QuickBooks Online 2021. Now, how do bank feeds fit into my accounting system? Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our quickbooks online bank feed test file. Before we set up the bank feeds, we want to consider what the role of the bank feeds will be in our accounting system. This being a very important step, because the bank feeds will play a different role depending on the type of accounting system we have in place.

00:29

This can be counter intuitive when we think about bank feeds that we hear bank feeds talked about, or even QuickBooks in general talked about the name of QuickBooks would indicate that the QuickBooks are going to make the bookkeeping very quick. And then of course, the bank feeds are supposed to be set up and are advertised as if you’re going to just connect to the bank that’ll feed everything into the QuickBooks system. And that’ll just generate your reports automatically.

00:51

That’s not necessarily the case, it’s going to take some work to set up the bank feeds, especially for the first bank feeds that you’re going to be setting up meaning how far back do you need the data to be entering into the bank feeds. And then even from that point forward, it depends on what type of bookkeeping system you will have, as to what role the bank feeds will take, you want to carefully consider this before connecting the bank feeds.

01:15

So that you know this from the start, if you don’t do that, what will happen is you may just enter a whole bunch of data from the bank into the system, but not know how to properly allocate it. And you could be quite overwhelmed if that’s the case. So you want to have a basic idea of what your accounting system is going to be, then how the bank feeds fit into it, then connect to the bank feeds and figure out where your starting point will be where it’s going to be the baseline point, meaning what date Are you going to need to start entering data into the bank or from the bank into the system.

01:47

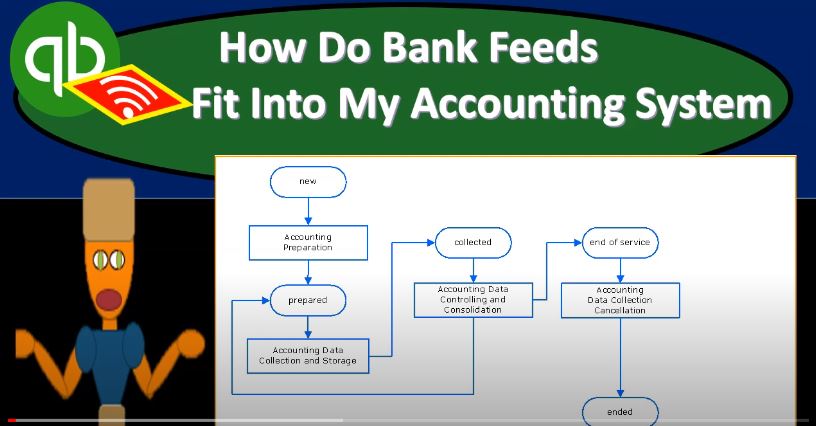

And then how is that data is going to act within your accounting system to consider this further. Let’s go on to the QuickBooks desktop version. You don’t need the desktop version to follow along with the desktop version has this flowchart. So we just want to consider the flowchart because that’s our accounting cycles. And then we want to consider how bank feeds might fit into our accounting cycle for different types of companies that we may have.

02:08

When you’re thinking about bank feeds, in general, you’re thinking about data from the bank flowing into your QuickBooks system, you’re basically thinking about a bank statement, that’s what the bank has, they basically have a bank statement, which basically has your your cash transactions, of course, and that would include deposits increased to your checking account, and then checks or withdrawals, those might be electronic, or they might be cash deposits, or they might be checks that are coming out, or there may be electronic transfers out of the bank account.

02:36

But in essence, that’s all the bank has, they have the bank, they have the increases, they have the decreases. Now, obviously, cash is involved in every cycle that we have in our accounting system. Not every financial transaction involves cash, if we’re on if we have like an accrual system of some way, or shape or form. But cash is going to be involved in every cycle, like the purchasing cycle, the sales cycle, the employee or payroll cycle, and therefore Can’t you know, if we can get the cash right, then we have things going, you know, that’s pretty big component.

03:08

Cash is like the lifeblood of the company. It’s involved in every cycle that we have with regards to the accounting system. So let’s go into our flowchart over here. And let’s consider the system that would be most easy to rely entirely on on or as much as possible on the bank feeds. And then we’ll add levels of complexity as we go through this thought process.

03:28

So what would be the easiest business to use to just basically try to rely on bank feeds to be as close to what would probably be advertised as bank feeds as possible meaning connect to the bank added to QuickBooks, and then it just magically makes your financial statements for you, as you connect to the bank, what would be closest to that scenario as possible? It would be closest to that scenario if we had not only a cash basis system, but we were dependent on the bank, meaning we are not using the bank as a double check to our accounting system.

