In this presentation, we’re going to enter service items into an invoice. So we’re going to be adding customers as well as new service items as we do. So let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. I’m going to go to our flowchart in the desktop version just to consider what we are doing here. We’re now going to be creating invoices and this is are going to be invoices for guitar lessons that guitar lessons are going to work like this. We’re going to be doing their Guitar Lessons through the month, then we’re going to determine the hours that were spent on the guitar lessons similar to if we were a law firm or a accounting firm, then we’re going to bill the clients for those guitar lessons and have different billable rates for who the guitar lesson was with.

00:49

So let’s see what this would take what would look like this is going to be the type of situation that we might have, like we say in a legal firm or an accounting firm where we might be billing on some type of hourly rate we might have different rates that would be charged depending on the individual that was working on a particular case, similar item here that we’re gonna have different charges for the different people that are working on, you know the guitar lessons. So we’re going to minimize this we’re going to go back to our get great guitars, we’re going to go to the plus button. We’re then going to go to the invoice so we’re going to send an invoice.

01:23

Now, first, we’re going to be dealing with God. So God is gonna we’re going to say she’s a guitar instructor. God is going to be our guitar instructor. She’s going to give us basically her hours that she has spent doing guitar lessons for some clients. So we’re going to look at these clients that God has been working with, with regards to guitar lessons, we’re going to build these clients based on what we charge for Jodi, Jodi charge. Alright, so what would this look like? We’re going to say that we’re going to say the client is star Lee we’re gonna have a new client called Star lean. I’m going to say tab then we would probably want stars detail but I’m acting I’m Not going to put the detail in here, we’re just going to add the new customer that I’m going to tap through this, we’re going to be tapping through I’m going to say net 30 is the terms, we’re going to say the date is the 28th.

02:11

Let’s make it that the 29th. And then everything else I’m going to keep as is I’m going to go down to the product or service, then I’m going to add a new product or service and this is for our guitar instructor. And I’m going to call it God. Guitar Lessons. So this is we’re going to say basically, if we’re get great guitars, God is kind of like our employee.

02:37

We do the billing for Jodi Jodi then been an instructor calculated her time and who she spent the time on kind of like a law firm or CPA firm would do. And then and then we’re going to take that time sheet and build the customer for that based on some rate that we’re applying to Jodi’s time some hourly rate, this may or may not be what we actually pay God because it’s different than her payroll. rate, right? It’s going to be the rate that we build for it. And we might, you know, kind of mark up the rate just like we would for for inventory items to cover costs of the business as well.

03:12

So this is going to be the rate Jodi’s rate that we’re charging customers for a guitar lesson she provides under, get great guitars, our mock company here, so we’re going to say God, then it’s going to be setting up an item, not an inventory item that this time not a certain not a non inventory item, but a service item. So it’s going to be a service item, no inventory involved.

03:35

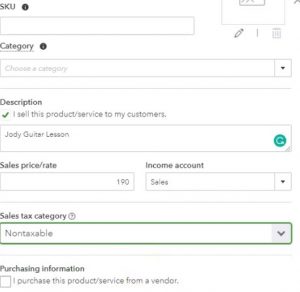

So then we’re going to say it’s going to be God guitar lessons. I’m not going to put anything in the SKU category, nothing their description, I’m going to say also God guitar lesson price we’re going to say is 190. That’s Jodi’s rate, they’re charging, it’s going to be going to the sales, not to the product, right? We have the two income here. So we’re going to be on sales, not the product. We’re going to differentiate by whether we sell things or services. And so this is going to be the service item. And then we’re going to say, is it taxable? It’s not taxable. So I’m going to select the drop down and say it’s non taxable because this is a service item, as opposed to an inventory item.

04:17

We don’t purchase this from a vendor so that’s what we want. So nothing there. We’re going to say Save and Close. And so there we have it description pops up. We got quantity now we’re going to say is five times the 190. That’s going to give us get us up to the 950. So we’re going to say it’s the 950 on the invoice, what will this do when we populate this invoice, increase accounts receivable that’s what an invoice does. Other side going to income. This being the service income account for the 950 service item, not inventory item. Therefore, no sales tax, no inventory decreasing no cost of goods sold that we have to deal with. So then we’re going to do this again.

04:57

We’re going to say Save and news. I’m going to go down here. Instead of Saving clothes I’m gonna hit the drop down or the rise up. And I’m going to say we need the Save and new so we want save and new. And we’ll get this is going to be Jody’s other client now which is going to be Diane Martinez. We’re going to tab we’re going to add Diana here. I’m just going to tap through everything looks good. So everything looks good here within just going to go on down to the product. And once again, this is Jodi’s. we’re imagining we’re taking this from Jodi’s time sheets that she’s applying to what customers clients she worked on, and so we’re going to say this is Jody guitar lessons, same thing. She said she has five hours there as well.

