In this presentation, we will make loan payments with the help and the use of an amortization schedule. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to start off by opening up our reports down below, we’re going to be opening up three reports. This time, we’re going to be opening up the balance sheet report, our favorite report the balance sheet reports, we’re going to scroll back up top, change the dates from 1120 to 1231 to zero, then we’re going to go ahead and run that report. Then I’m going to go back up top and duplicate the tabs. I’m going to right click on the tab, I’m going to duplicate that tab. Going back to the left and we’re going to do this again. We’re going to go back down to the reports down below. We’re going to be opening up the profit and loss our second favorite report the profit and loss, the p&l the income statement, we’re going to be changing the dates up top again.

00:51

Now note here on the income statement. You could think of it just as the second month of operations that we’re working on. We’re working on February or for the year to date. I’m going to put in the whole year to date at this point. So I’m going to say, Oh 10120, I’ll just put in the whole year. Obviously, we don’t you know, we’ve only put two months of information 1231 to zero. All right, and then I’m going to run that report. And then I’m going to open up the trial balance as well. But first, I’m going to duplicate the tab.

01:17

So I’m getting ahead of myself, I’m going to right click on the tab up top, and we’re going to duplicate it. And then we’re going to do this one more time. With the TV the old trusty trial balance, we’re going to go down below, and we’re going to search for the trial balance. And remember, you don’t want to type in trustee just type in trial balance. And the trustee is just the nickname that we have for you can have trial balance, strolling back up top and we’re gonna change the dates of topic and from a one on one to zero to 1230 120. Run that report. Then I’m going to duplicate the tab up top one more time, I’m going to right click on the tab up top, duplicate it. There we have it. Okay, let’s first start off on the balance sheet. So I’m going to go to the balance sheet. All the way to the right, I’m going to close up the hamburger going to hold down Control, scroll up a little bit to the 125.

02:07

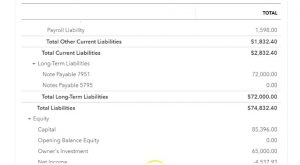

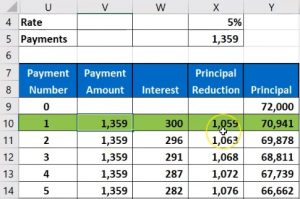

Then I’m going to scroll down to where we are looking, we’re going to be considering here, the loan payable, or the note payable, we’re calling it. So we have a note payable of that 72,000, we’re going to make a payment on it, when we make the payment on it, it’s going to be reducing the note payable liability, it’s going to be reducing the checking account. But we’re also going to have to deal with that interest portion of it as well. Now remember, we made a amortization schedule last time to deal with that. So here’s our amortization schedule, here’s our first loan that we’re going to make I’m going to make that green right now our first loan payment that we’re going to make.

02:42

So I’m going to make that green if it lets me so I’m going to make it green because that’s the one we’re working on. And we’re going to make the payment for this amount amount of the checking account going down interest being this portion and principal being this portion three accounts then affected as we enter this into the system. Just want to point out here however, that if you don’t Have an amortization schedule and and you work with with a CPA firm or you want the bookkeeping process to be as easy as possible. You could say, hey book bookkeeper, when you enter the data into the system, all I need you to do is record a decrease in the loan balance of the 1003 59 that we’re going to make the payment of, and the other side, simply go into the checking account just a two sided transaction.

03:24

If you do that, you can memorize that transaction. And it’ll be very easy to do the data input, then you can have at the end of the month or the end of the year, you or a CPA firm or whatever your accounting firm could then take the amortization schedule and adjust for the interest portion of it periodically. And that could be a system that you can use to make the data input very easy to make a system where you don’t need to be using the amortization schedule and a system where you will be correct on a periodic system after the adjusting entries have been made at the end of the month, or the end of the year. So just keeping that in mind, we’re going to do the full process here in recording the interest and principle with each payment.

04:05

Alright, so let’s go back to our QuickBooks Online. So that means two accounts are going to be on the balance sheet one account on the profit and loss or income statement, that being the interest expense, kind of like the rent on the loan that we took out. Let’s go back to the first tab, we’re going to imagine we’re doing this basically with an electronic type of transfer to the bank out of our checking account. Therefore, we’re going to be using that Expense Type form, we could go to the register as well. But because there’s three accounts involved, it might be easier to use the form. So I’m going to go to the check here or the new, we’re going to be in the money I’m going to go to the expense form. Again, you can find this form in the register. But given the fact that we have three accounts affected, it might be easier to use the actual form rather than the register.