03:56

But rather, we’re taking the information from the bank in order to create our books. So we’re completely dependent on the bank under that system, and that system might work well, if we have something like gig work or something like that. So if we do especially service type of business, and we do it through, say, an online provider, and we get paid from say, an app store or something like that, say we have Amazon sales for book sales or something like that, or audiobook sales, or we have YouTube revenue, or we have course revenue, and we’re just getting revenue, we’re just getting revenue that’s coming from like an app that is coming to us directly.

04:34

And when we get the revenue, we’re just going to call it income. So any revenue that we have, we’re basically going to call it income, and then all the expenses that we have, we’re on a cash basis. And most of our if most of our expenses, especially our electronic transfers that we pay directly out of the checking account, then those will be fairly quickly transferring through the bank, and that would be kind of the easiest system to use. So in that case, in terms of the of the cycle for the revenue cycle.

05:01

For example, we wouldn’t be using any, any invoice because we’re not invoicing anyone, we’re just waiting to get the money from the gig work, right? We don’t need to Bill anyone in that case or invoice, we don’t have to create sales receipt even which would be a cash basis financial transaction, because we’re not going to collect cash and then go to the bank and have to give a receipt, we don’t need to give a receipt to anybody, or anything like that, we’re just gonna wait till the revenue clears the bank.

05:25

And then and then we’re not even going to record the deposit, right, we’re gonna let the bank deposit come into our account, and then record the deposit. That would be the easiest type of system that we would have. And then basically, if you’re looking at your bank statement, then everything that comes into our account, that’s a deposit, we will in essence, record as revenue. So then we can just say everything that’s a deposit will be revenue for us.

05:48

Unless it’s something unusual, such as us, the owner putting money into the company, we got to make sure that if we put money into the company, then it’s going to be an investment. But otherwise, everything that goes into the company is a deposit unless it’s from us, or unless it’s going to be a loan. So that’s pretty straightforward. If it’s an electronic transfer coming from something like a YouTube, or something like Amazon, or audio, audible books or something like that, then they’ll probably have the description of Who gave it to you in the electronic transfer.

06:17

And we can even add a vendor as we add that information into it as well. So we can just build our books based on the bank feeds in that case. And then on the expense side of things, if we try to make all of our transactions, basically electronic transfers, then once again, we might just wait until the transaction is clear the bank, once they clear the bank, then we record them from the bank feeds. And if there are electronic transfers, we may even have the vendor information, the vendor information helping us to assign the correct account like the utility expense, the phone expense and whatnot, and possibly make a vendor so that deposits we need customers, and then on the on the decreases, we’d have vendors.

06:59

So that would be the easiest trend that the easiest kind of system to use, which is we’re just building our books on the bank, we’re not only on a cash basis system, we’re basically dependent on the bank meaning and that means when the deposits come in, we’re just going to take them from the bank feeds and record basically deposits at that point. And we’re not going to be dealing with accounts receivable, we’re not going to be dealing with accounts payable, we’re just going to basically record our expenses when we pay them.

07:23

And that would be basically the the easiest system to use that and under that system, then the bank reconciliation is still necessary, but not as important. I mean, not as as doesn’t have as much effect in terms of your internal controls. Because you’re not double checking anything, you’re just basically checking or making sure that you haven’t double input anything or that you missed something in terms of on the bank feed on your books.

07:48

So we’ll take a look at that as we go forward. Then if we add a level of complexity, you might say, well, what if I’m in a in a system, where basically I make sales during the day, say you’re a restaurant or something like that, and you make cash sales. And basically you use this form to create sales receipts, basically, you’re Imagine you’re at a register, or something like that people pay you during the day you provide the food truck service or something like that, at the same point in time, you’re still kind of on a cash basis with regards to the revenue cycle.

08:18

Because you’re receiving money at the same point you’re doing work. But if you’re recording a sales receipt here into the system, that sales receipts going to be increasing the the basically cash that you’re going to receive, and the other side is going to go to sales at the point you made the sale, not the point in time that it hit the bank, not the point in time that it cleared the bank. And you might have cash sales that are happening here.

08:42

And if you have cash sales, you’re gonna want to be collecting the cash and make sure that it ties out to your sales receipts that you have is kind of one of your checks that everything is doing going properly. And then you’re probably going to want to put this money into undeposited funds, and then walk over to the bank and deposit it into the bank grouping all of your cash transactions together into the bank and putting it into the bank at one lump sum.