05:41

So that’s going to be our invoice there. So we’re going to say invoice, accounts receivable, it’s going to be going up, the other side being sales revenue going up. We’re going to do this again. We’re going to go to save and new. Next we’re going to have the next client which is Lynn Jackson. And I’m going to say tab, we’re going to add that customer. When a tab through this, everything, everything looks good. And we have the time sheet which is going to be Joe D. Guitar Lessons again and we’re going to put this in at 10 hours. So Jody’s did a lot of work this month we’re going his there so that once again that comes out to 1900. That means the AR is going to be going up, accounts receivable is going to be going up and the other side’s going to be going to revenue.

06:28

Okay, we’re going to say save a new again save a new. Next we’re going to have our other instructors going to be Angela, we’re going to say Angela is our other instructor. She’s going to give us her time she of the people that she’s having guitar lessons with and we’re going to invoice for them based on her hourly rate. So we’re going to go back up and say okay, she says that she taught Jenny, Jenny Jones. So we’re going to say Jenny Jones tab, add Jenny Jones. We’re going to go through the same process. However down here. We’re going to be changing the name now because now we’ve got Angela, this is Angela, our instructor.

07:02

She’s a guitar instructor. She very good guitar lessons Angela guitar or lessons sons tab, we’re going to be adding that once again, it’s going to be a service item, not an inventory item but a service item. So we’re going to add the service item. I’m going to copy the name of top. And we’re not going to have an SKU category, we’re just simply going to put that in the description. The rate we’re going to say is 150. So 154 Angelo on. That’s what we bill for her for her rate, hourly rate. And then that’s going to be going to an income account that income account being the sales account as opposed to the product account, sales account, the one we’re using for services as opposed to the product account.

07:47

Then it’s not subject to sales tax, I’m going to say no, not taxable because it is a service item. And then we’re going to go save and close. There we have that and we’re going to say that she has to hours here, so seven hours at the 150 or 1050. So what’s going to happen here accounts receivable is going to increase 1050 other side sales or income account the sales account, which is our income account, then we’re going to say Save and new down below, save and new. And then we’re going to do this again. So I’m going to go back up top. She says another item on her time sheet is for Diana. So our customer of Diane Miller Miller’s I spell Miller, I think so I’m going to say adding that we’re going to say save. So there’s our customer and then this is going to be charging for Angela.

08:41

Angela. Guitar Lessons at 150. We’re going to say six hours. She says here she has, that’s going to be 906 times to 150 900. Increasing the AR by the 900 the other side going to sales. Let’s go ahead and say save a new again. Then we’ll go back up top to the customers. We got the next Customers for Angela is going to be Jill Gonzalez, Jill Gonzalez, we’re going to add we’re going to add that and save that. Then we’re going to say down here in the product or service, we have the service which is Angela. Angela guitar lessons, we’re going to say there are nine here. That puts us at the 1003 15. So that’s going to be Angeles time sheets.

09:22

Now we’re gonna do this one more time for one more of our guitar instructors. So we’re going to say Save and new again. Our next guitar instructor is Rebecca. She’s going to give us her time sheets and the customers that she spent her time with. So we’re going to say all right, the first customer is going to be Noah Davis. All right, Noah Davis, we’re going to say tab we’re going to say save. And then in the product or service, we’re going to add a new one. We’re going to say this is for Rebecca’s time sheet, Rebecca, SAR, the lessons tab, and once again, it’s going to be a service it Tim that we’re going to be setting up to this, we’re going to be our basically our hourly rate.

10:03

We’re going to be charging for Rebecca’s hourly, the guitar lessons, I’m going to say the description will be the same sales price, this time, we’re going to charge 100. For her services, it’s going to be going to the sales account on the other side rather than the product account. It’s not taxable because it’s going to be a service item as opposed to an inventory item. So then we’re going to say Save and Close. There we have it. And for this invoice for Noah, we have eight hours. So we’re going to say eight hours at $100. That’s going to be the 800. We’re gonna say save a new for her next client. Her next client is grace. So we’re going to say grace. Matthew, Grace Matthew tab, we’re going to say save on that ad in Greece, Matthew. Then in the products down below, we’re going to say this is for Rebecca.

10:55

So Rebecca is guitar lessons will pick up Rebecca here and the hours are going to be six hours. So six hours times 100. That’s going to be the 600. And then we have one more individual for Rebecca on her time cards. So we’re going to say Save and new. Once again, this one’s going to be Pam. So we’re going to say this is Pam Smith. So Pam Smith, and then we’re going to say tab adding Pam Smith. And then we’re going to go down to the product down below. And that’s going to be once again for the Rebecca guitar lessons. Rebecca guitar lessons, the number of hours we’re going to say is eight. That brings us to the 800.