04:53

Now we’re typically going to be needing to use the other reason down here because if you use the business operations, you may not be able to To use up anything other than expense accounts in the transaction, so we need to be using the other down below. And then we’re going to say, Who did you pay, I’m gonna say our bank is Chase. So I’m just gonna say chases the bank. So that’s going to be who we paid Chase. And we’re going to say that we made the payment on Oh 20120. So the first of the month, we’re going to make it at the beginning of the month. So this is going to be the first payment, we’re going to say it’s a month at the beginning of the month, we’re going to be taking it out of the checking account, and then the other side that is going to the loan payable and interest. So the expense means the checking accounts going to be going down, we expect this number at the end of the day, the amount that’s coming out of a checking account to be the payment amount of the 1359.

05:44

So we’re going to put in the other two amounts, the reduction in the loan and the interest down below and it should add up to then that amount that comes out of the checking account. So we’re then going to say that we have the loan. Let’s start with that loan payable or we called it notes payable. So I’m looking for that note again. I keep on trying to Putting loan I can’t find it because I put loan and set a note. And there it is, what’s the 7951 tab and we could put in the description, you could put first payment, payment, and then the amount is going to be for that 1059. That’s the amount that’s allocated to the principal portion. 1059, tab, tab, tab, tab. There we go. And then we need the other side going to interest now we haven’t put anything to interest expense yet an income statement account.

06:32

So let’s see if they have an interest expense account here set up for us within QuickBooks as they set up our GL accounts. So do we see interest expense? I don’t see it there. I’m going to type it in and see if it pops up. If I missed it in two, they called it they’re calling like they have we have an account of an expense called interest paid. Okay, that looks good. I’ll keep that interest paid. That’s kind of a funny time because we might I’ve interest expense we didn’t pay, you know. So interest expense, I think would be a better term. But that’s the account they gave us. If I’m getting picky, I can go back and just change the name of the account rather than making a new one. So I’ll keep that account. And if I’m if I’m picky, I can go change the name of it, because I don’t like interest paid as much as interest expense. But in case, we’re then going to go back up and it’s going to be 300. That’s going to be the amount 300.

07:23

And then if we add those two up the 1059 and 300, that adds up to 1003 59. Does that mean that is that is that the amount of payment it should be adding up to? It is so that looks good, everything looks good. So what is this going to do? The expense means it doesn’t mean that it’s an expense. By the way, remember, because we actually have a note down here, even though we do have an expense, just realize that the expense form is just what we’re using to basically reduce the checking account with something other than a check. So that is going to be reducing the checking account by the 1359. And then we’re going to say the other side is going to go to the notes payable that Going to be decreasing the notes payable. And then we’re going to have an expense which will increase the expense by 300 and decrease net income by that 300. Let’s check it out.

08:10

Let’s go to save and close and see what happens. So it might be first easiest to see this on the trial balance because that’s where we can see everything kind of on one page, right, so I can close the burger over here, the hamburger, bring it back up to 125. We then scroll down to the notes payable we see then we have the 72,000 in the notes payable. If I select that item, then we see our expense here. So there’s our expense item on to one and there it is, if I was to go into it, then we would get back to you. Of course our expense eventually was a little slow. It took a kind of a while. I’m going to close that back up, scroll back up to the top. We’re going to go back to our records and that was the loan PayPal now it’s checked the balance is that 70,009 41 if I go to my amortization schedule 70,009 41. So that’s what you want to tie out as long as you’re if you’re ending number their ties out, you’re looking pretty good.

09:11

So we look really good here, I think, and then the other side is going to be going to the checking account obviously went down. So the checking account went down. Let’s go there and check that out, check out the checking account. And that’s going to be an expense to chase here on February 1. So we’re going to go back to the right and we see it decreasing there as well. I won’t go into it again, because we know what that expense looks like. It’s not very complicated than the other side is going to be down below down here. And that’s going to be an interest paid. It was kind of funny name but there’s that 300 in the interest paid, and there is our expense once again.

09:50

So scrolling back up top, there they are. If you were to look at this and you don’t like the trial balance, you want to say well what are the categories on the balance sheet we’ll do that really quick since this is kind of new. When we have the notes stable. There’s the notes payable in the liability section of the balance sheet on the balance sheet balance sheet. Scrolling down liabilities were in notes payable 72,000. If we were to go into the 72,000, we then have our expense, scrolling back up top, then we also know that cash went down, obviously cash is the checking account on the balance sheet, first amount first account on the balance sheet cash checking account. Scrolling down to the bottom of it, we see chase there as well. And that expense going back to the prior reports, then let’s take a look at the p&l Profit and Loss where the interest expense will be showing.