09:08

What will then appear on the bank statement, then under that system will be one lump sum cash basis, it’ll just be cash. So you won’t have any other kind of customer information related to it. It’ll just be basically cash that cleared the bank. And you’ll have to reconcile what we put on our books then under that system

09:27

to what is on the bank. So under that system, you’d still be on a cash basis, but you wouldn’t be reliant on the bank, you would be recording the transactions as they happen. When you record the transactions here, you would be recording the customer information and the sales information. And then you would take that information deposited into the bank, which means it would then increase your checking account in one lump sum.

09:50

And then when you have the bank feeds that come through when this deposit comes to run the bank feed, you’re no longer dependent on the bank feed to record the deposit and revenue But rather, you’re basically using the bank feed as kind of like a check to help you out with your bank reconciliation process, you’re double checking that the bank system is the same as what you’ve recorded in your system. And that is a better internal control, because that gives you an internal control to kind of check to different accounting systems, the bank recorded one thing, you recorded one thing, they are the same, you recorded them differently, you didn’t record your thing based on the bank, you recorded it independent from the bank, and the two things tie out, therefore you have kind of that double check.

10:33

That’s what the bank reconciliation process will be. The bank feed in that case serves a different purpose. It’s still important, but it will be like a reconciliation. Now you might think, Well, why don’t I just under that system, if I collected cash, why don’t I just wait and then deposit the cash into the bank, and then wait till it clears the bank and then record the revenue once it clears the bank, you can’t do that.

10:55

But then you lose a couple internal controls, you lose the internal control of checking your sales receipts, to the cash deposits, and then the internal control of checking your deposit to the bank deposit. And if you just record, save this deposit here, and it It consisted of a bunch of different customers that put money in, you won’t know who the customers will, you won’t be able to track it by customer, it’ll just be a deposit you and you’ll just have no customer information for it, which might be fine, you might not need the customer information.

11:26

But that’s just you know, the pros and cons of using that system. So you lose some internal control, you lose some ability to sort your revenue by customer and have the customer information, if you if you go to that system, and you’re like a food truck type of system or something like that.

11:42

And then if you add another level of complexity, at least on the revenue side, you might say, well, what if I’m in a system where I have to build a client’s like a bookkeeper, or lawyer or landscaper or something like that, where I do the work, possibly I count my hours that I use when I did the work, or I bill in some other way or I count the hours of my employees, and then periodically I send an invoice out the invoice, then increase in accounts receivable, the other side go into revenue, and I have to then track the payments to make sure that they pay me at some later time, then I would receive the payment.

12:15

And then I would record the deposit. Well in that case, now you’re on an accrual system, because you’re using accounts receivable under that case. So accounts receivable, this transaction right here, when people owe you money has nothing to do with cash, and then you’re going to get cash at a later point in time. So under that system, because you need to track who owes you the money. If you’re using accounts receivable and need to track who owes you the money, then bank feeds are going to take another role, you’re going to have to say I want to create the sales receipt.

12:43

And then you’re gonna have to record the received payment in some way. Now, you could wait until the receipt payment maybe clears the bank or something. But you’re probably going to want to, you know, record the fact that you received the payment from the customer, and then possibly make the deposit. And then once again, use the bank feeds to kind of verify and double check that that what you recorded on your side matches to what the bank feeds have, meaning you’re not using the bank feeds once again, under that system to create the books, but rather to double check the books, you’re using it basically to help you with the reconciliation process to help you with the bank reconciliation.

13:20

So those are those are kind of a you could do the same thing on the payable side. But the payable side, like if you’re using accounts payable, like you’re entering the bills, accounts payable goes up, then once again, you’re doing an accrual type of transaction here. So when you’re using an accrual type of transaction, the bank feeds are going to it’s going to complicate things, you’re not just building your books based on the bank feeds.

13:41

So you got to think, Okay, what kind of business do I have? Do I have like gigwalk or something like that where I can just, you know, rely on the bank, wait till everything clears the bank and make my books from the banks? Or do I have a system where I have to, you know, record the sales receipt, I want that internal control? Or do I have a system where I need to actually invoice the customers and also the next thing that could complicate things if you go to an inventory item, inventory, obviously, if you’re tracking inventory within the QuickBooks system will add another level of complexity as well.

14:13

Because inventory button in its nature isn’t a cruel thing again, and you’re gonna have to track the inventory and record the inventory. So that’s going to complicate, you know, building your books just from the bank statement once again. So we’ll think about these kind of things. As we go through the bank feed process. We’ll set up the bank feeds and consider different options building our bank feeds just from the bank statement and then considerable What if we had, you know, a create sales receipt and then we’re double checking and matching or what if we’re doing a full accrual service process have the bank feeds fit into that system?