals, organizations or businesses, should take time now to create or update their emergency plans. https://www.irs.gov/newsroom/as-hurri… http://accountinginstruction.info/ Taxpayers can begin getting ready for a disaster with a preparedness plan that includes securing and duplicating essential documents, creating lists of property and knowing where to find information once a disaster has occurred. Secure key documents and make copies Taxpayers should place original documents such as tax returns, birth certificates, deeds, titles and insurance policies inside waterproof containers in a secure space. Duplicates of these documents should be kept with a trusted person outside the area a natural disaster may affect. Scanning them for backup storage on electronic media such as a flash drive is another option that provides security and easy portability. Document valuables and equipment Taking photographs or videos of a home or business’s contents can help support claims for insurance or tax benefits after a disaster strikes. All property, especially expensive and high value items, should be recorded. The IRS disaster-loss workbooks can help individuals (PDF) and businesses (PDF) compile lists of belongings or business equipment. Employers should check fiduciary bonds Employers who use payroll service providers should ask the provider if it has a fiduciary bond in place. The bond could protect the employer in the event of default by the payroll service provider. The IRS also encourages employers to create an EFTPS.gov account where they can monitor their payroll tax deposits and sign up for email alerts. Rebuilding documents Reconstructing records after a disaster may be required for tax purposes, getting federal assistance or insurance reimbursement. Taxpayers who have lost some or all of their records during a disaster should visit IRS’s Reconstructing Records webpage. IRS stands ready In the case of a federally-declared disaster, taxpayers can visit the Tax Relief in Disaster Situations webpage for information or call 866-562-5227 to speak with an IRS specialist trained to handle disaster-related issues. A taxpayer impacted by a disaster outside of a federally declared disaster area may qualify for disaster relief. This includes taxpayers who are not physically located in a disaster area, but whose records necessary to meet a filing or payment deadline postponed during the relief period are located in a covered disaster area. Taxpayers located outside of a federally declared disaster area must self-identify to receive relief by calling 866-562-5227. Related items: Publication 2194, Disaster Resource Guide for Individuals and Businesses (PDF) Publication 583, Starting a Business and Keeping Records FS-2017-11, Reconstructing Records After a Natural Disaster or Casualty Loss Tax Relief in Disaster Situations Federal Emergency Management Agency Small Business Administration Disasterassistance.gov

WASHINGTON – The Internal Revenue Service today announced that interest rates will remain the same for the calendar quarter beginning Oct. 1, 2019, as they were in the prior quarter. https://www.irs.gov/newsroom/interest… http://accountinginstruction.info/ The rates will be: • five (5) percent for overpayments [four (4) percent in the case of a corporation]; • two and one-half (2.5) percent for the portion of a corporate overpayment exceeding $10,000; • five (5) percent for underpayments; and • seven (7) percent for large corporate underpayments. Under the Internal Revenue Code, the rate of interest is determined on a quarterly basis. For taxpayers other than corporations, the overpayment and underpayment rate is the federal short-term rate plus 3 percentage points. Generally, in the case of a corporation, the underpayment rate is the federal short-term rate plus 3 percentage points and the overpayment rate is the federal short-term rate plus 2 percentage points. The rate for large corporate underpayments is the federal short-term rate plus 5 percentage points. The rate on the portion of a corporate overpayment of tax exceeding $10,000 for a taxable period is the federal short-term rate plus one-half (0.5) of a percentage point. The interest rates announced today are computed from the federal short-term rate determined during July 2019 to take effect Aug. 1, 2019, based on daily compounding. Revenue Ruling 2019-21, announcing the rates of interest, is attached and will appear in Internal Revenue Bulletin 2019-38, dated Sept. 16, 2019.

IRS Tax Tip 2019-116, August 26, 2019 https://www.irs.gov/newsroom/these-ta… http://accountinginstruction.info/ Starting a business can be very rewarding. It can also be a little overwhelming. From business plans to market strategies, and even tax responsibilities…there are many things to consider. Here’s what new business owners can do to help get off to a good start. Choose a business structure. The form of business determines which income tax return a business taxpayer needs to file. The most common business structures are: Sole proprietorship: An unincorporated business owned by an individual. There’s no distinction between the taxpayer and their business. Partnership: An unincorporated business with ownership shared between two or more people . Corporation: Also known as a C corporation. It’s a separate entity owned by shareholders. S Corporation: A corporation that elects to pass corporate income, losses, deductions, and credits through to the shareholders. Limited Liability Company: A business structure allowed by state statute. Choose a tax year. A tax year is an annual accounting period for keeping records and reporting income and expenses. A new business owner must choose either: Calendar year: 12 consecutive months beginning January 1 and ending December 31. Fiscal year: 12 consecutive months ending on the last day of any month except December. Apply for an employer identification number. An EIN is also called a federal tax identification number. It’s used to identify a business. Most businesses need an EIN. Have all employees complete these forms: Form I-9, Employment Eligibility Verification (U.S. Citizenship and Immigration Services) (PDF) Form W-4, Employee’s Withholding Allowance Certificate Pay business taxes. The form of business determines what taxes must be paid and how to pay them. Taxpayers interested in starting a business can find information for some industries on the Industries/Professions Tax Centers webpage. Each state has additional requirements for starting and operating a business. Prospective business owners should visit their state’s website for info about state requirements. More information: Small Business Admiration’s 10 steps to start your business