10:36

Closing the whole the burger, the burger, scrolling back down, and then we see the oldest refresh it doesn’t look like it’s there yet. Maybe it’s a refreshing thing. I’m going to refresh it. And then if I scroll down, then we see the interest paid. So here’s the interest paid of the 300 increase in the expense which will decrease the net income we’re currently at a loss at this point in time. Okay, so let’s do it, we’re going to do this again, I’m going to go back to the first tab. And I’m going to do it again as of the end of the month. So we’re going to jump to the end of the month. And we’re going to put these both in the month of February. But one of the beginning one of the end, just to see that difference between the fact that if you use the amortization table, then the amount of payment will be the same, but the interest in principle will differ.

11:22

So that’s just to emphasize the need for the amortization table. So for that, I’m going to make the second one green just to know which one I’m on. So I don’t you know, like pick up the wrong one on accident, because I kind of do that sometimes. So keep that green ones, the one we’re on, that’s the one, then we’re going to go back and we’re going to write another expense, I’m going to go back up to add new, we’re going to add another expense, it’s going to be very similar but a little different. So I’m going to scroll back down, so it doesn’t scrunch up my expense or do anything funny to it. I’m going to pick the other reason down here. And then we’re going to be paying it to chase again. So it’s going to chip But this time at the end of the month Oh to 28 to 28 to zero, coming out of a checking account, notice it’s trying to memorize my transaction down here. And that’s nice because it has these two accounts already there, however the amounts are wrong. So that’s the problem.

12:17

Now if we were to use the kind of simplified method with the adjusting entry process at the end of the month, this would be right because all we would have to do is put the other side to the note payable. And then and then we’re going to rely on the accounting department or ourselves to make adjustments periodically, so we can just tell the bookkeeper Hey, just keep putting it to the liability account. Don’t worry about the interest, we will deal with that periodically at the end of the month. If you do that, then this transaction will be saved each month and the actual payment will be very easy to make. And then all you need to do is adjust the the amortization schedule periodically at the end of the month, or the end of the year to account for the interest and tied into the amortization schedule. So just be aware of that here. These two, these two accounts are correct, but these two amounts are wrong. So if I go back to the amortization table, we’re going to say that the principal should now be 1063.

13:12

So I’m going to pick up the 1063. Here 1063. And then the interest portion, all we got to do is put on the interest portion, not too difficult. We can use the amortization schedule, it’s going to be the 296296. So 296 there we have it. What’s going to happen once we record this was check this number, the amount of cash going down is 1359. Is that right? That’s the payment 1359. All right, what’s going to happen when when we record this checking accounts going to be going down by the 1359.

13:43

We know that by the expense form, which is basically a check form but not actually a check, but kind of an electronic transfer form that we would use if something was decreasing the checking account that wasn’t a check. And then the other side is going to be decreasing the notes payable by the 161063 to the note repeat payable that will remain on the books being that 69878, hopefully, and then we’re going to have an interest expense of the 296. Alright, let’s save and close and see if that is indeed the case, if that is what actually happens. Let’s check it out on the trial balances time, because that’s the easiest place to see these accounts both on the balance sheet and the profit and loss or income statement, I’m holding down control zooming up a little bit to that 120 5%.

14:28

So we can view what’s going on, we’re going to go into the checking account first, checking account up top scrolling back down, we see the expense now at the end of the month. So again, these are two months away, we kind of jumped forward in time. So now we’re at the second payment, we’re imagining the whole month has passed. We’re at the second month of payment just to see the difference between the two. Note here there is no difference between the first and second payment, because that’s the point we’re trying to make the payments the same by adjusting the interest in principle portions each month. So we’re going to say that looks good and that’s the expense.

14:59

I’m going Go back up top, then we want to take a look at the loan going down. So here’s the loan, let’s go into the loan and say what happened with that we have our second expense at the end of the month, there’s the expense at the end of the month, it looks different. So these two are different now, right? Because there’s a different amount, that’s decreasing the loan because the amount of interest was different because the amount of rent went down because we have a different Principle number. Alright, so we’re going to go back up top and say, all right, well, does our loan balance match up to what’s on our amortization table, we have the 69878 is that what I have over here 69878. That looks good. Looks good.

15:40

Then I’m going to go down to the interest paid interest paid interest expense, we’re going to pick up that 596596. And of course, these two are different as well. The first one at the, you know, month apart, these are two months apart or one month apart. So we have the 300 and the 296 being different as well. Due to the difference in the amortization schedule we had discussed prior. So scrolling back up top, this is going to be what our trial balance looks like. At this point in time, we will be printing out the trial balance that you can use as a report resource and check your numbers at the end of each presentation.