11:32

Alright, so that’s going to be it we’re going to say Save and Close this time. Then let’s take a look at our financial statements. I’m going to hit the drop up or drop down, rise up and we’re going to go to the Save and Close this time. And then let’s go to our financials are our reports. reports on the bottom left, we’re going to go into the reports on the bottom left. We’re going to be open up the balance sheet that’s going to be our favorite report. We’re going to go back up top for it changing the dates up top from a 1012 Zero to 1230 120.

12:02

We will run that report. Then we’re going to duplicate the tab up top going to the tab up top right clicking on it and duplicating it. Then I’m going to go back to the tab to the left back to the tab to the left, go back to the reports on the left, on the bottom left or left bottom. And then we’re going to be opening up the profit and loss. Let’s open up the P and L the profit and loss the income statement will change the dates up top from a one on one to zero to 1230 120. Run that report. And let’s go up top and right click on the tab, duplicate it. Then we’ll open up the TB trial bounce back to the first tab. Back to the reports down below.

12:44

We’re looking for the trial balance which I like to type in there because they put it at the bottom of the reports. So I’m going to type in trial balance. Then I’m going to go back up top change the dates Oh 10120 to 1230 120 will Run that report. Then we’ll go to the tab up top, right click on it and duplicate that report. Then I’m going to go to the balance sheet. And let’s see what happens. I’m going to close the old hamburger on the left, hold down Control, scroll up to get to about 125. And then let’s see what we have. So we’re in the accounts receivable. If I select the accounts receivable, then we should have a whole bunch more invoices we sent out down here. And so here’s all of our invoices for all of our customers that we just put in place. So this is basically our billable and this is kind of what you would expect to see. If you were in like I say, a law firm, or bookkeeping firm.

13:40

The partners might then have people underneath them that they would basically say, you know, give us your time she’d give us who you worked for, make sure it’s billable. So we can build, you know, and then they’re going to end and they’re going to be making the bills either you know, monthly or weekly or every couple of weeks. And it might look something like this right and we’d have to build that would then be going out Which would be increasing the accounts receivable based on the bill billable rates and the time sheets given by the people working for them. So then I’m going to go back up top, and we’re going to go back to our balance sheet. Then the other side, of course is going to be on the p&l profit and loss.

14:21

So if you’re going the p&l profit and loss, close the old hamburger, it should be under the sales Adam, we’ve broken up the sales for the service rather than the product. So the sales versus the products going to open up the sales. And then if we scroll down, we see of course, all of our invoices once again, so there’s all of our invoices that are increasing the income or sales. If I scroll back up, go back to our profit and loss. That of course increases the income number, which increases our bottom line number. Now note to that when you think about the profit and loss report, you can think about it for the two months time period we have now January through February, or you can think about it just for The second month, the month of February. I know I brought it to the end of the year. That’s just what I always do. But there’s no data in there after February.

15:08

So you could bring, like, say, let’s just look at February Oh 201 to zero to 1231, which is just, you know, February because there’s no data after February. And then if we go down, now we’re looking at basically the income statement, just for February. And then if I was to scroll back up, for example, and we went over 101 to zero to 1231, two, let’s make it 202 29 to zero, and then run that report. And if we did our comparison report now by going from totals 12 months, then and running that report, then you can see kind of a comparison again, this is how we’re doing or this is performance report, so it’s accumulating upwards for the month of January accumulating upwards for the month of February. Then of course, the total between the two of them.

16:03

If you look at the trial balance, it’s a little bit easier to see this kind of thing closing the hamburger, because then the accounts receivable would be going up here. And of course, you can jump right to the other side, which of course, would be sales on the income statement, but still on the trial balance down below, on the same report. Let’s take a look at one more report that being the customer balance detail. So if I go back to the first tab, go back to the reports down below. I’m going to hold down Control and scroll down a bit so it doesn’t get all scrunched up over here and mess things up. And then let’s see if we can type it into the find window.

16:37

I want the customer I mean, I’m sure we can. Yeah, it’s not like it’s a problem but customer balance detail. That’s the one I want. Let’s open up the customer balance detail there. And the date is the date. Okay, all dates. That’s good. So then we have of course who owes us money. Let’s close to hamburger and hold down Control and scroll up back up to 125. We’ve got Diana here and then we’ve got all the all of our customers, right, Miller, Matthew Jones, Gil Gonzalez Jones, Lynn Jackson, right and so on and so forth that adding up to the 10,005 1110. That’s going to tie out to the AR hopefully I’m pretty sure it will I’m pretty confident, pretty confidence going out 10 511 point one, and there’s the 10 511 point one in the AR on the TV or trial balance as well and of course it would be on the balance sheet to